The Impact of a Potential Conflict Between Venezuela and Guyana on the Global Oil Market

Introduction

In the global oil market, Venezuela has played an important role as one of the world's biggest oil producers because of its strategic endeavors within OPEC. However, sanctions and an economic downturn have caused a decrease in Venezuela's oil production, hindering the country's oil producing status in recent years. In contrast, due to recent oil discoveries and production, neighboring Guyana has become a new player in the global oil market. With newly discovered oil deposits, Guyana is positioned to increase its energy influence, while Venezuela struggles with decreasing production and geopolitical turbulence, creating new tensions between the two countries.

Furthermore, in December 2023, tensions began between Venezuela and Guyana over a long-standing territorial dispute. The border territory around the Essequibo River, which spans 160,000 square kilometers (62,000 square miles), is the center of a dispute between Venezuela and Guyana and is claimed by both countries. The border around this thinly populated area was first drawn in 1899, when Guyana was ruled by the British. Following major oil discoveries off the coast of Guyana in 2015, Venezuela reaffirmed its claim to the territory. With President Nicolas Maduro promising exploration efforts in the disputed region, Caracas recently secured backing for reclaiming the Essequibo through a referendum vote. For this reason, a potential conflict between Venezuela and Guyana over the Essequibo territorial dispute could cause disruptions to regional oil transportation routes and supply chains, which could lead to price volatility in the oil market.

Venezuela's Significance in The Global Oil Market

Venezuela has been a significant player in the global oil market since Shell geologists discovered oil in the country in 1922, leading to a sharp increase in output by the late 1920s and making Venezuela the world's second-largest oil producer behind the United States. Venezuela has the world's highest proven oil reserves at 304 billion barrels, slightly more than Saudi Arabia's 298 billion barrels, according to the 2022 BP Statistical Review of World Energy. The country holds historical influence in the global oil market as a founding member of OPEC, joining the group in 1960 with Saudi Arabia, Iran, Iraq, Kuwait, and other countries in an effort to control oil prices and strengthen state authority over the sector. That same year, Venezuela increased the income tax on oil businesses to 65% and established the Venezuelan Petroleum Corporation (PDVSA), a state-owned oil company. However, in recent years, the oil industry in Venezuela has appeared completely different than that of the twentieth century.

Oil production in Venezuela from 2008 to 2022 (In million barrels per day)

Source: https://www.statista.com/statistics/265185/oil-production-in-venezuela-in-barrels-per-day/

