Drilling Dreams, Sinking Realities

Introduction

Climate change is increasingly recognised as the most significant long-term downside risk to almost all investment sectors. This urgency is underscored by the approaching 2024 U.S. Presidential election, where energy policy is a key issue, particularly in the context of the Republican Party’s push to revive the fossil fuel industry. With global temperatures in 2023 reaching unprecedented highs and surpassing even the most dire projections, the severity of climate-related disasters has escalated. These developments make it clear that mitigating climate change is not just an environmental imperative but also a critical economic and geopolitical challenge. The outcome of the U.S. election could have profound implications for global energy policies, especially as the Republican nominee, Donald Trump, advocates for an aggressive expansion of fossil fuel production.

Increasing Severity of Climate Disasters

2023 has been a stark reminder of the accelerating impacts of climate change. Record-breaking global temperatures, partly driven by an El Niño intensified by climate change, have led to widespread heatwaves, wildfires, and other extreme weather events. These developments have surpassed the projections of most climate models, highlighting the increasing unpredictability and severity of climate-related disasters, and the real-world implications of inaction on climate policy. The nonlinear trajectory of ecosystem collapse is one that has far-reaching implications, affecting everything from agriculture and infrastructure to public health and economic stability.

Graph 1.0 (Global Temperature Trends)

As the graph above shows, 2023 surpassed every previous temperature record by-far; almost showing an off-the-charts uptick in increasing temperatures. This must be seen in the context of the political economy of the green energy transition, involving stakeholders like big-oil to employ significant effort to subdue, delay, and slow down momentum of green energy through extensive lobbying in an effort to stay relevant in a world where renewable energy has become cheaper than conventional oil and gas as shown in the graph below.

Graph 2.0 (Energy cost by source)

COP and Delayed Multilateral Action

The international community has attempted to make some progress toward addressing climate change, with the United Nations’ Conference of the Parties (COP) serving as a central platform for multilateral action. COP 28 in Dubai marked a significant moment, signalling what many hoped would be the beginning of the end for fossil fuels. However, the subsequent COP 29, hosted in Baku, Azerbaijan—also a petro-state—seems to have reduced the pace and effectiveness of global climate action, and put the world off-track to limit global warming to 1.5C. The influence of fossil fuel interests and lobbying has continued to slow progress, delaying the implementation of much-needed measures to reduce emissions on a global scale, which by the number of lobbyists in COP 26 for instance, outnumbered national delegations to the convention.

Graph 3.0 (number of lobbyists in COP 26)

The 2024 U.S. Presidential Elections

The 2024 U.S. Presidential election represents a pivotal moment for the country’s energy policy, particularly in the context of climate change. Donald Trump’s acceptance speech at the Republican National Convention on July 19th highlighted his intent to revive America’s fossil fuel industry. Declaring, “We will drill, baby, drill!” Trump pledged to ramp up domestic fossil fuel production to unprecedented levels, with the aim of making the United States "energy dominant" on the global stage. His commitment to this vision was evident in his efforts to court oil industry leaders, promising to roll back President Joe Biden’s environmental regulations in exchange for financial support for his re-election campaign.

Trump’s team argues that unleashing vast untapped oil reserves in regions like Alaska and the Gulf of Mexico could significantly boost production if environmental regulations were eased. However, experts contend that such plans might not significantly alter the U.S. energy landscape, whether fossil or renewable. Despite the oil industry’s grievances under Biden, the sector has seen substantial growth, with oil and gas production reaching record levels. Biden’s administration has issued more drilling permits in its first three years than Trump did during his entire term, and the profits of major oil companies have soared due to the 2020s global commodities boom.

Federal Policy and Oil Production

The impact of federal policy on oil production is often tempered by broader market dynamics and investor behaviour. The oil industry, particularly after the financial strains of the shale boom, now prioritises capital discipline, driven more by market conditions and Wall Street’s influence than by the White House’s policies. Even if Trump were to win the presidency, the overall trajectory of oil production is likely to continue being shaped by global supply-demand balances and the strategic decisions of organisations like OPEC.

Interestingly, Trump’s promise to repeal Biden’s Inflation Reduction Act (IRA)—which includes substantial subsidies for green energy—may face significant obstacles. The IRA’s benefits are largely concentrated in Republican districts, and industries traditionally aligned with fossil fuels are beginning to recognise the advantages of low-carbon technologies. For example, companies benefiting from the IRA’s subsidies for hydrogen and carbon capture are prepared to defend these incentives against any potential repeal.

Conclusion

The urgency of addressing climate change is often underestimated due to a common misunderstanding of the non-linear feedback loops involved in ecosystem collapse. Many tend to view emissions as a simple, transactional force with nature, failing to grasp the exponential and potentially catastrophic consequences of inaction. This underestimation leads to a dangerous complacency, undervaluing the need for urgent and robust policy action.

The U.S. holds significant sway over global climate outcomes mainly because of two reasons: (1) It is the second largest emitter; and (2) it is one of the only countries in the world for climate policy to be a partisan issue, making it particularly susceptible to hampering global emissions targets.

With much of the Global South still dependent on coal, oil, and gas, a unilateral decision by the U.S. to aggressively increase fossil fuel consumption could single-handedly push the planet toward an irreversible climate disaster. The stakes are incredibly high, especially as the political economy of the green transition faces opposition from entrenched fossil fuel interests. These forces work to delay and obstruct the shift to renewable energy, despite the clear and present need to accelerate this transition to prevent ecological collapse.

Having already surpassed 1.5C warming; the world is headed towards 4.1-4.8C warming without climate action policies; 2.5-2.9C warming with current policies; and 2.1C warming with current pledges and targets. In this context, if the U.S. were to aggressively change course and begin burning more, instead of less as Trump suggests—it may severely hamper the ability of the global ecosystem to recover and restore, potentially breaching already critical tipping points.

Graph 4.0 (projected warming in different scenarios)

Therefore, it becomes more important than ever for climate-conscious energy policy, to recognise that ecological collapse is a non-linear and irreversible outcome of breaching environmental tipping points, and to underscore the need to prevent misinformation on climate change spreading as a result of forces acting against renewable energy in the political economy of the green transition.

The good news, however, may be that while Republicans may advocate for a new oil boom, the realities of global markets and investor behaviour suggest a different outcome. Wall Street, driven by a cost-benefit analysis that increasingly favours renewable energy, may not align with the interests of a pro-fossil fuel administration. Although the White House can influence energy policy, it is ultimately market forces that will dictate the future of America's energy landscape. This shift towards green energy, driven by economic viability and technological advancements, underscores the need for accelerated action to mitigate climate risks and ensure a sustainable future.

A Strait Betwixt Two

As the Yemeni Houthi group's assault on maritime vessels continues to escalate, the risk to key commodity supply chains raises global concern. As analysed in this series' previous article (available here), conflict escalation impacts the region's security, impacting key trade routes and global trade patterns. The Suez Canal is a key trade route whose stability and security could impact and shift trade dynamics. As the search for alternative trade routes ensues, the Strait of Hormuz makes use of a power vacuum to expand its influence.

