Nickel and Dime: The Philippines' Approach to Attracting Western Capital

Introduction

Aware of the integral role of critical minerals in clean energy systems and other modern technologies, the Philippines has begun courting Western investment to develop its domestic critical mineral industry. The country has vast reserves of untapped natural resources, including nickel, a critical component of electric vehicle (EV) batteries. According to the International Energy Agency, global demand for nickel is expected to increase by approximately 65% by the end of the decade. The Philippines stands to financially benefit from the expected surge of demand for nickel in the coming years, but must first build the requisite infrastructure (e.g., mines, refining plants, processing facilities, transport hubs, etc.) to realise the economic potential of this mineral resource.

To attract increased foreign investment, the Philippines is positioning itself as an alternative to China in the global nickel supply chain. This stance draws from the rationale that the United States (U.S.) and other Western countries will want to diversify their critical mineral supply chains away from China given contemporary security concerns with China and its dominance over nickel supplies and processing capabilities. Such a strategy has both geopolitical and economic implications, especially as it relates to strategic trading and investment blocs that reflect the U.S.-China power competition. By aligning with Western interests, the Philippines aims to bolster its economic growth while contributing to a more balanced global supply chain for critical minerals.

Nickel Industry in the Philippines

The Philippines is currently the world’s second-largest supplier of nickel, accounting for 11% of global production. The country’s nickel exports are expected to increase over the next couple of years to meet growing global demand, particularly in the EV sector. However, this outlook depends on how the country navigates other political and economic factors, including (1) volatility in market prices; (2) trade relations and international partnerships; (3) ability to attract foreign investment; (4) the implementation of government policies that promote industry development; and (5) environmental, social, and governance considerations. The Philippines Government has seemingly decided that, at its current stage, the best way to develop the country’s nickel production capacity is by focusing on boosting foreign investment in the domestic nickel industry.

Investment Strategy

Indonesia is the largest global supplier of nickel, producing over 40% of the world’s nickel in 2023. Approximately 90% of Indonesia’s nickel industry is controlled by Chinese companies, giving China a dominant market position over nickel. The market concentration of this critical mineral has caused unease and consternation amongst Western nations that fear China may leverage this control over the global nickel supply chain to their disadvantage. The Philippines, which itself has experienced escalating tensions with China over territorial claims in the South China Sea, has leveraged this fear, attempting to use it to spur greater foreign investment in their own nickel industry. Through this investment, the Philippine government hopes to develop the domestic nickel sector, especially as it relates to downstream processing, where most of the value-added occurs. The investment strategy comes amid a broader effort to augment economic ties and foster greater alignment with the U.S. and its allies, although the country is still open to Chinese investment. Government officials in Manila have shared that the U.S., Australia, Britain, Canada, and European Union have all expressed interest in directing investment to the Philippines’ nickel sector.

To date, there have been a few initiatives to advance the Philippines’ nickel industry. In late 2023, government officials from the Philippines and the U.S. signed a Memorandum of Understanding that provided $5 million to set up a technical assistance programme to develop the Philippines’ critical mineral sector. The leaders of the U.S., Japan, and the Philippines also held an economic security summit in April 2024 that featured discussions on strengthening critical mineral supply chains. Similarly, there have been preliminary talks about a trilateral arrangement in which the Philippines would supply raw nickel, the U.S. would provide financing, and a third country (e.g., Australia) would offer the technology necessary to process and refine the nickel. However, thus far, these discussions have yielded little in the way of concrete financing or investment initiatives that would provide notable benefit to the industry.

Geopolitical and Geoeconomic Implications

While the U.S. and its allies support a diversification of the global nickel supply chain, their ability to shift the paradigm will likely prove to be a difficult undertaking. Strengthening the Philippines’ nickel mining, processing, and refining capacity up to a level in which it will be able to recapture significant market share from Indonesia and China will require a huge amount of economic and political resources. This is something most countries will shy away from incurring in an important election year. For example, the U.S. has communicated its reluctance to sign a critical minerals agreement amidst the 2024 U.S. presidential race. Further, countries will not want to antagonise China and risk retaliation, given that many economies currently rely on China for the production and processing of critical minerals and their downstream technologies.

As a result of major Chinese investment and technological innovation, Indonesia’s production of nickel has notably increased in recent years. This flood of new nickel supplies has put downward pressure on global nickel prices and crowded out competition from entering the market. With slumping prices, it may be a challenge to attract sufficient foreign financing without a policy framework or safeguards that could inspire greater investor confidence. A potential remedy could be regulatory policies and tax incentives that favour non-Chinese companies. Nevertheless, the economic development associated with increased nickel production is integral to the Philippines economy, so the country does not want to alienate Chinese investors if they prove to be the best path forward.

Concluding Remarks

The Philippines’ strategic efforts to develop its nickel industry through Western investment illustrate the dynamics of economic ambition and geopolitical considerations. By positioning itself as a viable alternative to the China-dominated Indonesian nickel industry, the Philippines aims to leverage global security concerns to increase investment in its domestic nickel sector. However, the realisation of this ambition will hinge on overcoming significant political and economic challenges, such as fluctuating prices and dynamic geopolitical tensions. As the country navigates these hurdles, the outcome of its initiatives will significantly impact its role in the global critical minerals supply chain, shaping future economic and strategic alignments.

M23: How a local armed rebel group in the DRC is altering the global mining sector

In recent weeks, North Kivu, a province in the eastern part of the Democratic Republic of Congo (DRC), has seen over 135,000 displacements in what has become the latest upsurge in a resurging conflict between the Congolese army and armed rebel groups. The indiscriminate bombing in the region puts an extra strain on the already-lacking humanitarian infrastructure in North Kivu, which thus far harbours approximately 2.5 million forcibly displaced people.

The March 23 Movement, or M23, is an armed rebel group that is threatening to take the strategic town of Sake, which is located a mere 27 kilometres west of North Kivu’s capital, Goma, a city of around two million people. In 2023, M23 became the most active non-state large actor in the DRC. Further advances will exacerbate regional humanitarian needs and could push millions more into displacement.

The role of minerals

Eastern Congo is a region that has been plagued with armed violence and mass killings for decades. Over 120 armed groups scramble for access to land, resources, and power. Central to the region, as well as the M23 conflict, is the DRC’s mining industry, which holds untapped deposits of raw minerals–estimated to be worth upwards of US$24 trillion. The recent increase in armed conflict in the region is likely to worsen the production output of the DRC’s mining sector, which accounts for 30 per cent of the country’s GDP and about 98 per cent of the country’s total exports.

The area wherein the wider Kivu Conflicts have unfolded in the last decade overlaps almost entirely with some of the DRC’s most valuable mineral deposits, as armed groups actively exploit these resources for further gain.

