2024 Elections Report: Risks & Opportunities for Commodities Sector

In the ever-evolving landscape of global commodities, the year 2024 stands as a pivotal juncture marked by transformative elections across diverse regions. As nations prepare to cast their ballots, the outcomes hold the power to shape policies and strategies that will significantly influence energy, trade relations, and resource management worldwide.

This report encapsulates the intricate intersections between political shifts and their repercussions on the commodities sector. London Politica’s Global Commodities Watch has made a selection of the most significant countries, and analysed the potential impact of elections based on election programmes, past policies, and scenario planning.

India’s Lithium Rush: Supply Chains, Clean Energy, and Countering China

The discovery of vast lithium deposits in the Indian territory of Jammu and Kashmir is being hailed as a win for the country’s clean energy transition. With the government already promoting domestic EV manufacturing, this could prove to be one of the missing pieces for the puzzle of an Indian EV supply chain.

Background

With rising demand for portable electronics and a push for a low-carbon future, lithium has become one of the most important minerals. Given its application in lithium-ion batteries, it is vital for powering everything from electric vehicles and portable electronics to stationary energy storage systems.

In particular, Lithium-ion battery demand from EVs is set to rise sharply, from the current 269 gigawatt-hours in 2021 to 2.6 terawatt-hours (TWh) per year by 2030 and 4.5 TWh by 2035. According to BloombergNEF’s (BNEF) Economic Transition Scenario (ETS) – which assumes no additional policy measures – global sales of zero-emission cars will rise from 4% of the global market in 2020 to 70% by 2040. Consequently, the global supply chain for lithium has become increasingly important.