Suez Canal

The Suez Canal is a 193-kilometre waterway that connects the Red Sea to the Mediterranean Sea. Approximately 12% of global trade passes through the Canal, granting it vast economic, strategic, and geopolitical influence on a global scale. This canal shortens maritime trade routes between Asia and Europe by approximately 6,000 km by removing the need to export around the Cape of Good Hope and serves as a vital passage for oil shipments from the Persian Gulf to the West. Approximately 5.5 million barrels of oil a day pass through the Canal, making it a ‘competitor’ of the Strait of Hormuz.

Global trade via the Suez Canal is likely to decrease as a result of the rising tensions near the Bab el-Mandeb Strait. Due to their geographic predispositions, the Bab el-Mandeb Strait and the Suez Canal are interdependent; bottlenecks in either trade choke point will have a knock-on effect on the other. Bottlenecks caused by Houthi aggression against ships in the strait are likely to redirect maritime traffic from the Suez Canal to alternative passageways. From November to December 2023, the volume of shipping containers that passed through the Canal decreased from 500,000 to 200,000 per day, respectively, representing a reduction of 60%.

Suez Canal Trade Volume Differences (metric tonnes)

The overall trade volume in the Suez Canal has decreased drastically. Between October 7th, 2023, and February 25th, 2024, the channel’s trade volume decreased from 5,265,473 metric tonnes to 2,018,974 metric tonnes. As the weaponization of supply chains becomes part of regional economic power plays, there is a global interest in decreasing the vulnerability of vital choke points via trade route diversification. The lack of transport routes connecting Europe and Asia has hampered these interests, making choke points increasingly susceptible to exploitation.

Oil Trade Volumes in Millions of Barrels per Day in Vital Global Chokepoints

Source: Reuters

Quantitative Analysis

Many cargoes have been rerouted through the Cape of Good Hope to avoid the Red Sea region since the beginning of the Houthi conflict. Several European automakers announced reductions in operations due to delays in auto parts produced in Asia, demonstrating the high exposure of sectors dependent on imports from China.

In the first two weeks of 2024, cargo traffic decreased by 30% and tanker oil carriers by 19%. In contrast, transit around the Cape of Good Hope increased by 66% with cargoes and 65% by tankers in the same period. According to the analysis of JP Morgan economists, rerouting will increase transit times by 30% and reduce shipping capacities by 9%.

Depiction of Trade Route Diversion

Source: Al Jazeera

More fuel is used in the rerouted freight, an additional cost that increases the risk of cargo seizure and results in elevated shipping rates. The most affected routes were from Asia towards Europe, with 40% of their bilateral trade traversing the Red Sea. The freight rates of the north of Europe until the Far East, utilising the large ports of China and Singapore, have increased by 235% since mid-December; freights to the Mediterranean countries increased by 243%. Freights of products from China to the US spiked 140% two months into the conflict, from November 2023 to January 25, 2024. The OECD estimates that if the doubling of freight persists for a year, global inflation might rise to 0.4%.

The upward trend in freight rates can be seen in the graphic pictured below, depicting the “Shanghai Containerised Freight Index” (SCFI). The index represents the cost increase in times of crisis, such as at the beginning of the pandemic, when there were shipping and productive constraints, and more recently, with the Houthi rebel attacks. Most shipments through the Red Sea are container goods, accounting for 30% of the total global trade. Companies such as IKEA, Amazon, and Walmart use this route to deliver their Asian-made goods. As large corporations fear logistic and supply chain risk, more crucial trade volumes could be rerouted.

Shanghai Containerized Freight Index

Energy Commodity Impact

Of the commodities that traverse the Red Sea, oil and gas appear to be the most vulnerable. Before the attacks, 12% of the oil trade transited through the Red Sea, with a daily average of 8.2 million barrels. Most of this crude oil comes from the Middle East, destined for European markets, or from Russia, which sends 80% of its total oil exports to Chinese and Indian markets. The amount of oil from the Middle East remained robust in January. Saudi oil is being shipped from Muajjiz (already in the Red Sea) in order to avoid attack-hotspots in the strait of Bab al-Mandeb.

Iraq has been more cautious, contouring the Cape of Good Hope and increasing delays on its cargo. Iraq's oil imports to the region reached 500 thousand barrels per day (kbd) in February, 55% less than the previous year's daily average. Conversely, Iraq's oil imports increased in Asia, signalling a potential reshuffling of transport destinations. Trade with India reached a new high since April 2022 of 1.15 million barrels per day (mbd) in January 2024, a 26% increase from the daily average imports from Iraq's crude.

Brent Crude and WTI Crude Fluctuations

Source: Technopedia

Refined products were also impacted. Usually, 3.5 MBd were shipped via the Suez Canal in 2023, or around 14% of the total global flow. Nearly 15% of the global trade in Naphta passes through the Red Sea, amounting to 450 kbd. One of these cargoes was attacked, the Martin Luanda, laden with Russian naphtha, causing a 130 kbd reduction in January compared with the same month in 2023. Traffic to and from Europe is being diverted in light of the conflict. Jet fuel cargoes sent from India and the Middle East to Europe, amounting to 480 kbd, are avoiding the affected region, circling the Cape of Good Hope.

Due to these extra miles and higher speeds to counteract the delays, bunker fuel sales saw record highs in Singapore and the Middle East. The vessel must use more fuel, and bunker fuel demand increased by 12.1% in a year-over-year comparison in Singapore.

In 2023, eight percent, or 31.7 billion cubic metres (bcm), of the LNG trade traversed the Red Sea. The US and Qatar exports are the most prominent in the Red Sea. After sanctioning Russia's oil because of the Ukrainian War, Europe started to rely more on LNG shipments from the Middle East, mainly from Qatar. The country shipped 15 metric tonnes of LNG via the Red Sea to Europe, representing a share of 19% of the Qatari LNG exports. Vessels travelling to and from Qatar will have to circle the Cape of Good Hope, adding 10–11 days to travel times and negatively impacting cargo transit.

US LNG export capacity has increased in the past few years, sending shipments to Asia via the Red Sea. The Panama Canal receives many LNG cargoes from the US via the Pacific, yet its traffic limitations cause US cargo to be routed through the Atlantic and the Red Sea. The figure “Trade Shipping Routes” below displays the dimensions of the shifts that US LNG cargoes must take in the absence of passage via the Panama Canal.

Trade Shipping Routes

Source: McKinsey & Company

Until January 15, at least 30 LNG tankers were rerouted to pass through the Cape of Good Hope instead. Russia's LNG shipments to Asia are currently avoiding the Red Sea, and Qatar did not send any new shipments in the last fortnight of January after the Western strikes at Houthi targets.

Risk Assessment

A share of 12% of oil tankers, ships designed to carry oil, and 8% of liquified gas pass through this route towards the Mediterranean. Inventories in Europe are still high, but if the crisis persists for several months, energy prices could be aggravated. As evidenced by the sanctions against Russia, cargo reshuffling is possible. Qatar can send its cargoes to Asia, and those from the US can go to European markets, allowing suppliers to effectively avoid the Red Sea.