The artisanal and small-scale mining (ASM) sector produces about 90 per cent of the DRC’s mineral output. As the ASM sector typically lacks the size and security needed to efficiently deter influence from regional rebel groups, the mining sector as a whole falls victim to instability as a result of the M23 upsurge. Armed conflict and intervention by armed groups impacts 52 per cent of the mining sites in Eastern Congo, which manifests in the form of illegal taxation and extortion. As such, further acquisitions by M23 in Eastern Congo may put the DRC’s mineral sector under further strain.

The United Nations troop withdrawal

The escalation of the M23 conflict coincides with the United Nations’ plan to pull the entirety of their 13,500 peacekeeping troops out of the region by the end of the year upon the request of the recently re-elected government. With UN troops withdrawn, a military power vacuum is likely to form, thereby worsening insecurity and further damaging the DRC’s mining sector. However, regional armed groups are not the only actors that can clog this gap.

Regional international involvement

A further problem for the DRC’s mining sector is that the country’s political centre, Kinshasa, is located more than 1,600 km away from North Kivu, while Uganda and Rwanda share a border with the province.

Figure: Air travel distance between Goma and Kinshasa, Kigali and Kampala (image has been altered from the original)

The distance limits the government’s on-the-ground understanding of regional developments, including the extent of the involvement of armed groups in the ASM sector, thereby restricting the Congolese military’s effectiveness in countering regional rebellions.

In 2022, UN experts found ‘solid evidence’ that indicates that Rwanda is backing M23 fighters by aiding them with funding, training, and equipment provisions. Despite denials from both Kigali and M23 in explicit collaboration, Rwanda admitted to having military installments in eastern Congo. Rwanda claims that the installments act as a means to defend themselves from the Democratic Forces for the Liberation of Rwanda (FDLR)–an armed rebel group that Kigali asserts includes members who were complicit in the Rwandan genocide. The FDLR serves as a major threat to Kigali’s security, as its main stated aim is to overthrow the Rwandan government.

As such, M23, on the other hand, provides Rwanda with the opportunity to assert influence in the region and limit FDLR’s regional influence. Tensions between Rwanda and the DRC have, therefore, heightened, especially with the added fact that the Congolese army has provided FDLR with direct support to help the armed group fight against M23 rebels. As such, the DRC has been accused of utilising the FDLR as a proxy to counter Rwandan financial interests in the Congolese mining sector.

Another major point of contention between the states involves the smuggling of minerals. The DRC’s finance minister, Nicolas Kazadi, claimed Rwanda exported approximately $1bn in gold, as well as tin, tungsten, and tantalum (3T). The US Treasury has previously estimated that over 90 per cent of DRC’s gold is smuggled to neighbouring countries such as Uganda and Rwanda to undergo refinery processes before being exported, mainly to the UAE. Rwanda has repeatedly denied the allegations.

Furthermore, the tumultuous environment caused by the conflict might foster even weaker checks-and-balance systems, which will exacerbate corruption and mineral trafficking, which is already a serious issue regionally.

In previous surges of Congolese armed rebel violence, global demand for Congolese minerals plummeted, as companies sought to avoid problematic ‘conflict minerals’. In 2011, sales of tin ore from North Kivu decreased by 90 per cent in one month. Similar trends can be anticipated if the M23 rebellion gains strength, which may create a global market vacuum for other state’s exports to fill.

China

In recent years, China gained an economic stronghold of the DRC’s mining sector, as a vast majority of previously US-owned mines were sold off to China during the Obama and Trump administrations. It is estimated that Chinese companies control between 40 to 50 per cent of the DRC’s cobalt production alone. In an interest to protect its economic stakes, China sold nine CH-4 attack drones to the DRC back in February 2023, which the Congolese army utilised to curb the M23 expansion. Furthermore, Uganda has purchased Chinese arms, which it uses to carry out military operations inside of the DRC to counter the attacks of the Allied Democratic Forces (ADF), a Ugandan rebel group, which is based in the DRC. In return for military support, the DRC has granted China compensation via further access to its mining sector, which is helping bolster China’s mass production of electronics and technology within the green sector.

The US

Meanwhile, the US has put forth restrictions on imports of ‘conflict minerals’, which are minerals mined in conflict-ridden regions in DRC for the profit of armed groups. Although the US attempts to maintain certain levels of mineral trade with the DRC, the US’s influence in the country will likely continue to phase out and be overtaken by Beijing. The growing influence of M23 paves the path for further future collaboration between China and the DRC, both militarily and economically within the mining sector.

The UAE

The UAE, which is a major destination for smuggled minerals through Rwanda and Uganda, has since sought to end the illicit movement of Congolese precious metals via a joint venture that aims to export ‘fair gold’ directly from Congo to the UAE. In December of 2022, the UAE and DRC signed a 25-year contract over export rights for artisanally mined ores. The policy benefits both the DRC and the UAE as the UAE positions itself as a reliable partner in Kinshasa’s eyes, which paves the path for further business collaboration. In 2023, the UAE sealed a $1.9bn deal with a state-owned Congolese mining company in Congo that seeks to develop at least four mines in eastern DRC. The move can be interpreted as part of the UAE’s greater goal to increase its influence within the African mining sector.

Global Shifts

China and the UAE’s increasing involvement in the DRC can be seen as part of a greater diversification trend within the mining sector. Both states are particularly interested in securing a stronghold on the African mining sector, which can provide a steady and relatively cheap supply of precious metals needed to bolster the UAE’s and China’s renewables and vehicle production sectors. The scramble for control over minerals in Congo is part of the larger trend squeezing Western investment out of the African mining sector.

Furthermore, the UAE’s increasing influence in the DRC is representative of a larger trend of the Middle East gaining more traction as a rival to Chinese investment in Africa. Certain African leaders have even expressed interest in the Gulf states becoming the “New China” regionally, as Africa seeks alternatives to Western aid and Chinese loans.

Although Middle Eastern investment is far from overtaking China’s dominance of the global mining sector, an interest from Africa in diversifying their mining investor pools can go a long way in changing the investor share continentally. Furthermore, if the Middle East is to bolster its stance as a mining investor, Africa serves as a strategic starting point as China’s influence in the African mining sector is at times overstated. In 2018, China is estimated to have controlled less than 7 per cent of the value of total African mine production. Regardless, China’s strong grip on the global mining sector might be increasingly challenged through investor diversification in the African mining sector. The DRC is an informant of such a potential trend.

The further spread of the M23 rebellion, though likely to damage the Congolese mining business, might also foster stronger relations with countries such as the UAE which seek to minimise ‘conflict mineral’ imports. As such, the spread of the M23 rebellion–which acts as a breeding ground for smuggling, might catalyse new and stronger trade relations with the Middle East. This could be indicative of a trend of “de-Chinafication” in the region, or at least greater inter-regional competition for investment into the African mining sector.