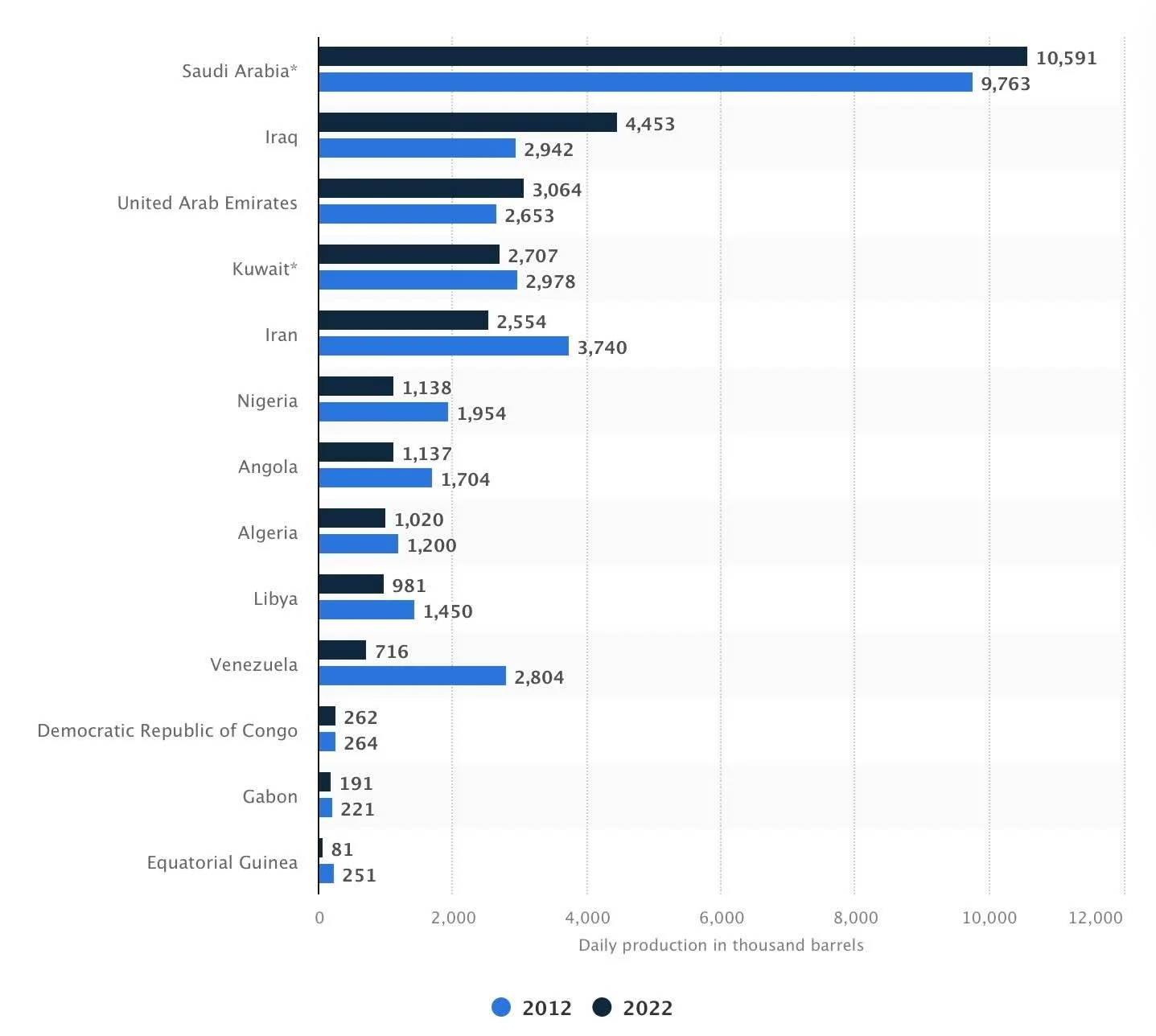

Venezuela's status as a key contributor to the world's oil supply has declined in recent years due to sanctions enforced by several nations against Venezuelan-produced oil, notably by the United States in 2019. Furthermore, the heavy composition of Venezuela's crude oil creates difficulties for the refining and production operations. In defiance of US sanctions, Venezuela was able to maintain and continue oil trade alliances with China, Cuba, Iran, Russia, and Turkey. Nonetheless, as described in the graph below, Venezuela’s crude oil production fell significantly from 2,804,000 barrels per day in 2012 to 716,000 barrels per day in 2022, decreasing its rank in global production among the rest of OPEC countries.

Crude oil production of the OPEC in 2012 and 2022, by member state (in 1,000 barrels per day)

Source: https://www.statista.com/statistics/271821/daily-oil-production-output-of-opec-countries/

In November 2022, the US lifted sanctions on Venezuela's oil and gas industry and allowed Chevron to resume limited operations in an effort to mitigate rising global energy costs as a result of the Russo-Ukrainian war. Chevron increased production through joint ventures with PDVSA, shipping crude oil to the US, which has increased the likelihood of a production rebound for Venezuela after years of decline. Because of this, Venezuela could once again become a major force in the energy sector given its abundance of oil resources; however, throughout Venezuela’s oil production decline, its neighboring country, Guyana, has remarkably shifted its position as a global oil producer.