Around 12% of the seaborn grains traversed the Red Sea, representing monthly grain shipments of 7 megatonnes. The most considerable bulk are wheat and grain exports from the US, Europe, and the Black Sea. Around 4.5 million metric tonnes of grain shipments from December to February avoided the area, with a notable decrease of 40% in wheat exports. The attacks affected Robusta coffee cargoes as well. Cargoes from Vietnam, Indonesia, and India towards Europe were intercepted, impacting shipping prices and incentivizing trade with alternative nations.

Daily arrivals of bulk dry vessels, including iron ore and grain from Asia, were down by 45% on January 28, 2024, and container goods were down by 91%. However, further significant disruptions to agricultural exports are not expected. Most of the exports from the US, a large bulk, were passing through the Suez Canal to avoid the congestion of the Panama Canal due to the droughts that limited the capacity of circulation. These cargoes are now traversing the Cape route.

Around 320 million metric tonnes of bulk sail through Suez, or 7% of the world bulk trade. No significant impacts are predicted for iron ore or coal, which represented 42 and 99 megatonnes of volume, respectively, shipped through the Red Sea in 2023. Most of the dry bulks that traverse the impacted region can be purchased from other suppliers, precluding significant supply disruptions.

As of March 1st, reports show that only grain shipments and Iranian vessels were passing through the Red Sea. There were no oil or LNG shipments with non-Iranian links in the Red Sea. These developments illustrate the significant trade shifts caused by the Red Sea crisis. As of today, a looming threat lies in the Houthis’ promises of large-scale attacks during Ramadan. The lack of intelligence on the Houthi’s military capacity and power makes it difficult to ascertain the extent of future conflicts, generating further uncertainty in commercial trade.

The Strait of Hormuz

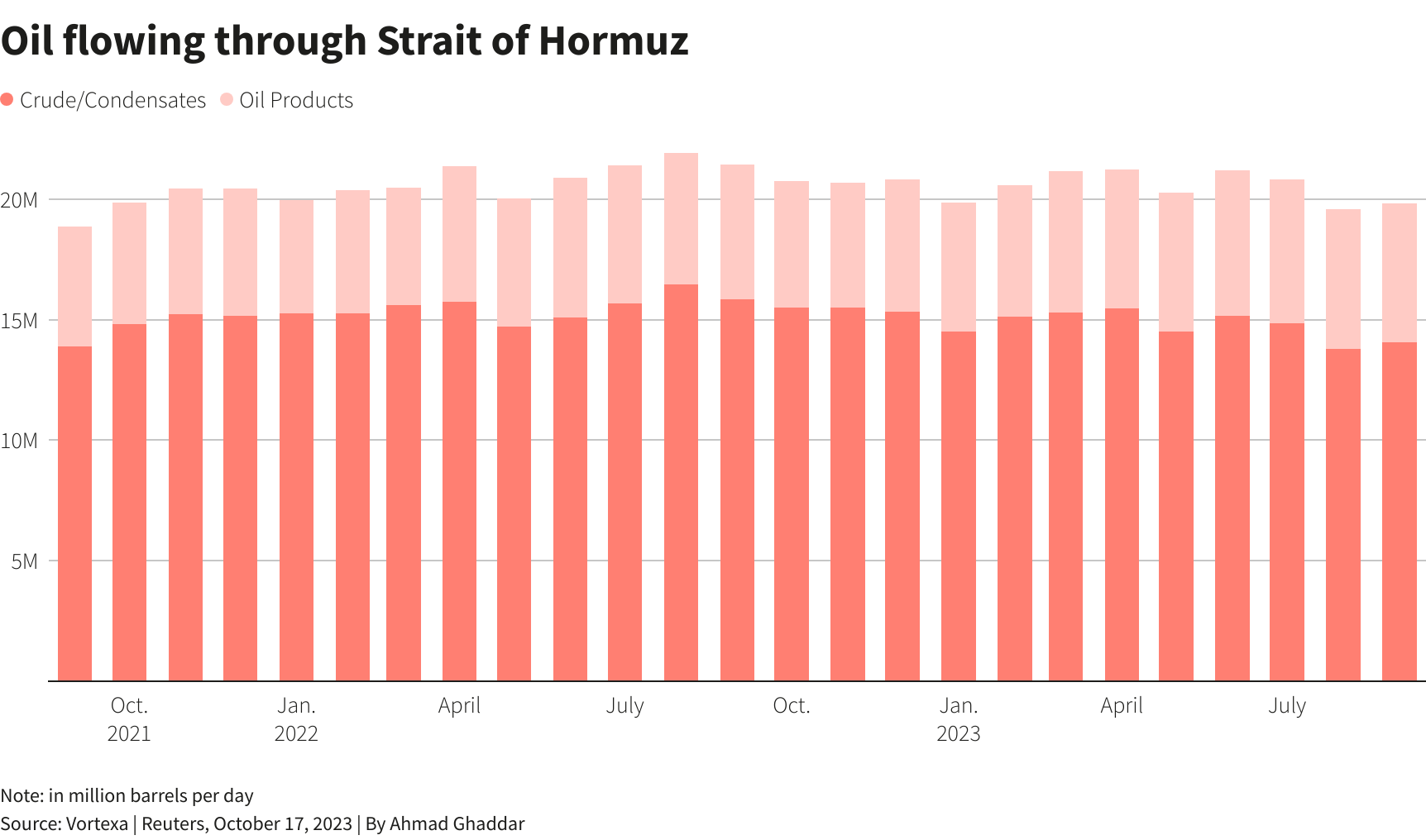

The Strait of Hormuz is a channel that connects the Persian Gulf to the Gulf of Oman, providing Iran, Oman, and the UAE with access to maritime traffic and trade. The strait is estimated to carry about one-fifth of the global oil at a daily trade volume of 20.5 million barrels, proving to be of vital strategic importance for Middle Eastern oil supply the world’s largest oil transit chokepoint. The strait is a prominent trade corridor for a myriad of oil-exporting nations, namely the OPEC members Saudi Arabia, Iran, the UAE, Kuwait, and Iraq. These nations export most of their crude oil via the passage, with total volumes reaching 21 mb of crude oil daily, or 21% of total petroleum liquid products. Additionally, Qatar, the largest global exporter of LNG, exports most of its LNG via the Strait.

Geographic Location of Strait of Hormuz

Source: Marketwatch

Although the strait is technically regulated by the 1982 United Nations Convention on the Law of the Sea, Iran has not ratified the agreement. Through its geostrategic placement, Iran can trigger oil price responses through its influence on trade transit, establishing the country’s regional and global influence.

Strait of Hormuz Oil Volumes

Source: Reuters

Experts are particularly worried that the turbulence is likely to spread to the Strait of Hormuz now that Iran backs the Houthis in Yemen and might want to support their cause by doubling down regionally. However, this is something that would cause a lot of backlash in the form of a further tightening of economic sanctions against Tehran, which might deter further provocations.

Despite Iran’s previous threats to block the Strait entirely, these have never gone into effect. Diversifying trade routes to avoid supply shocks and bottlenecks is of interest to regional oil-exporters dependent on the route for maritime trade access. Such diversification attempts have already been undertaken, as seen by the UAE and Saudi Arabia's attempts to bypass the Strait of Hormuz through the construction of alternative oil pipelines. The loss of trade volume from these two producers, holding the world's second and fifth largest oil reserves, respectively, severely hindered the corridor’s prominence.