The Impact of a Potential Conflict Between Venezuela and Guyana on the Global Oil Market

Introduction

In the global oil market, Venezuela has played an important role as one of the world's biggest oil producers because of its strategic endeavors within OPEC. However, sanctions and an economic downturn have caused a decrease in Venezuela's oil production, hindering the country's oil producing status in recent years. In contrast, due to recent oil discoveries and production, neighboring Guyana has become a new player in the global oil market. With newly discovered oil deposits, Guyana is positioned to increase its energy influence, while Venezuela struggles with decreasing production and geopolitical turbulence, creating new tensions between the two countries.

Furthermore, in December 2023, tensions began between Venezuela and Guyana over a long-standing territorial dispute. The border territory around the Essequibo River, which spans 160,000 square kilometers (62,000 square miles), is the center of a dispute between Venezuela and Guyana and is claimed by both countries. The border around this thinly populated area was first drawn in 1899, when Guyana was ruled by the British. Following major oil discoveries off the coast of Guyana in 2015, Venezuela reaffirmed its claim to the territory. With President Nicolas Maduro promising exploration efforts in the disputed region, Caracas recently secured backing for reclaiming the Essequibo through a referendum vote. For this reason, a potential conflict between Venezuela and Guyana over the Essequibo territorial dispute could cause disruptions to regional oil transportation routes and supply chains, which could lead to price volatility in the oil market.

Venezuela's Significance in The Global Oil Market

Venezuela has been a significant player in the global oil market since Shell geologists discovered oil in the country in 1922, leading to a sharp increase in output by the late 1920s and making Venezuela the world's second-largest oil producer behind the United States. Venezuela has the world's highest proven oil reserves at 304 billion barrels, slightly more than Saudi Arabia's 298 billion barrels, according to the 2022 BP Statistical Review of World Energy. The country holds historical influence in the global oil market as a founding member of OPEC, joining the group in 1960 with Saudi Arabia, Iran, Iraq, Kuwait, and other countries in an effort to control oil prices and strengthen state authority over the sector. That same year, Venezuela increased the income tax on oil businesses to 65% and established the Venezuelan Petroleum Corporation (PDVSA), a state-owned oil company. However, in recent years, the oil industry in Venezuela has appeared completely different than that of the twentieth century.

Oil production in Venezuela from 2008 to 2022 (In million barrels per day)

Source: https://www.statista.com/statistics/265185/oil-production-in-venezuela-in-barrels-per-day/

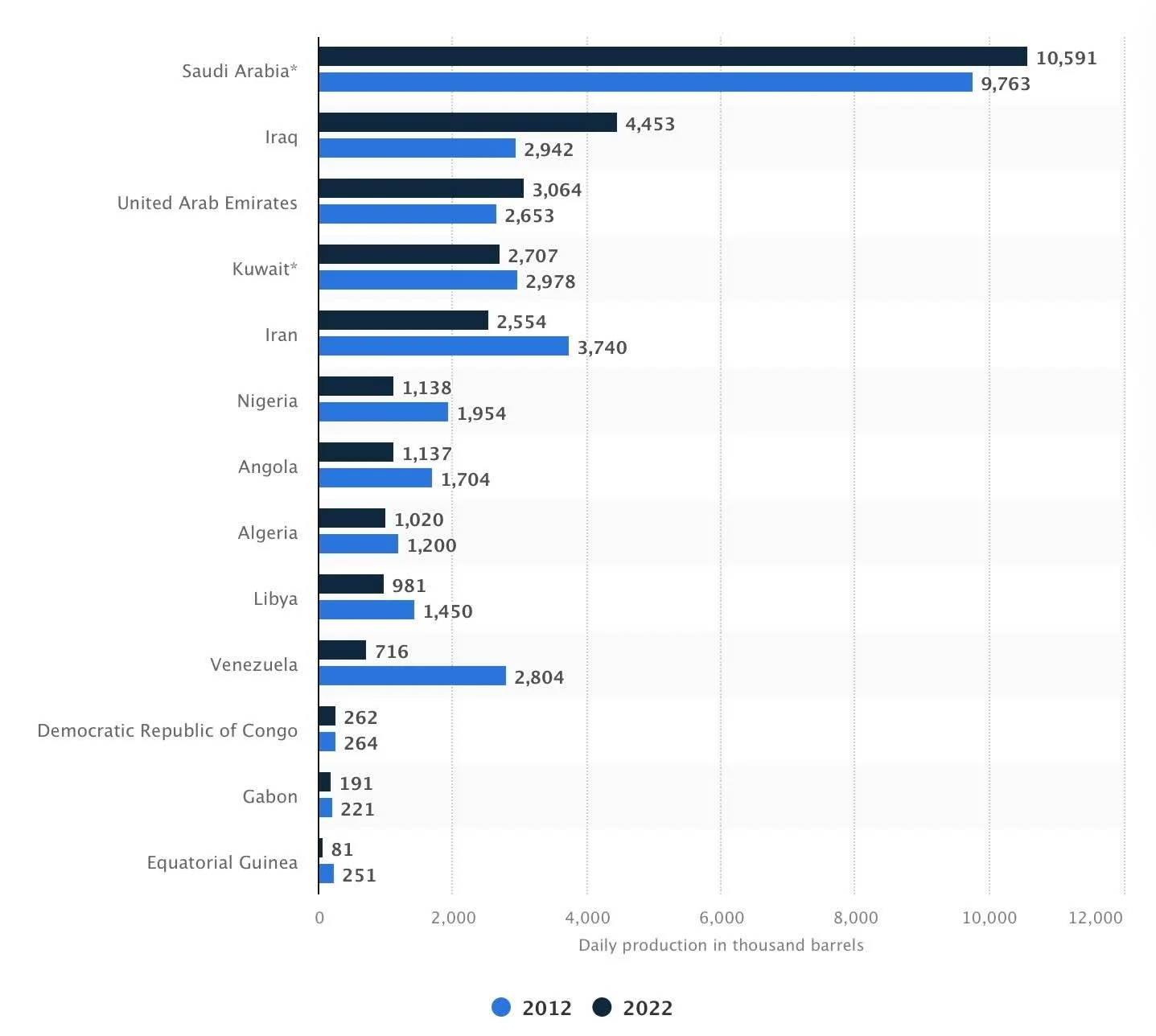

Venezuela's status as a key contributor to the world's oil supply has declined in recent years due to sanctions enforced by several nations against Venezuelan-produced oil, notably by the United States in 2019. Furthermore, the heavy composition of Venezuela's crude oil creates difficulties for the refining and production operations. In defiance of US sanctions, Venezuela was able to maintain and continue oil trade alliances with China, Cuba, Iran, Russia, and Turkey. Nonetheless, as described in the graph below, Venezuela’s crude oil production fell significantly from 2,804,000 barrels per day in 2012 to 716,000 barrels per day in 2022, decreasing its rank in global production among the rest of OPEC countries.