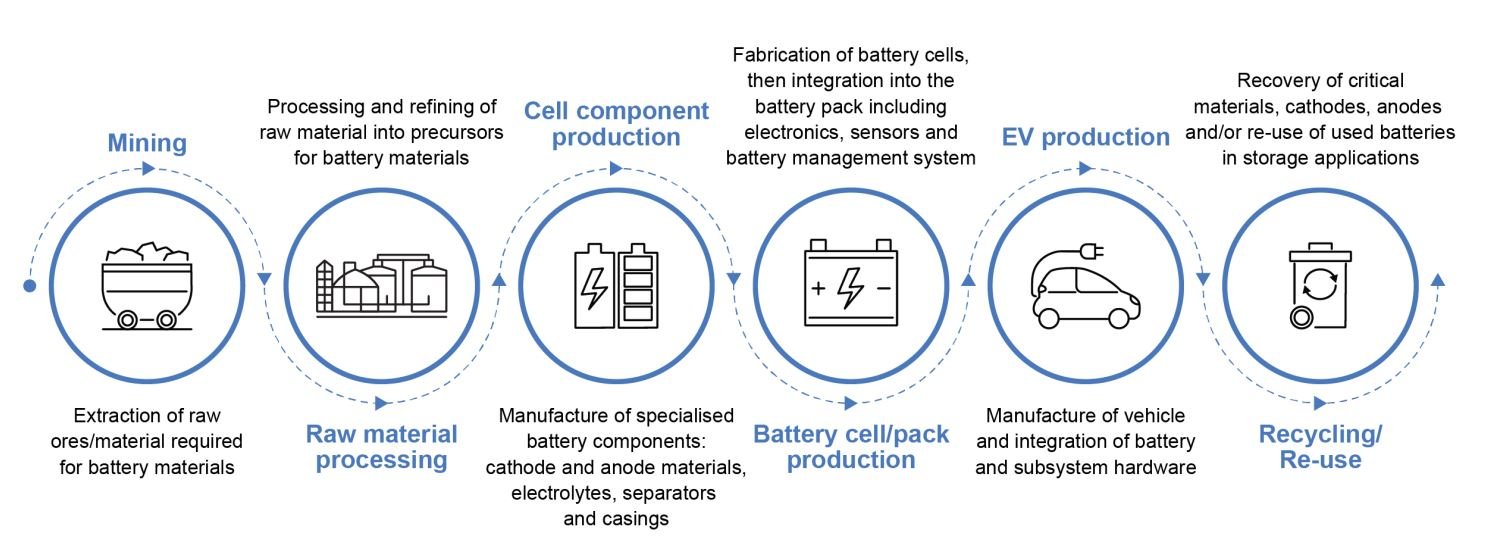

EV battery supply chain. Image credit: International Energy Agency

The lithium supply chain is complex, involving multiple stages and players, and is subject to geopolitical and economic factors. Most of the world’s lithium deposits are in the ‘Lithium Triangle’ of the world in South America – Chile, Argentina, and Bolivia. Of these three, however, only Chile Ranks amongst the list of the world’s top lithium producers, headed by Australia. Apart from production, China dominates both the refining and battery manufacturing in the EV battery value chain.

Source: Statista

India: The New Potential Partner of the World

Given the global geopolitical environment, singular dependence on China for a vital resource such as lithium has far-reaching strategic implications. Naturally, democratic nations across the world are prioritizing the reconfiguration of their supply chains for critical manufacturing inputs. Combining its demographic dividend, educated and sufficient workforce, and entrepreneurial spirit– India is rising as a potential and reliable partner. The European Union’s ‘China + 1’ strategy, the EU-India Trade and Technology council, the United States’ recent Initiative for Critical and Emerging Technologies (iCET), and Australia’s Economic Cooperation Trade Agreement with India – testify to the merit that the liberal-democratic world order sees in a partnership with India.

In the given friend-shoring environment that India enjoys, the recent discovery of 5.9 million tons of lithium in the country is monumental. India’s automobile sector itself is transforming. According to NITI Aayog, by 2030, 80% of two and three-wheelers, 40% of buses, and 30 to 70% of cars in India will be EVs. The newly found lithium can help the nation meet rising demand, both domestically and globally. India’s government has already been pushing for electric mobility and domestic EV manufacturing. The 2023-24 Union Budget, allocated INR 35,000 crore for crucial capital investments aimed at achieving energy transition, including efforts for electrification of at least 30% of the country's vehicle fleet by 2030 and net-zero targets by 2070. For EV manufacturers, the government has launched initiatives such as the Faster Adoption of Manufacturing of Electric Vehicles Scheme – II (FAME – II), allocating approximately $631 million towards subsidizing and promoting the adoption of clean energy vehicles.

Indian Lithium deposits: Risks and Challenges

The recent discovery in the Reasi district of the Union territory of Jammu and Kashmir solves one of the major challenges to a localized li-ion battery supply chain in the country– access to lithium deposits. However, there are more challenges ahead.

Firstly, the Reasi district is just 100 kilometres from the Rajouri district, a geopolitically sensitive area. Although today these areas are well-connected to India with proper infrastructure, including airports and highways, the Line of Control between India and Pakistan is less than 100 kilometres from Rajouri and around 200 kilometres from Reasi. The region’s proximity to Azad Jammu and Kashmir also makes it vulnerable to militant activities. Greater infrastructural development in the region, including a robust logistics network will have to be developed to ensure an uninterrupted indigenous supply chain (given that other stages of the supply chain are also established domestically).

Secondly, although the Geological Survey of India (GSI) has the capacity to discover and locate lithium deposits, the remainder of the value chain to produce commercial-grade lithium indigenously is not in place. Similar to Australia, Canada, and China, the identified lithium reserves in India are in hard rock formations. In order to extract the resource, mining capabilities will first have to be established in the region. It is still unclear whether these reserves will be managed by state authorities or undertaken by the central government, given the strategic importance of the resource. Furthermore, whether the mines be auctioned, like India’scoal mines, or entrusted to a public sector enterprise, is not yet known.

Timely and major investment in developing refining, processing, and purification technologies will be required. India will have to build a large-scale capacity for transforming extracted material into high-purity lithium in order to take full advantage of this discovery. While the opportunity is considerable, so are the costs. India’s government will need to devise a clear strategy that effectively helps both the country’s energy transition and domestic manufacturing ambitions.

Image credit: Nitin Kirloskar via Flickr