The attacks on the Red Sea might cause damage to the oil and LNG cargo from countries in the Persian Gulf, increasing costs for oil and gas exporters. However, cargoes could find alternative destinations. The vast Asian markets, which face a shortage of energy products due to a loss of trade through the Red Sea, could be a potential suitor. Finding new LPG (liquefied petroleum gas) contracts could be beneficial for Iran, and its recently enhanced production capacity could supply various markets.

Geopolitics and Prospects for a Route Shift

Although the Strait of Hormuz stands to capture diverted trade flows from the Suez Canal, its global influence is still limited by Iran’s geopolitical ties. As exemplified by the Iran-US conflict, Iran’s conflicts can severely impact traffic through the Strait, significantly impacting the stability of the route and prospects for future growth.

Although security and stability are of paramount importance to trade, efforts to provide these traits could be counterproductive. On March 12th, China and Russia conducted maritime drills and exercises in the Gulf of Oman with naval and aviation vessels. According to Russia's Ministry of Defence, this five-day exercise sought to enhance the security of maritime economic activities using maritime vessels with anti-ship missiles and advanced defence systems. Over 20 vessels were displayed in this joint naval drill, attempting to lure trade through the promise of stability and security.

Whether meant as a display of power or a promise of security, the pronounced presence of Russian and Chinese forces could aggravate geopolitical tensions and increase the potential for conflict in the region, driving global trade prospects down. With precedents of trade conflict, such as the IRGC’s seizure of an American oil cargo in the Persian Gulf on January 22nd, various countries might be sceptical of rerouting commodity trade through the Strait.

Tensions are also aggravated by Iran’s alleged assistance in the Houthi attacks. The US has supposedly communicated indirectly with Iran to urge them to intervene in the region. China and Russia’s interest in improving the Strait’s trade prospects would benefit from a de-escalation of the Houthi conflict, as shown by China’s insistence on Iran’s cooperation in the Houthi conflict. As the conflict stands, the Strait’s prospect as an alternative trade route is dependent not only on Iran’s reputation and presence in global conflicts but also on the route’s patrons and proponents.

Conclusion

The extent to which the Strait of Hormuz could benefit from trade diversion depends not only on its ability to pose itself as a viable trade route but also on the duration of the Houthi conflict. In order to capture trade volumes and increase international trade through the route, Iran would have to ameliorate its geopolitical ties and provide stability to compete with rising prospective trade route alternatives. Although the conflict in the Suez has yet to show promising signs of de-escalation, securing the Suez would likely cause previous trade volumes to resume and restore its hegemony in commodity trade. It remains to be seen whether the conflict will endure long enough to allow other trade routes to be established as alternatives and permanently shift power balances in global trade.

The Impact of a Potential Conflict Between Venezuela and Guyana on the Global Oil Market

Introduction

In the global oil market, Venezuela has played an important role as one of the world's biggest oil producers because of its strategic endeavors within OPEC. However, sanctions and an economic downturn have caused a decrease in Venezuela's oil production, hindering the country's oil producing status in recent years. In contrast, due to recent oil discoveries and production, neighboring Guyana has become a new player in the global oil market. With newly discovered oil deposits, Guyana is positioned to increase its energy influence, while Venezuela struggles with decreasing production and geopolitical turbulence, creating new tensions between the two countries.

Furthermore, in December 2023, tensions began between Venezuela and Guyana over a long-standing territorial dispute. The border territory around the Essequibo River, which spans 160,000 square kilometers (62,000 square miles), is the center of a dispute between Venezuela and Guyana and is claimed by both countries. The border around this thinly populated area was first drawn in 1899, when Guyana was ruled by the British. Following major oil discoveries off the coast of Guyana in 2015, Venezuela reaffirmed its claim to the territory. With President Nicolas Maduro promising exploration efforts in the disputed region, Caracas recently secured backing for reclaiming the Essequibo through a referendum vote. For this reason, a potential conflict between Venezuela and Guyana over the Essequibo territorial dispute could cause disruptions to regional oil transportation routes and supply chains, which could lead to price volatility in the oil market.

Venezuela's Significance in The Global Oil Market

Venezuela has been a significant player in the global oil market since Shell geologists discovered oil in the country in 1922, leading to a sharp increase in output by the late 1920s and making Venezuela the world's second-largest oil producer behind the United States. Venezuela has the world's highest proven oil reserves at 304 billion barrels, slightly more than Saudi Arabia's 298 billion barrels, according to the 2022 BP Statistical Review of World Energy. The country holds historical influence in the global oil market as a founding member of OPEC, joining the group in 1960 with Saudi Arabia, Iran, Iraq, Kuwait, and other countries in an effort to control oil prices and strengthen state authority over the sector. That same year, Venezuela increased the income tax on oil businesses to 65% and established the Venezuelan Petroleum Corporation (PDVSA), a state-owned oil company. However, in recent years, the oil industry in Venezuela has appeared completely different than that of the twentieth century.

Oil production in Venezuela from 2008 to 2022 (In million barrels per day)

Source: https://www.statista.com/statistics/265185/oil-production-in-venezuela-in-barrels-per-day/