Crude oil production of the OPEC in 2012 and 2022, by member state (in 1,000 barrels per day)

Source: https://www.statista.com/statistics/271821/daily-oil-production-output-of-opec-countries/

In November 2022, the US lifted sanctions on Venezuela's oil and gas industry and allowed Chevron to resume limited operations in an effort to mitigate rising global energy costs as a result of the Russo-Ukrainian war. Chevron increased production through joint ventures with PDVSA, shipping crude oil to the US, which has increased the likelihood of a production rebound for Venezuela after years of decline. Because of this, Venezuela could once again become a major force in the energy sector given its abundance of oil resources; however, throughout Venezuela’s oil production decline, its neighboring country, Guyana, has remarkably shifted its position as a global oil producer.

Guyana's Emergence in The Global Oil Market

With a population of 791,000, Guyana has been one the poorest countries in South America, with approximately 41% of its population living below the poverty line in 2017, and more than 40% of its people surviving on less than $5.50 a day. Little did this country realise that its economic course would change after May 2015 when ExxonMobil first discovered significant oil deposits off the country’s coast in an area called the Liza field in the Stabroek Block. This discovery changed the dynamics of the global energy landscape by adding the largest amount of new oil to the reserves since the 1970s.

The discovery of an estimated 11 billion barrels of oil reserves saw the start of commercial drilling in 2019, significantly increasing the economic landscape for Guyana. Even during the global economic downturn caused by the Covid-19 pandemic, Guyana's GDP grew by an astounding 49% in 2020, making it one of the fastest-growing economies in the world. Guyana became the seventh-largest crude oil producer in Latin America in 2022, producing 276,000 barrels per day, a significant rise from the average of 74,000 barrels per day in 2021. Because of its rising oil output, Guyana’s GDP grew by an astonishing 62.3% in 2022. Having already received $1.6 billion in oil revenues by May 2023, Guyana’s government utilised the funds for infrastructure projects and stable economic development projects. If present economic patterns continue, Guyana may rank among the world's top producers of oil per person by 2030.

Current oil producers in Guyana, Exxon, Hess Corp., and China's CNOOC, produced 400,000 barrels per day from two vessels by August 2023, generating $2.8 billion in revenues for Guyana, and employing 4,400 Guyanese. Exxon plans to expand up to ten offshore projects with partners Hess Corp and CNOOC. ExxonMobil projects that by 2026, its oil production in Guyana will increase to 750,000 barrels per day. By 2027, their projects are expected to make Guyana the third-largest producer in Latin America after only Brazil and Mexico. According to the International Energy Agency, by 2028, Guyana will produce 1.2 million barrels per day, with four additional oil fields expected to be operational that same year.

Production of crude oil in Guyana from 2019 to 2022 (in 1,000 barrels per day)

Source: https://www.statista.com/statistics/1260886/crude-oil-production-guyana/

Due to Guyana’s increasing oil production, spot markets have emerged and interest in Guyanese crude oil is expanding throughout Europe. Guyana was able to secure a larger share of the European oil market in 2023, after finding a window of opportunity as a result of sanctions on Russian oil following its invasion of Ukraine. Refinitiv Eikon data indicates that during the first half of 2023, Guyana's oil exports to Europe amounted to over 215,000 barrels per day, or 63% of the nation's total exports of 338,254 bpd. This is an increase over 2022, when roughly 50% of Guyana's shipments were sent to Europe. However, increasing tensions between Venezuela and Guyana, both important oil-producing nations with significant shipping infrastructure, could disrupt oil shipping routes in the event of conflict between the two countries.

Potential Disruption to Oil Shipping Lanes

Ports are essential for the distribution of oil throughout the world and have increased in the vicinity of oil rich countries. Approximately 2.9 billion tons of oil and natural gas products, or around 62% of the world's petroleum production, were transported by sea in 2015. Such is the case for both Venezuela and Guyana. The Jose Terminal, situated in northeastern Venezuela, is the most significant oil export terminal for the country, producing 920,000 barrels of crude oil a day on average in 2019. The map below shows the major ports in Venezuela and Guyana, as well as other ports in the region. For Venezuela, these ports include, from west to east: Maracaibo, Bajo Grande, Puerto Miranda, Amuay, Punta Cardon, El Palito, Puerto Cabello, La Guaira, Jose Terminal, Puerto La Cruz, El Guamache, and Palua–which is located more inland. For Guyana (from west to east) these ports include: Georgetown, Linden, which is located inland, and New Amsterdam. It is important to note Trinidad and Tobago’s location along the maritime trade route that passes through Venezuela and Guyana, which holds seven important sea ports. Because of the location of various important ports in the region, and the oil routes that pass through them, a potential conflict between Venezuela and Guyana could disrupt these shipping routes in the Caribbean, as well as nearby maritime ports.

Location of Major Ports in Venezuela and Guyana and Others in the Region

Source: https://portwatch.imf.org/

For context, similar situations came as a result of attacks by Houthi rebel groups on Israeli-owned or -bound shipments, as well as Russia’s invasion of Ukraine. According to freight analytics company Vortexa, nine million barrels of oil were moved via the Suez Canal every day in the first half of 2023. The recent attacks on container ships in the Red Sea by Iran-backed Houthi groups from Yemen led freight companies to reroute their cargo around the Cape of Good Hope to avoid accessing the Suez Canal. This caused a significant disruption to global supply chains. It is estimated that the additional fuel expenses to reroute ships around the southern tip of Africa was $1 million for each round voyage between Asia and Northern Europe. Likewise, during Russia’s invasion of Ukraine, several issues, including the suspension of port operations in Ukraine, damage to critical infrastructure, trade restrictions, and rising fuel prices caused substantial disruptions to regional logistics in the Black Sea region. Ships and containers were forced to find alternate routes as ports closed and carriers stopped offering shipping services to Russia and Ukraine.

Maritime Shipping Routes in the Region

Source: https://portwatch.imf.org/

Similarly, shipping routes in the region could be interrupted due to a possible conflict between Venezuela and Guyana. Military operations may cause disruptions at the major trade sea ports in Venezuela and Guyana, as well as target Guyana’s shipping lanes for naval blockades aimed at container ships. Freight companies may be forced to reroute cargo, impacting regional supply chains, raising transit times, and increasing costs. The conflict may also replicate the logistical difficulties that followed Russia's invasion of Ukraine, such as the halting of port operations or even oil production operations. Such a scenario could also create volatility in the oil market.