Guyana's Emergence in The Global Oil Market

With a population of 791,000, Guyana has been one the poorest countries in South America, with approximately 41% of its population living below the poverty line in 2017, and more than 40% of its people surviving on less than $5.50 a day. Little did this country realise that its economic course would change after May 2015 when ExxonMobil first discovered significant oil deposits off the country’s coast in an area called the Liza field in the Stabroek Block. This discovery changed the dynamics of the global energy landscape by adding the largest amount of new oil to the reserves since the 1970s.

The discovery of an estimated 11 billion barrels of oil reserves saw the start of commercial drilling in 2019, significantly increasing the economic landscape for Guyana. Even during the global economic downturn caused by the Covid-19 pandemic, Guyana's GDP grew by an astounding 49% in 2020, making it one of the fastest-growing economies in the world. Guyana became the seventh-largest crude oil producer in Latin America in 2022, producing 276,000 barrels per day, a significant rise from the average of 74,000 barrels per day in 2021. Because of its rising oil output, Guyana’s GDP grew by an astonishing 62.3% in 2022. Having already received $1.6 billion in oil revenues by May 2023, Guyana’s government utilised the funds for infrastructure projects and stable economic development projects. If present economic patterns continue, Guyana may rank among the world's top producers of oil per person by 2030.

Current oil producers in Guyana, Exxon, Hess Corp., and China's CNOOC, produced 400,000 barrels per day from two vessels by August 2023, generating $2.8 billion in revenues for Guyana, and employing 4,400 Guyanese. Exxon plans to expand up to ten offshore projects with partners Hess Corp and CNOOC. ExxonMobil projects that by 2026, its oil production in Guyana will increase to 750,000 barrels per day. By 2027, their projects are expected to make Guyana the third-largest producer in Latin America after only Brazil and Mexico. According to the International Energy Agency, by 2028, Guyana will produce 1.2 million barrels per day, with four additional oil fields expected to be operational that same year.

Production of crude oil in Guyana from 2019 to 2022 (in 1,000 barrels per day)

Source: https://www.statista.com/statistics/1260886/crude-oil-production-guyana/

Due to Guyana’s increasing oil production, spot markets have emerged and interest in Guyanese crude oil is expanding throughout Europe. Guyana was able to secure a larger share of the European oil market in 2023, after finding a window of opportunity as a result of sanctions on Russian oil following its invasion of Ukraine. Refinitiv Eikon data indicates that during the first half of 2023, Guyana's oil exports to Europe amounted to over 215,000 barrels per day, or 63% of the nation's total exports of 338,254 bpd. This is an increase over 2022, when roughly 50% of Guyana's shipments were sent to Europe. However, increasing tensions between Venezuela and Guyana, both important oil-producing nations with significant shipping infrastructure, could disrupt oil shipping routes in the event of conflict between the two countries.

Potential Disruption to Oil Shipping Lanes

Ports are essential for the distribution of oil throughout the world and have increased in the vicinity of oil rich countries. Approximately 2.9 billion tons of oil and natural gas products, or around 62% of the world's petroleum production, were transported by sea in 2015. Such is the case for both Venezuela and Guyana. The Jose Terminal, situated in northeastern Venezuela, is the most significant oil export terminal for the country, producing 920,000 barrels of crude oil a day on average in 2019. The map below shows the major ports in Venezuela and Guyana, as well as other ports in the region. For Venezuela, these ports include, from west to east: Maracaibo, Bajo Grande, Puerto Miranda, Amuay, Punta Cardon, El Palito, Puerto Cabello, La Guaira, Jose Terminal, Puerto La Cruz, El Guamache, and Palua–which is located more inland. For Guyana (from west to east) these ports include: Georgetown, Linden, which is located inland, and New Amsterdam. It is important to note Trinidad and Tobago’s location along the maritime trade route that passes through Venezuela and Guyana, which holds seven important sea ports. Because of the location of various important ports in the region, and the oil routes that pass through them, a potential conflict between Venezuela and Guyana could disrupt these shipping routes in the Caribbean, as well as nearby maritime ports.