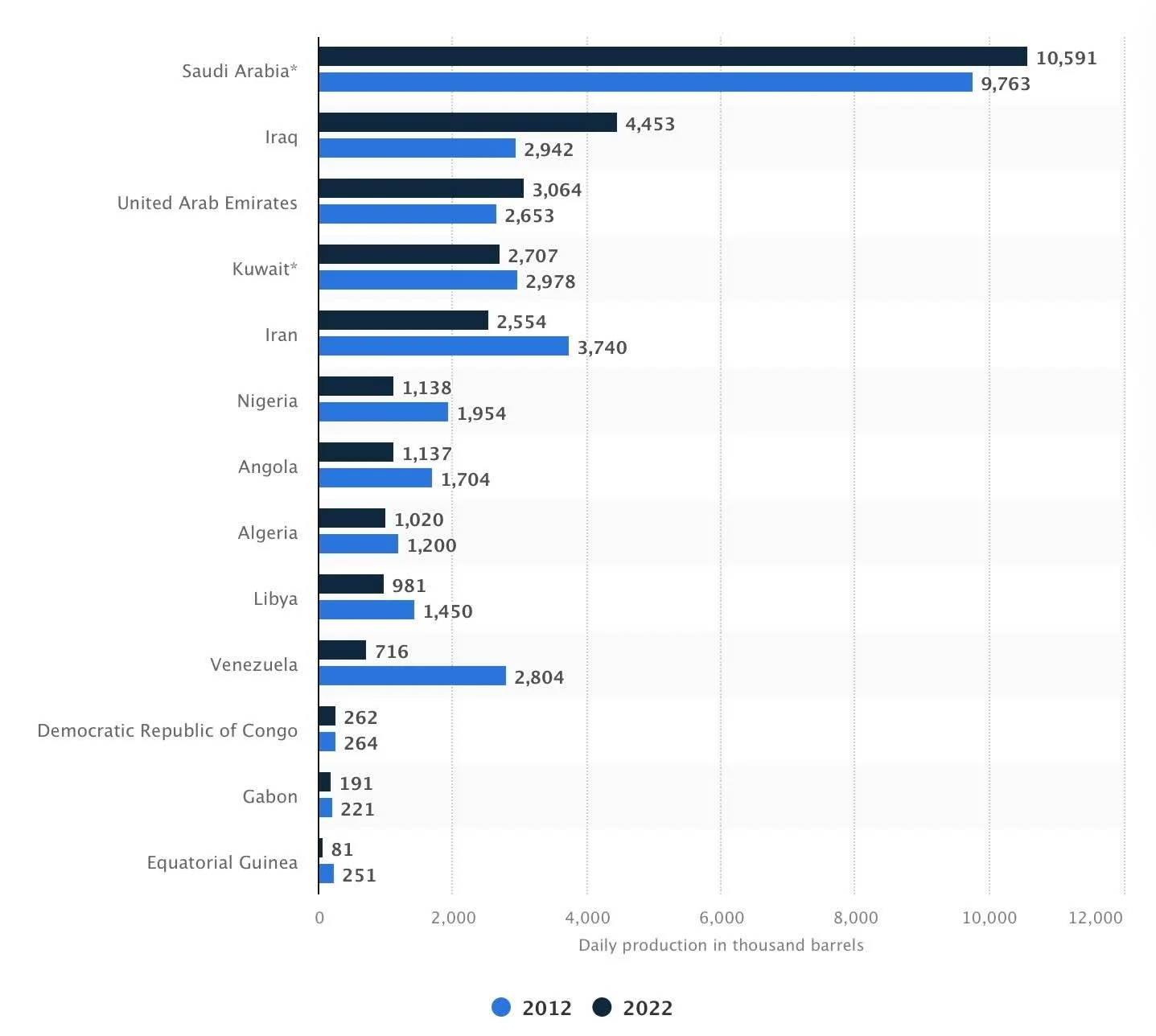

Venezuela's status as a key contributor to the world's oil supply has declined in recent years due to sanctions enforced by several nations against Venezuelan-produced oil, notably by the United States in 2019. Furthermore, the heavy composition of Venezuela's crude oil creates difficulties for the refining and production operations. In defiance of US sanctions, Venezuela was able to maintain and continue oil trade alliances with China, Cuba, Iran, Russia, and Turkey. Nonetheless, as described in the graph below, Venezuela’s crude oil production fell significantly from 2,804,000 barrels per day in 2012 to 716,000 barrels per day in 2022, decreasing its rank in global production among the rest of OPEC countries.

Crude oil production of the OPEC in 2012 and 2022, by member state (in 1,000 barrels per day)

Source: https://www.statista.com/statistics/271821/daily-oil-production-output-of-opec-countries/

In November 2022, the US lifted sanctions on Venezuela's oil and gas industry and allowed Chevron to resume limited operations in an effort to mitigate rising global energy costs as a result of the Russo-Ukrainian war. Chevron increased production through joint ventures with PDVSA, shipping crude oil to the US, which has increased the likelihood of a production rebound for Venezuela after years of decline. Because of this, Venezuela could once again become a major force in the energy sector given its abundance of oil resources; however, throughout Venezuela’s oil production decline, its neighboring country, Guyana, has remarkably shifted its position as a global oil producer.

Guyana's Emergence in The Global Oil Market

With a population of 791,000, Guyana has been one the poorest countries in South America, with approximately 41% of its population living below the poverty line in 2017, and more than 40% of its people surviving on less than $5.50 a day. Little did this country realise that its economic course would change after May 2015 when ExxonMobil first discovered significant oil deposits off the country’s coast in an area called the Liza field in the Stabroek Block. This discovery changed the dynamics of the global energy landscape by adding the largest amount of new oil to the reserves since the 1970s.

The discovery of an estimated 11 billion barrels of oil reserves saw the start of commercial drilling in 2019, significantly increasing the economic landscape for Guyana. Even during the global economic downturn caused by the Covid-19 pandemic, Guyana's GDP grew by an astounding 49% in 2020, making it one of the fastest-growing economies in the world. Guyana became the seventh-largest crude oil producer in Latin America in 2022, producing 276,000 barrels per day, a significant rise from the average of 74,000 barrels per day in 2021. Because of its rising oil output, Guyana’s GDP grew by an astonishing 62.3% in 2022. Having already received $1.6 billion in oil revenues by May 2023, Guyana’s government utilised the funds for infrastructure projects and stable economic development projects. If present economic patterns continue, Guyana may rank among the world's top producers of oil per person by 2030.

Current oil producers in Guyana, Exxon, Hess Corp., and China's CNOOC, produced 400,000 barrels per day from two vessels by August 2023, generating $2.8 billion in revenues for Guyana, and employing 4,400 Guyanese. Exxon plans to expand up to ten offshore projects with partners Hess Corp and CNOOC. ExxonMobil projects that by 2026, its oil production in Guyana will increase to 750,000 barrels per day. By 2027, their projects are expected to make Guyana the third-largest producer in Latin America after only Brazil and Mexico. According to the International Energy Agency, by 2028, Guyana will produce 1.2 million barrels per day, with four additional oil fields expected to be operational that same year.

Production of crude oil in Guyana from 2019 to 2022 (in 1,000 barrels per day)

Source: https://www.statista.com/statistics/1260886/crude-oil-production-guyana/

Due to Guyana’s increasing oil production, spot markets have emerged and interest in Guyanese crude oil is expanding throughout Europe. Guyana was able to secure a larger share of the European oil market in 2023, after finding a window of opportunity as a result of sanctions on Russian oil following its invasion of Ukraine. Refinitiv Eikon data indicates that during the first half of 2023, Guyana's oil exports to Europe amounted to over 215,000 barrels per day, or 63% of the nation's total exports of 338,254 bpd. This is an increase over 2022, when roughly 50% of Guyana's shipments were sent to Europe. However, increasing tensions between Venezuela and Guyana, both important oil-producing nations with significant shipping infrastructure, could disrupt oil shipping routes in the event of conflict between the two countries.

Potential Disruption to Oil Shipping Lanes

Ports are essential for the distribution of oil throughout the world and have increased in the vicinity of oil rich countries. Approximately 2.9 billion tons of oil and natural gas products, or around 62% of the world's petroleum production, were transported by sea in 2015. Such is the case for both Venezuela and Guyana. The Jose Terminal, situated in northeastern Venezuela, is the most significant oil export terminal for the country, producing 920,000 barrels of crude oil a day on average in 2019. The map below shows the major ports in Venezuela and Guyana, as well as other ports in the region. For Venezuela, these ports include, from west to east: Maracaibo, Bajo Grande, Puerto Miranda, Amuay, Punta Cardon, El Palito, Puerto Cabello, La Guaira, Jose Terminal, Puerto La Cruz, El Guamache, and Palua–which is located more inland. For Guyana (from west to east) these ports include: Georgetown, Linden, which is located inland, and New Amsterdam. It is important to note Trinidad and Tobago’s location along the maritime trade route that passes through Venezuela and Guyana, which holds seven important sea ports. Because of the location of various important ports in the region, and the oil routes that pass through them, a potential conflict between Venezuela and Guyana could disrupt these shipping routes in the Caribbean, as well as nearby maritime ports.