Potential Market Volatility

Geopolitical tensions can demonstrably impact oil market prices, especially when they involve major oil-producing countries. An increase in tensions and hostility between Venezuela and Guyana could cause oil price volatility. Several studies have analysed the impact that geopolitical risks have on oil market dynamics. Observing two studies, one study stated that “geopolitical risks can increase speculation through investor attention” and the other saying geopolitical risk can “lead to oil market fluctuations”. In the past, according to the European Bank’s ECB Economic Bulletin from August, 2023, there has been a mixed effect of geopolitical events on oil prices. For example, following Russia's invasion of Ukraine, oil prices increased by around 30% in just two weeks, while prices increased by about 4% following the October 7, 2023 attacks by Hamas in Israel. The ECB also states that oil prices are primarily impacted by geopolitical instability through 1) the increased economic uncertainty brought on by high tensions and interruptions in commerce, and 2) financial markets might account for potential dangers to the oil supply in the future. Risks to the oil supply could raise prices if they impact large oil producers or strategically critical distribution nations. The table below indicates a VAR model from the ECB Economic Bulletin, revealing that geopolitical tensions involving Venezuela could drive up the price of oil by roughly 1.4%. Thus, according to the studies and model, escalating tensions between Venezuela and Guyana could increase oil market volatility. The potential disruptions to shipping lanes and oil production could lead to increased speculation and oil market fluctuations.

Estimated responses of oil prices to country-specific and global geopolitical shocks (percentages)

Source: European Central Bank

Conclusion

A potential conflict between Venezuela and Guyana could have implications for the global oil market. The importance of maintaining stability in the region is highlighted by the fact that Venezuela has always been a significant oil-producing country, and that Guyana is now becoming a new major player in the oil market. Market volatility is a concern due to the possible disruption of oil supply and shipping lanes associated with potential conflict between the two nations. For now, oil market observers can rest easy knowing that both the presidents of Guyana and Venezuela met in mid-December, promising not to use force or threats. However, their dispute over the Essequibo region remains unresolved.

Potential scenarios for Israel - Palestine conflict and effect on commodities

On October 7, Israel was attacked by Hamas. The event, which was classified as Israel’s 9/11 by Ian Bremmer, led to at least 1,300 fatalities and 210 abductions. Israel has launched a strong military response, and as of the 20th day since the original attack the situation remains unresolved. Both sides are experiencing ongoing hostilities and Netanyahu, Israel’s president, stated that the country is preparing for a ground invasion of the Gaza Strip, which will result in further civilian casualties.

Various groups are threatening to involve themselves in the conflict. Hezbollah, for instance, has issued warnings indicating the possibility of launching a significant military operation from Lebanon to northern Israel if the latter enters the Gaza Strip. It also has been discussing what a ‘real victory’ would look like with its alliance partners Hamas and Islamic Jihad. Israeli forces, on the other hand, bombed Syria shortly after air raids sounded in the Golan Heights, a disputed territory that has been annexed by Israel since 1967. This offensive targeted the Aleppo airport and sources claimed its goal was to stop potential Iranian attacks being launched from Syria. Additionally, Iran has faced accusations of funding the attack, which raises concerns about its involvement.

Consequences for commodities

The ongoing conflict has emerged as a significant geopolitical factor on global oil markets. However, there have not been immediate impacts on physical flows yet. During the weekend of 7th to 9th October there was an increase in Brent crude prices of about 4% , which later fell 0.2% after Hamas released two American hostages. Prices fell even further after Israel appeared to hold off on its widely expected ground invasion of Gaza. These dynamics show that the risk premium in the oil price takes into account the severity of the conflict and the likelihood for escalation.

Yet, Israel’s limited oil production capacity means that, if the conflict remains localised, it is unlikely to have a significant impact on global oil supply. Traditional energy commodities (and their prices), that can be viewed as a substitute to oil, have not been impacted so far either. Natural gas, for example, is both a substitute to oil and also largely produced by Israel with its southern offshore Tamar field. Despite European gas prices reaching their highest price since February on Friday 13th, markets do not appear to be pricing in the possibility of an escalation extending beyond Israel and Gaza. If that was the case, even higher prices would be recorded.

The most significant impacts on oil markets are more likely to occur if other nations actively engage in the conflict. After the explosion of a hospital in Gaza on 17th of October, Iran called for an oil embargo against Israel in retaliation for the deadly attacks. The Gulf Cooperation Council (GCC) countries have expressed their unwillingness to support Iran, stating that “oil cannot be used as a weapon”, which helped markets to not consider any embargos for the moment. Moreover, the impact of this action would be limited, since Israel could source its oil from a wide array of other countries.

Another point worth mentioning, it is estimated that 98% of Israel’s imports and exports are made by sea, making the national ports a crucial part of the country’s infrastructure. These ports are currently under a significant risk of potential damage, which has heightened shipping insurance premiums and affected the costs of importing into and exporting from Israel.

Possible scenarios and implications

1. If the conflict remains confined to the Israel - Palestine region

While there could be short-term volatility in oil prices during the most intense attacks and as potential escalation threats rise, neither of these regions are significant oil producers. Therefore, recent rises are not expected to have a lasting impact on oil prices, which should soon stabilise between $93 and $100 per barrel. However, it is important to mention that this price range was already predicted before the current war between Israel and Palestine took place.

2. War involving Hezbollah

Some recent attacks have taken place between Israel and Hezbollah, however, if the latter joins the conflict, the impact on oil markets could be more substantial. This could lead to potential global economic consequences due to risk-off sentiment in the financial markets, leading to oil prices rising by $8 per barrel, approximately. Another group that can act on the conflict are the Houthis, an Iran-backed group in Yemen which allegedly launched missiles against Israel on October 19th, that were intercepted by the United States. While Yemen primarily exports cereal commodities, its involvement can further escalate geopolitical tension and instability in the region.

3. Iran enters the conflict formally

The most significant impact on the oil market would arise if Iran officially joins the conflict, potentially causing a $64 per barrel increase to a price of $152.38 for Brent crude. Iran controls the Strait of Hormuz, a passage crucial for connecting the Persian Gulf with the Indian Ocean. Thus, if the Strait is blocked, important countries for oil production such as Iraq, the United Arab Emirates, and Kuwait would be landlocked. Consequently, Iran would see its gas revenues rise due to higher prices. This situation also creates challenges for gas importing countries, especially for the EU’s energy security that has already seen a cut of supply from Russia.

As a consequence of Iran’s increased involvement shipping expenses would likely increase, also associated with war-risk premiums on shipping insurance. Those refer to additional costs that are also included in shipping prices to cover for vessels and cargo that are operating in areas of geopolitical risk. In the Ukrainian and Russian conflict for example, the war risk premium was firstly around 1% and has further escalated to 1.25%. While the overall value may not be significant, it can still present an additional challenge in the trading of energy related commodities.

Moreover, Iran is still exporting a significant amount through loopholes. If Iran decides to formally join the conflict, there probably would be stricter enforcement of sanctions by the United States which would tighten global oil supplies. Higher oil prices would also cause external geopolitical impacts. In the US, elevated oil prices could be a factor against the election of Joe Biden, who has invested significant political capital on the Middle East’s diplomacy with an attempt to normalise Saudi Arabia and Israel relations. For Russia, on the other hand, higher oil prices are vital to increase the country’s revenue and continue its war against Ukraine.