Location of Major Ports in Venezuela and Guyana and Others in the Region

Source: https://portwatch.imf.org/

For context, similar situations came as a result of attacks by Houthi rebel groups on Israeli-owned or -bound shipments, as well as Russia’s invasion of Ukraine. According to freight analytics company Vortexa, nine million barrels of oil were moved via the Suez Canal every day in the first half of 2023. The recent attacks on container ships in the Red Sea by Iran-backed Houthi groups from Yemen led freight companies to reroute their cargo around the Cape of Good Hope to avoid accessing the Suez Canal. This caused a significant disruption to global supply chains. It is estimated that the additional fuel expenses to reroute ships around the southern tip of Africa was $1 million for each round voyage between Asia and Northern Europe. Likewise, during Russia’s invasion of Ukraine, several issues, including the suspension of port operations in Ukraine, damage to critical infrastructure, trade restrictions, and rising fuel prices caused substantial disruptions to regional logistics in the Black Sea region. Ships and containers were forced to find alternate routes as ports closed and carriers stopped offering shipping services to Russia and Ukraine.

Maritime Shipping Routes in the Region

Source: https://portwatch.imf.org/

Similarly, shipping routes in the region could be interrupted due to a possible conflict between Venezuela and Guyana. Military operations may cause disruptions at the major trade sea ports in Venezuela and Guyana, as well as target Guyana’s shipping lanes for naval blockades aimed at container ships. Freight companies may be forced to reroute cargo, impacting regional supply chains, raising transit times, and increasing costs. The conflict may also replicate the logistical difficulties that followed Russia's invasion of Ukraine, such as the halting of port operations or even oil production operations. Such a scenario could also create volatility in the oil market.

Potential Market Volatility

Geopolitical tensions can demonstrably impact oil market prices, especially when they involve major oil-producing countries. An increase in tensions and hostility between Venezuela and Guyana could cause oil price volatility. Several studies have analysed the impact that geopolitical risks have on oil market dynamics. Observing two studies, one study stated that “geopolitical risks can increase speculation through investor attention” and the other saying geopolitical risk can “lead to oil market fluctuations”. In the past, according to the European Bank’s ECB Economic Bulletin from August, 2023, there has been a mixed effect of geopolitical events on oil prices. For example, following Russia's invasion of Ukraine, oil prices increased by around 30% in just two weeks, while prices increased by about 4% following the October 7, 2023 attacks by Hamas in Israel. The ECB also states that oil prices are primarily impacted by geopolitical instability through 1) the increased economic uncertainty brought on by high tensions and interruptions in commerce, and 2) financial markets might account for potential dangers to the oil supply in the future. Risks to the oil supply could raise prices if they impact large oil producers or strategically critical distribution nations. The table below indicates a VAR model from the ECB Economic Bulletin, revealing that geopolitical tensions involving Venezuela could drive up the price of oil by roughly 1.4%. Thus, according to the studies and model, escalating tensions between Venezuela and Guyana could increase oil market volatility. The potential disruptions to shipping lanes and oil production could lead to increased speculation and oil market fluctuations.

Estimated responses of oil prices to country-specific and global geopolitical shocks (percentages)

Source: European Central Bank

Conclusion

A potential conflict between Venezuela and Guyana could have implications for the global oil market. The importance of maintaining stability in the region is highlighted by the fact that Venezuela has always been a significant oil-producing country, and that Guyana is now becoming a new major player in the oil market. Market volatility is a concern due to the possible disruption of oil supply and shipping lanes associated with potential conflict between the two nations. For now, oil market observers can rest easy knowing that both the presidents of Guyana and Venezuela met in mid-December, promising not to use force or threats. However, their dispute over the Essequibo region remains unresolved.