Location of Major Ports in Venezuela and Guyana and Others in the Region

Source: https://portwatch.imf.org/

For context, similar situations came as a result of attacks by Houthi rebel groups on Israeli-owned or -bound shipments, as well as Russia’s invasion of Ukraine. According to freight analytics company Vortexa, nine million barrels of oil were moved via the Suez Canal every day in the first half of 2023. The recent attacks on container ships in the Red Sea by Iran-backed Houthi groups from Yemen led freight companies to reroute their cargo around the Cape of Good Hope to avoid accessing the Suez Canal. This caused a significant disruption to global supply chains. It is estimated that the additional fuel expenses to reroute ships around the southern tip of Africa was $1 million for each round voyage between Asia and Northern Europe. Likewise, during Russia’s invasion of Ukraine, several issues, including the suspension of port operations in Ukraine, damage to critical infrastructure, trade restrictions, and rising fuel prices caused substantial disruptions to regional logistics in the Black Sea region. Ships and containers were forced to find alternate routes as ports closed and carriers stopped offering shipping services to Russia and Ukraine.

Maritime Shipping Routes in the Region

Source: https://portwatch.imf.org/

Similarly, shipping routes in the region could be interrupted due to a possible conflict between Venezuela and Guyana. Military operations may cause disruptions at the major trade sea ports in Venezuela and Guyana, as well as target Guyana’s shipping lanes for naval blockades aimed at container ships. Freight companies may be forced to reroute cargo, impacting regional supply chains, raising transit times, and increasing costs. The conflict may also replicate the logistical difficulties that followed Russia's invasion of Ukraine, such as the halting of port operations or even oil production operations. Such a scenario could also create volatility in the oil market.

Potential Market Volatility

Geopolitical tensions can demonstrably impact oil market prices, especially when they involve major oil-producing countries. An increase in tensions and hostility between Venezuela and Guyana could cause oil price volatility. Several studies have analysed the impact that geopolitical risks have on oil market dynamics. Observing two studies, one study stated that “geopolitical risks can increase speculation through investor attention” and the other saying geopolitical risk can “lead to oil market fluctuations”. In the past, according to the European Bank’s ECB Economic Bulletin from August, 2023, there has been a mixed effect of geopolitical events on oil prices. For example, following Russia's invasion of Ukraine, oil prices increased by around 30% in just two weeks, while prices increased by about 4% following the October 7, 2023 attacks by Hamas in Israel. The ECB also states that oil prices are primarily impacted by geopolitical instability through 1) the increased economic uncertainty brought on by high tensions and interruptions in commerce, and 2) financial markets might account for potential dangers to the oil supply in the future. Risks to the oil supply could raise prices if they impact large oil producers or strategically critical distribution nations. The table below indicates a VAR model from the ECB Economic Bulletin, revealing that geopolitical tensions involving Venezuela could drive up the price of oil by roughly 1.4%. Thus, according to the studies and model, escalating tensions between Venezuela and Guyana could increase oil market volatility. The potential disruptions to shipping lanes and oil production could lead to increased speculation and oil market fluctuations.

Estimated responses of oil prices to country-specific and global geopolitical shocks (percentages)

Source: European Central Bank

Conclusion

A potential conflict between Venezuela and Guyana could have implications for the global oil market. The importance of maintaining stability in the region is highlighted by the fact that Venezuela has always been a significant oil-producing country, and that Guyana is now becoming a new major player in the oil market. Market volatility is a concern due to the possible disruption of oil supply and shipping lanes associated with potential conflict between the two nations. For now, oil market observers can rest easy knowing that both the presidents of Guyana and Venezuela met in mid-December, promising not to use force or threats. However, their dispute over the Essequibo region remains unresolved.

2024 Elections Report: Risks & Opportunities for Commodities Sector

In the ever-evolving landscape of global commodities, the year 2024 stands as a pivotal juncture marked by transformative elections across diverse regions. As nations prepare to cast their ballots, the outcomes hold the power to shape policies and strategies that will significantly influence energy, trade relations, and resource management worldwide.

This report encapsulates the intricate intersections between political shifts and their repercussions on the commodities sector. London Politica’s Global Commodities Watch has made a selection of the most significant countries, and analysed the potential impact of elections based on election programmes, past policies, and scenario planning.

Potential scenarios for Israel - Palestine conflict and effect on commodities

On October 7, Israel was attacked by Hamas. The event, which was classified as Israel’s 9/11 by Ian Bremmer, led to at least 1,300 fatalities and 210 abductions. Israel has launched a strong military response, and as of the 20th day since the original attack the situation remains unresolved. Both sides are experiencing ongoing hostilities and Netanyahu, Israel’s president, stated that the country is preparing for a ground invasion of the Gaza Strip, which will result in further civilian casualties.

Various groups are threatening to involve themselves in the conflict. Hezbollah, for instance, has issued warnings indicating the possibility of launching a significant military operation from Lebanon to northern Israel if the latter enters the Gaza Strip. It also has been discussing what a ‘real victory’ would look like with its alliance partners Hamas and Islamic Jihad. Israeli forces, on the other hand, bombed Syria shortly after air raids sounded in the Golan Heights, a disputed territory that has been annexed by Israel since 1967. This offensive targeted the Aleppo airport and sources claimed its goal was to stop potential Iranian attacks being launched from Syria. Additionally, Iran has faced accusations of funding the attack, which raises concerns about its involvement.

Consequences for commodities

The ongoing conflict has emerged as a significant geopolitical factor on global oil markets. However, there have not been immediate impacts on physical flows yet. During the weekend of 7th to 9th October there was an increase in Brent crude prices of about 4% , which later fell 0.2% after Hamas released two American hostages. Prices fell even further after Israel appeared to hold off on its widely expected ground invasion of Gaza. These dynamics show that the risk premium in the oil price takes into account the severity of the conflict and the likelihood for escalation.

Yet, Israel’s limited oil production capacity means that, if the conflict remains localised, it is unlikely to have a significant impact on global oil supply. Traditional energy commodities (and their prices), that can be viewed as a substitute to oil, have not been impacted so far either. Natural gas, for example, is both a substitute to oil and also largely produced by Israel with its southern offshore Tamar field. Despite European gas prices reaching their highest price since February on Friday 13th, markets do not appear to be pricing in the possibility of an escalation extending beyond Israel and Gaza. If that was the case, even higher prices would be recorded.

The most significant impacts on oil markets are more likely to occur if other nations actively engage in the conflict. After the explosion of a hospital in Gaza on 17th of October, Iran called for an oil embargo against Israel in retaliation for the deadly attacks. The Gulf Cooperation Council (GCC) countries have expressed their unwillingness to support Iran, stating that “oil cannot be used as a weapon”, which helped markets to not consider any embargos for the moment. Moreover, the impact of this action would be limited, since Israel could source its oil from a wide array of other countries.

Another point worth mentioning, it is estimated that 98% of Israel’s imports and exports are made by sea, making the national ports a crucial part of the country’s infrastructure. These ports are currently under a significant risk of potential damage, which has heightened shipping insurance premiums and affected the costs of importing into and exporting from Israel.