The most extreme scenario would entail Israel conducting a strike on Iran’s nuclear facilities, potentially causing oil prices to surge well beyond $150 per barrel. Therefore, heightened efforts to remove U.S. sanctions on Venezuelan oil would help relieve the strain on global oil prices. Increased access to Latin America's oil resources could act as a shock absorber against price increases and supply disruptions. In the US, more specifically, it would offer a more favourable outlook to Joe Biden's administration.

The Russian Oil Maskirovka: Why Aramco is Cutting Oil Prices

Oil markets have had an interesting year following the Russian invasion of Ukraine, to say the least . While firms have benefitted from this, with many announcing record profits, Saudi Aramco announced that it would be lowering oil prices in its main market Asia. This is off the back of weak manufacturing data from China that triggered a fall in Brent and WTI futures which track global oil prices. Although prices were raised in Asia, they remain unchanged in the United States but increased for European consumers. Aramco cut prices to $2.55 above the regional benchmark while Brent Crude futures jumped up to $87 per barrel before stabilising at $73 per barrel. Markets now look to the OPEC meeting in June, with some analysts believing that the group may decide to cut production again in a bid to keep high prices inflated.

On the one hand, it is not that surprising that Saudi Aramco’s profits dropped 19 per-cent considering their record profit of $161 billion off the back of an abnormal year for markets, but this is not just because of the oil market correcting itself. Saudi Arabia is competing with cheap Russian oil in key markets, like China and India, and, with 60 per-cent of its crude oil going to Asian markets - this is beginning to hurt the Kingdom’s economy. The IMF has halved its prediction on Saudi GDP growth from 8.7 per-cent to 3.1 per-cent, after cheap Russian oil undercut OPEC and priced Saudi Arabia out of key markets. However, this will only last until the Ukraine crisis is resolved and Russian oil can freely flow in global markets again. By convincing Saudi Arabia and OPEC to help sustain high prices, Russia has been able to sell its own oil at a discount to make up for the damage Western sanctions have caused on its economy. Unsurprisingly, this has ruffled feathers in the United States.

While Saudi Arabia is considered an ally of the United States, the relationship between the two nations has been less than cordial in recent years. The Kingdom has found itself becoming a rival oil exporter to the United States, and so has shown less interest in cooperation. President Biden refused to communicate with Crown Prince Mohammed Bin Salman, due to his involvement in the assassination of Jamal Khashoggi, and the relationship was further strained in March 2020, when Saudi Arabia dumped 40 million barrels of oil onto the market while in the midst of an oil price war with Russia. The resulting price decrease to -$37.63 per barrel was unprecedented and pushed American fracking companies out of business, thereby benefitting Saudi Arabia by decreasing global production and increasing prices.

Since then, Russia and Saudi Arabia have led their respective group of oil producers, together called OPEC+, to sustain high oil prices which had been placing inflationary pressures even before the Ukraine crisis began. In March of last year, they decided to increase production by 400,000 barrels a day each month, signalling that they had no interest in providing a safety net for Western Europe which has faced a decrease in Russian oil imports. This was following a call between Biden and King Salman in February, in which the former asked for more Saudi oil to relieve American allies, but nothing came of this. This coupled with Saudi Aramco making a $3.6 billion investment in Chinese Petrochemical firm Rongsheng and Xi Jinping calling for oil trade in Yuan, has caused security concerns in Washington. Biden might be facing more personal political problems due to oil markets though. Since WW1, sitting presidents won re-election only one out of seven times the economy has been in recession 2 years before they were up for re-election. With the OPEC meeting in June being held when the US is expected to breach its debt ceiling, if Biden does not receive favourable outcomes from both these issues, he can all but wave re-election in 2024 goodbye.

In the same way that neither Russia nor Saudi Arabia officially admitted to being in a price war in 2020, neither side has acknowledged the deception Russia orchestrated in convincing Saudi Arabia to sustain high oil prices. While the war in Ukraine has helped to keep these prices high, this has backfired in allowing Russia to snap up key markets in Asia. Whether this will remain the case going into the future is dubious. Looking at China, Russia was only able to unseat Saudi Arabia for 2 months of this year as the main supplier of oil, so if peace talks progress this year Saudi Arabia is likely to retake their lost market share. Moving forward we can expect oil prices to spike again if OPEC decides to cut production in June, but these prices are also dependent on the US debt ceiling. Although a default has never occurred before, OPEC are still looking at developments in the United States warily and it is evident that bad news coming from Capitol Hill will overshadow whatever decisions OPEC makes.

Photo Credits: mining.com

Petrobras: Balancing Risk and Opportunity in Brazil's Oil Industry

Petróleo Brasileiro S/A - or simply called Petrobras - is the leading player in oil and gas production in Brazil. The majority-state-owned company has a net revenue of R$ 452 billion (approx. USD$90bn), outputs approximately 2.77 million barrels of oil equivalent per day, and is a publicly-listed company traded on the New York Stock Exchange (NYSE:PBR), Nasdaq (NASDAQ:PBR), and the London Stock Exchange (LSE:0KHP), and several others. Despite its relevance to the global energy markets and its considerable growth potential, investors’ sentiment towards Petrobras usually contains extra grains of salt. The company is often embroiled in domestic wrangles and power struggles that shed uncertainty about its corporate governance and was at the centre of a major corruption scandal involving high-rank Brazilian policymakers in 2015.

After the election of Lula da Silva as president, markets again reacted badly due to a perceived high potential for undesired political influence over the appointment of Petrobras’ Board of Directors, for changes in its dividend distribution, and a revision of the company’s pricing policy (which currently follows a parity with international import prices). One year later, a scanning of those three issues and of the newly appointed Board might still prove revealing of Petrobras' future and better prepare investors to hedge against associated risks.

Currently, the State-owned Companies Act (2016) prohibits figures with a potential conflict of interest due to previous positions inside public administration from being appointed to the Board for a period of 3 years after leaving the previous function, which is also endorsed in Petrobras’ statute. A Bill reducing the “quarantine” period to 1 month is stalled in the Upper House of Congress since 2022, prompting many to wonder if the Bill’s approval could be pushed to ensure greater coalition support in times of political turbulence. Despite being a possible strategy, it is far from being the likely one. A Supreme Court decision has already suspended the proposed 3-year quarantine period of the Bill, and 3 of the government’s 6 appointees were confirmed on the Board despite alleged concerns about their ties with partisan politics. However, other bills and reforms are among Lula's top priorities with Congress, making it unlikely that he would create an unnecessary conflict with the Upper House over Petrobras, especially when opposition forces are strengthened.

Acting as Petrobras's CEO is Jean-Paul Prates, who has vaguely commented on the possibility of changing the dividend distribution policy, but both Lula’s and Bolsonaro’s defence for greater taxing in dividend yield distributions likely does little to appease markets. Still, a recent judicial attempt of halting Petrobras’s dividend distribution shed even more uncertainty about how alternative ways of interference - ones that do not even involve the Board’s discretion - can be overreaching, indicating a high likelihood of taxation in the future.

The potential for a change in the company’s policy of maintaining parity with international oil prices also cannot be discarded, as key figures inside the Board have signalled they desire its revision. Nevertheless, in a continued scenario of high oil prices due to external shocks, the Board is likely to be interested in retaining a part of Petrobras’ profitability by not announcing major changes in the parity policy for the near future.

While the prospects for stable dividend yield distributions and insulation from rent-seeking dynamics appear less optimistic, posing increasing risks for investors, Brazil's potential to become a major player in clean energy production presents an opportunity. Petrobras is actively exploring cutting-edge technologies in renewable energy markets, such as wind-powered energy and green hydrogen production, which could enhance its long-term profitability. While the company’s issues span across multiple incumbencies and require careful assessment of long-term tolerance for loss, the most risk-appetite investors can still find creative ways to offset the balance and - with some stroke of luck - profit from the undertaking.

Photo credit: Global Business Outlook

Commodities in the First Quarter: Inflation, War, and Geopolitics

Goldman Sachs’ 2023 commodity markets outlook had anticipated a substantial return of over 40 per-cent by the end of 2023 for commodities (S&P GSCI TR Index). As the first quarter of 2023 draws to a close, S&P GCSI spot prices closed the quarter at a -2.81 per-cent loss. As was the case in many financial markets, the S&P GCSI saw its biggest decline in the first quarter in the week of Silicon Valley Bank’s collapse – gold being the glaring exception. Of course, this is by no means indicative of how commodity markets will perform for the remainder of the year. Nevertheless, the impact of the ongoing banking on the inflation-duration investment cycle (elaborated below in Figure 1) for commodities remains to be assessed. This spotlight aims to do precisely that, considering some of the macroeconomic assumptions and models proposed in Goldman Sachs’ 2023 commodity outlook.

Understanding the Inflation-Duration Investment Cycle

The inflation-duration investment cycle is a tool useful for understanding investment in commodities and commodity market behaviour, relative to inflation and interest rates. It loosely correlates with the Merril Lynch Investment Clock – although it is a bit more specific to commodity markets.

Figure 1 - The Inflation-Duration Investment Cycle. Adapted from Goldman Sachs Commodity Outlook.

When Goldman Sachs published their 2023 Commodity Outlook, they affirmed that at present, the commodity market was still in the first stage of the inflation-duration investment cycle. Crucially, the 2023 Commodity Outlook explains that in addition to the current high-inflation, high-interest rate macroeconomic environment, commodity markets are confined in an underinvestment super cycle such that unless there is a sustained increase in capital expenditure (capex), increasing demand cannot trigger a supply-side response hence creating inflationary pressures in the short-term. The remainder of this spotlight will sum up the overarching macro-level geopolitical supply-side risks impacting three core sectors of the commodities market: agriculture, rare earth minerals, and energy markets.

Agriculture in Q12023

S&P agriculture indices (GSCI Agriculture, GSCI Livestock, and GSCI Grains) outperformed the S&P GSCI with GSCI Livestock being the best performing index considered in this spotlight, gaining 5.94 per-cent this quarter. Agriculture and Grains lost 0.61 per-cent and 2.57 per-cent, respectively.

At the macro-level there are two factors that will keep grain prices high, despite losses in value in the first quarter of 2023. These factors are the supply-side issues resulting from the Russo-Ukrainian War, despite the recent extension of the Black Sea Grain Initiative, and climate change – which is already having some impact on grain yields. As hypothesised at the start of the Russo-Ukrainian war, grain prices skyrocketed as the two countries contribute to about half of the world’s grain supplies. The wide use of grain in human and animal diet means that the precarity of grain supply will likely underpin most food-related price rises and contribute significantly to the cost of living crisis, globally. For that reason, the extension of the Black Sea Grain Deal on March 18 was of great relief for the global food supply chain. However, despite the extension there are two items still on the snag list: (i) a disagreement between Moscow and Kyiv over how much longer the Grain Deal will run for, and (ii) Russia banning major grain exporter – Cargill – from exporting Russian grain, which has already impacted futures’ prices.

Short-term risks impacting the supply of agricultural commodities also consist of grain supply, as they are crucial for animal feed. In addition to this, avian influenza outbreak in poultry supplies, which are not limited to just the United Kingdom, are having impact on related goods. Avian influenza outbreaks have been reported in the United Kingdom, United States, the rest of Europe, and there are fears that avian influenza and eventual egg shortages are also felt in South America. Long-term impacts of zoonotic diseases like avian influenza are difficult to quantify. Notwithstanding, after the outbreak of COVID-19 and the ensuing pandemic, there has been formal research dedicated to the matter which would suggest that countries with highly-industrialized, high-density agricultural industries run a higher risk of having disease outbreaks harm crop and livestock supplies. Thus, balancing land use and industrial density with growing populations’ driving up demand will be of importance if governments want to avoid severe shortages of crucial food items.

Energy Markets in 2023Q1

The three S&P energy indices considered in this spotlight – GCSI Natural Gas, Global Oil, and Global Clean Energy – all lost value quarter in 2023. Natural gas especially took a substantial hit, losing 44.43 per-cent of its value at the end of trading on March 31. Oil lost a little over five per-cent throughout the opening quarter whereas Global Clean Energy’s losses were below the one per-cent mark.

The stand out commodity here is natural gas (including LNG) and this is in large part because of the “geopolitical struggle between Europe and Russia” which will play a crucial role in dictating natural gas markets for the foreseeable future. As severe sanctions on Russian oil and gas were confirmed by the European Union throughout 2022, the bloc has not yet dealt with the fact that there is still strong demand and necessity for those commodities. Although some effort by means of REPowerEU have laid the groundwork for a shirt to alternative energy supplies, European countries have begun to look elsewhere for natural gas supplies. One such effort has been made by Italy who has looked to further increase imports of Algerian natural gas.

Another recent trend has been importing Indian-refined petroleum products derived from Russian oil, despite embargoes. This shows that short-term procurement of oil and gas into Europe could well become economically and politically costly until alternative energy supplies are not secured. As the necessity for reliable energy supplies begin to outweigh the political value of sanctions on Russia, European countries may well find themselves having to prioritise one over the other. A pessimistic outlook that may be, but it is already materialising; as France settled its first LNG deal in Yuan with China. As the BRICS countries begin to trade in their own currencies the return of a multi-polar energy market might lead to less market predictability and prolonged period of macro-scarcity.