Possible scenarios and implications

1. If the conflict remains confined to the Israel - Palestine region

While there could be short-term volatility in oil prices during the most intense attacks and as potential escalation threats rise, neither of these regions are significant oil producers. Therefore, recent rises are not expected to have a lasting impact on oil prices, which should soon stabilise between $93 and $100 per barrel. However, it is important to mention that this price range was already predicted before the current war between Israel and Palestine took place.

2. War involving Hezbollah

Some recent attacks have taken place between Israel and Hezbollah, however, if the latter joins the conflict, the impact on oil markets could be more substantial. This could lead to potential global economic consequences due to risk-off sentiment in the financial markets, leading to oil prices rising by $8 per barrel, approximately. Another group that can act on the conflict are the Houthis, an Iran-backed group in Yemen which allegedly launched missiles against Israel on October 19th, that were intercepted by the United States. While Yemen primarily exports cereal commodities, its involvement can further escalate geopolitical tension and instability in the region.

3. Iran enters the conflict formally

The most significant impact on the oil market would arise if Iran officially joins the conflict, potentially causing a $64 per barrel increase to a price of $152.38 for Brent crude. Iran controls the Strait of Hormuz, a passage crucial for connecting the Persian Gulf with the Indian Ocean. Thus, if the Strait is blocked, important countries for oil production such as Iraq, the United Arab Emirates, and Kuwait would be landlocked. Consequently, Iran would see its gas revenues rise due to higher prices. This situation also creates challenges for gas importing countries, especially for the EU’s energy security that has already seen a cut of supply from Russia.

As a consequence of Iran’s increased involvement shipping expenses would likely increase, also associated with war-risk premiums on shipping insurance. Those refer to additional costs that are also included in shipping prices to cover for vessels and cargo that are operating in areas of geopolitical risk. In the Ukrainian and Russian conflict for example, the war risk premium was firstly around 1% and has further escalated to 1.25%. While the overall value may not be significant, it can still present an additional challenge in the trading of energy related commodities.

Moreover, Iran is still exporting a significant amount through loopholes. If Iran decides to formally join the conflict, there probably would be stricter enforcement of sanctions by the United States which would tighten global oil supplies. Higher oil prices would also cause external geopolitical impacts. In the US, elevated oil prices could be a factor against the election of Joe Biden, who has invested significant political capital on the Middle East’s diplomacy with an attempt to normalise Saudi Arabia and Israel relations. For Russia, on the other hand, higher oil prices are vital to increase the country’s revenue and continue its war against Ukraine.

The most extreme scenario would entail Israel conducting a strike on Iran’s nuclear facilities, potentially causing oil prices to surge well beyond $150 per barrel. Therefore, heightened efforts to remove U.S. sanctions on Venezuelan oil would help relieve the strain on global oil prices. Increased access to Latin America's oil resources could act as a shock absorber against price increases and supply disruptions. In the US, more specifically, it would offer a more favourable outlook to Joe Biden's administration.

Decoding TotalEnergies’s massive $27 billion dollar deal with Iraq

On the 10th of July 2023, French major oil company TotalEnergies and the Iraqi government finally signed a much delayed $27 billion dollar energy deal, directed towards increasing the country’s oil production capacities by developing four oil, gas, and renewable projects. The signing of the deal, named the Gas Growth Integrated Project, took much longer than expected owing to several key reasons. First, a number of Shi'ite lawmakers had also cried foul over the deal, pointing to the lack of transparency and absence of bids from other oil companies. Another significant setback in the initial days of negotiation arose from TotalEnergies rejecting the now abolished Iraq's National Oil Company (INOC) as its partner in the project, mainly due to its lack of full legal status from the new Iraqi government. Iraq’s state owned Basrah Oil (BOC) will now be a partner in the project. The main hindrance to the project stemmed from sharing of revenues, which was finally resolved when Iraq agreed to take a stake in the project of 30 percent, in place of initial demand of 40 percent, giving majority stake to the French company.

Despite initial hiccups, the deal is seen as a welcome move both overseas and at home, one that will optimistically put Iraq on the path towards achieving energy sufficiency and helping to improve the business climate and attract further foreign investment. Iraq holds the world’s fifth largest proven oil reserves at 145 billion barrels, representing 8.4 percent of global reserves. Iraq’s potential as an oil producing nation has been held back due to years of sectarian violence, lack of transparency, governance, and poor environmental laws, leading to the withdrawal of many oil majors from the country. Exxon Mobil, Shell and BP have all scaled back their operations in recent years.

The launch of the Gas Growth Integrated Project is a watershed moment in Iraq’s history. The deal will see TotalEnergies intensify its efforts to increase gas production in the Ratawi field in the oil rich Basra region. This will help reduce Iraq’s reliance on gas imports from neighbouring Iran. For a long period of time, Iraq has relied on its neighbour for electricity and gas imports. Iran uses this as a leverage to exert influence on Iraqi politics. Iran, in the past and in the present, funds the training of the Popular Mobilization Forces, a paramilitary group trained to flush out the remaining US troops and anti-Iranian Kurdish elements that have operated in the northern region of the country. All of Iran’s initiatives are aimed towards keeping Iraqi and the American governments on its heels and exerting its influence in the region where the US has sought, from time to time to forge alliances and partnerships in order to nullify Iranian clout. Iran is a significant partner for Iraq in terms of trade and development prospects, with the latest breakthrough being in the railways sector. An MOU had been signed in March 2023, outlining executive procedures for establishing a rail connection between the two countries. Iran is making significant inroads into Iraq's economic landscape, creating an opportunity to invalidate America’s significant investments in the region. Iran’s economically driven shrewd tactics, such as these, will likely help to negate the US influence in the region as a whole and compel the US to rethink on its sanctions against Iran given that the commercial interests are at stake.

It appears that the US has also sought help from its Middle Eastern allies to hold back Iran’s ascendancy into Iraqi soil. Keeping its political differences aside, Saudi Arabia’s ACWA has agreed to develop The 1 GW solar power plant project in collaboration with TotalEnergies. The project seems to be part of the Iraqi government’s long term plan of solving electricity supply woes through installation of renewable sources. A portion of the revenue generated from the Gas Growth Integrated Project will be used by the French company to fund three additional projects: 1 GW solar power plant; a 600 million cubic feet a day gas processing facility, and a seawater project to boost Iraq’s southern oil production.

From the outside, the establishment of the solar power plant is a welcome move towards advancing Iraq on the path of self-sufficiency through sustainable modes of energy production. At the same time, it also appears to be a well crafted move by the Iraqi leadership to deviate attention from the environmental hazards that oil majors in Iraq have already created over a substantial period of time. Prior western oil majors have caused significant water shortages and pollution during its operations. The same environmentally catastrophic outcomes are likely to happen when TotalEnergies drives its efforts to increase production in the Ratawi oil field.

Past records also demonstrate that plants used by oil companies including BP and ExxonMobil accounted for 25% of the daily water consumption in a region of almost 5 million people. This leaves significantly less water for agriculture and other activities upon which the local rural communities are dependent upon. The harmful affluents emitted as a result of gas production has already affected the health of the residents in Iraq’s Basra region, with cancer rates having significantly grown in the region. While the deal has been projected to herald a new dawn in Iraq’s history, what remains to be seen is the possibility of the deal causing more harm than good to the Iraqi people in the long run.