On the other hand, the political and economic urgency to expedite the green energy transition is indicative of a positive outlook for renewables markets according to the International Energy Agency’s latest industry overview. Indeed, analysis and forecasts from McKinsey share this sentiment as they expect substantial growth in solar and wind energy. Bloomberg shares this sentiment in the hydrogen sector, too. As legislation and regulation gears itself towards carbon-neutrality in the world’s three largest economies – the United States, China, and the EU – there is a genuine legal basis for optimism in renewables markets. A medium to long-term risk to watch out for, however, would be the political and economic competition over the necessary resources – such as copper – for a green transition.

Rare Earth Metals in 2023Q1

In the opening quarter of the year, the S&P GCSI Core Battery Metals Index – which tracks stocks of rare earth metals (REM) pertinent to battery production – stagnated around the -0.34 per-cent mark. On the other hand the S&P GCSI Precious Metals Index soared 9.14 per-cent, though this was in large part due to investors backing gold and silver as the United States’ regional banking crisis erupted.

Although the relationship between geopolitical tensions and short-term supply risks of REMs is not yet at the scale of the relationship between geopolitical tensions and the supply of agricultural and energy commodities, there is reason to believe that this will not last very long. Essentially, this is because REMs and precious metals are crucial to the green energy transition and the production of key electronics’ components like semiconductors. REMs are also becoming ever-more important for the production and maintenance of modern-day defence systems. Thus, securing REM supply chains and secondary materials is a paramount task for states and businesses looking to establish a dominant presence at the international level. As of 2020 REM exports originated overwhelmingly from Asia with Myanmar, China, and Japan accounting for over half of all exports. The United States and its European allies, on the other hand, exported just over 10 per-cent of global REM exports. Furthermore, sanctions against Russia and Myanmar have further complicated access to REM imports for Western business and countries. This is exacerbated further by Beijing’s recent efforts to improve relations with Moscow and Naypyidaw – with the latter being crucial for China’s efforts to overcome the ‘Malacca Dilemma’.

In recognising this weak spot, both the Biden and Trump administrations took swift action to incentivise the reshoring production of crucial electronics, starting with the National Strategy for Critical and Emerging Technologies as a direct countermeasure to China’s efforts to increase its own electronics production. This was followed up with the CHIPS and Science Act and formal export controls, limiting semiconductors produced with American technology and inputs to China. In the meantime, the United States has sought to diversify its REM supplies from Africa, where China has a considerable geopolitical presence. What the impact the ongoing China-United States rivalry over REM supplies and semiconductor development will have on prices in the short-term remains to be seen, but the medium-to-long-term protectionism and antagonism between Beijing and Washington will likely lead to REMs enjoying substantial price increases considering their growing demand.

Summary: Outlook for 2023 and Beyond

The first quarter of 2023 carried forward many of 2022’s geopolitical dynamics and risks into global commodity markets. There have also been supply shocks, like avian influenza outbreaks and severe climate events, which have harmed the supply of crucial commodities that have further exacerbated the impacts of geopolitics on market activity.

This is particularly visible in agriculture markets where the uncertainty on how long the Black Sea Grain Initiative extension will last is a key risk to secure grain supplies globally. If Russia’s demands for a reduction of sanctions can be made credible by its recent rapprochement with China, then an extension of the Black Sea Grain Initiative beyond the current deadline will likely result from a reduction in Western sanctions. Conversely, if the West can find ways to cope with inflation and diversifying energy supplies, then Moscow might be forced to formally accept a longer extension. The outlook on the matter remains speculative, but the consequences of a no-extension scenario could spell disaster for global food supplies within the next quarter.

Although energy and REM markets are also mired by geopolitical power struggles and risks, the potential for a drastic spillover into commodity markets and the wider economy in the short-term is, at this stage, quite limited. Although, as REMs become more intertwined and necessary for future energy markets this outlook will likely change post-2023. This is because in the absence of short-term flashpoints, the increasing pursuance of protectionist and antagonising trade policies between Beijing and Washington will very likely undo much of the economic globalisation that occurred pre-COVID.

Hence, it is not likely that global commodity markets will break the macro-scarcity phase of the Inflation-Duration Investment Cycle in 2023 – and potentially prolong the under investment in commodities into 2024 and beyond. However, there is still a lot of 2023 to go and there is a lot of time for pressing issues to unfold and provide a clearer picture for commodity markets. Although, the current direction of the international regulatory and political environment does not offer much optimism for the long-term, with regards to increasing capex or securing crucial supply chains.

Cover photo credits to: Black Sea Grain Initiative FAQ | United Nations in Namibia

The 2020s Commodities Boom: How Long Before the Outlook Dives?

The link between commodities boom during recession and inflation is well-established. During a recession, central banks often lower interest rates to stimulate economic activity, which can lead to inflationary pressures. Inflation can also be driven by increased demand for commodities as economies recover. This was evident during the global financial crisis of 2008-2009, where a sharp increase in commodity prices occurred during the recovery phase.

Similarly, the COVID-19 pandemic in 2020 led to a sharp recession, followed by a commodity boom in 2021 due to a combination of factors, including supply chain disruptions and increased demand as economies reopened. The result was a surge in commodity prices, including oil, copper, and agricultural commodities that had continued well into 2023. It is important to highlight these dynamics between economic performance, and commodity rallies, to better outline market performance, and make better long term trading decisions. The link between commodity prices and inflation is made visually available by the St. Louis Federal Reserve.

To project when the outlook in the commodity markets can settle down a time-series analysis must be conducted using historical data to identify trends and patterns in commodity prices, such as the ones above. The analysis must also include macroeconomic variables such as interest rates, inflation, and GDP growth to identify the drivers of commodity prices. However, it is important to note that commodity prices are highly volatile and subject to various unpredictable factors such as natural disasters, political instability, and global events. Yet, based on current trends and projections, it is likely that the commodity boom will eventually settle down as global supply chains stabilise and interest rates cool down. However, the timing and extent of this will depend on a range of factors and will require ongoing monitoring and analysis.

The most likely estimate would be, not before FY2024. Given the reaction of markets to the increase in interest rates, multiple cases of bankruns, the subsequent banking crises, and ongoing Russian invasion of Ukraine, volatility is here to stay for the short-run. However, the CPI (Consumer Price Index) has been showing signs of improvement, with inflation in North America, and the Eurozone, almost at the cusp of weathering down. This follows a decline in energy prices, and can be credited to deflationary fiscal policies aimed at slowing monetary velocity. Given the response of the Federal Reserve, the fallout of the bank failures has been prevented from adding fuel to the fire, and efforts from both banks, and the government, to reassure depositors of confidence in the institutions that govern them, have allowed for the stabilisation of outlook for the short run. To conclude, investors can expect the commodities rallies to continue through 23’, although as economic and geopolitical forces begin to stabilise, the inflated boom can be seen as a short term bubble, waiting to burst as growth returns.