Catching Up to The Rat Race: Operation Expansion in Vaca Muerta

Argentina is home to the second and fourth largest non-conventional shale oil and gas deposits in the world, respectively. Known as Vaca Muerta, this shale field spans over 7.5 million acres and harbours around 308 trillion cubic feet of non-conventional gas and an estimated 16.2 billion barrels of oil. Since extraction activities began in 2011, Vaca Muerta has been the subject of political and social strife, causing setbacks in production and infrastructure development, preventing it from reaching its output potential. In recent years, joint efforts from the Argentine government with gas and oil companies, namely Yacimientos Petrolíferos Fiscales (YPF), Exxon and Petronas, have reinvigorated expectations for a new 'shale boom'.

YPF’s Ambitions

At the forefront of production revitalisation efforts lies the majority state-owned company YPF. Earlier this March, the energy company announced their five-year plan to double their oil output and raise natural gas production by 30% through the expansion of operations in Vaca Muerta. Of the $5 billion in capital expenditure guidance put forth by the company, $2.3 billion will be allocated to operation expansions in Vaca Muerta.

Nearly $700 million will be invested in infrastructure to support the growth in output, namely oil and gas facilities, with the main growth expected in unconventional reservoirs. YPF has also partnered with major oil superpowers on various projects. Shell revealed plans to invest $300 million in YPF's five year plan, seeking to reach daily production of 15,000 barrels by 2024. A $10 billion joint venture with Petronas will develop a 640 km pipeline from Vaca Muerta to the Buenos Aires province, connecting with the north pipeline systems. This pipeline will be concluded in 10 years and will provide a liquified natural gas (LNG) capacity of 25 million tons per year.

On June 20 2023, the construction of the Presidente Nestor Kirchner (PNK) pipeline began, requiring a $2.7 billion investment that will allow a daily gas transport increment of 11 million cubic metres. This investment is arguably the most important development in terms of infrastructure, as it will provide ease of transport within Argentina to neighbouring countries. This represents the Argentine government’s ambition to make Argentina an energy exporter, establishing itself as the main gas and oil provider to South American countries.

Illustration of Presidente Nestor Kirchner Gas Pipeline (Yellow Line)

Source: Energía Argentina

Shale Déjà Vu

Vaca Muerta has been touted as the protagonist of a new Shale boom by many, yet its performance as of late has contradicted these bold claims. Unlike the United States, site of the latest Shale revolution, Argentina struggles with immense political risk and economic instability. In this year alone, annual inflation is forecast at 146%, and the economy is set to shrink by 3% relative to 2022. The country is extremely polarised and ideologically divided, causing parties with conflicting ideals to come into power and then deviate from the previous governments' efforts. This lack of consistency and stability has led to various defaults, rising deficits, and stagnant projects that have inhibited the growth of the oil and gas extraction sector.

The Argentine shale reserves are comparable to the US', with an estimated 30 billion fewer recoverable oil barrels and 137 trillion more cubic feet of shale gas. It was the US’ superior pipeline infrastructure and favourable government policy, however, that facilitated its shale expansion. Current estimates provided by McKinsey & Company place Vaca Muerta breakeven prices at $36 per barrel of oil and $1.6 per million British thermal units for gas, providing ample opportunity for investment payoff. The current potential output of shale reserves in Vaca Muerta far exceeds the capacity of pipelines and extraction systems. In fact, production is already overwhelming workers in extraction facilities, and the expansion initiatives will only be able to meet output growth in the long run. The US, on the other hand, was able to expand its pipeline infrastructure to meet growth and output standards. The use of subsidies, tax credits, and reductions in drilling expenses also provided increased profitability that drove investments and allowed drilling operations to grow rapidly in the US. The previous Argentine government changed the interpretation of subsidies and removed support from energy companies, causing millions in losses for foreign companies. The current government has reinstated many subsidies to the sector, yet these changes between governments cause uncertainty that deters foreign investment and opportunities for growth.

Risks

Argentina is set to have elections in October, where the country will change its president, vice president, members of Congress, and governors. The current president has announced he will not run for president, and the remaining prospective political parties differ greatly in their approaches to governance. The fierce opposition between these parties will generate issues within Congress and make passing laws and approving state projects more difficult, potentially harming government projects or regulation changes to incentivise growth in Vaca Muerta. One of the main presidential candidates, Javier Milei, has voiced his plan to completely privatise YPF to prevent it from being used as a political tool. His plans for Vaca Muerta include implementing a consistent long-term production growth plan that alters the legal framework of the sector. This approach aims to reduce the power of the government, much like many of his other policies, and clashes greatly with the other political parties. The main opposition party, Juntos Por El Cambio, aims to foster the sector's growth by increasing the government's involvement in the form of subsidies and state investments, ultimately driving economic growth. The differences between candidates, and the current economic conditions, create uncertainty that makes Vaca Muerta a poor investment choice for many. Fear of privatisation also weighs on the sector, as a reduction of the state’s involvement would interfere with the current pipeline projects that are dependent on government funding.

For years on end, local indigenous people have voiced their disapproval of oil and gas extraction activities in Vaca Muerta. The Mapuche people have asked the government to review their plans for the new PNK pipeline to make sure it does not interfere with indigenous communities. Their concern for the environmental impact of these activities is also shared by various activist groups. Although the issue has not caught the attention of international organisations yet, many anti-fracking associations have begun to take notice. Various domestic activist groups, such as Greenpeace and Confederación Mapuche de Neuquén, have worked in cohort with local communities to cause disruptions by blocking extraction and construction sites, resulting in great losses in production. The construction of new pipelines has greatly aggravated these groups, promising issues in the near future. The extraction sector relies heavily on these pipelines, so the vulnerability to protests and further delays in construction is extremely high.

Recently, the International Rights of Nature Tribunal opened a case against fracking activities in Vaca Muerta. A delegation of the organisation concluded their visit to Vaca Muerta and presented their findings to the Deputy Chamber of the Argentine National Congress. In the presentation, the delegation highlighted water pollution, lack of water availability, damage to wildlife, and loss of fertile land in Rio Negro and Neuquen were a direct result of extraction activities. This initiative is one of many attempts to pressure Congress to enact laws that will safeguard the environment and surrounding indigenous communities. The laws and regulations that could result from these efforts would hinder extraction activities by disincentivizing companies from investing in the region through legal and financial sanctions, greatly impacting the development and profitability of the Vaca Muerta project. As extraction operations continue to expand and oil and gas production increases, these groups will likely intensify their efforts and take advantage of the delicate break-even balance of projects to pressure relevant authorities.

Future Prospects

Argentina still has the chance of experiencing a shale boom. All major political parties have expressed their interest in developing Vaca Muerta to facilitate the country’s economic recovery, although their methods differ. Taking the US as an example would suggest that parties that increase subsidies and tax breaks would be the most successful, but Argentina’s situation differs vastly from the US and should not follow the same exact path. Both approaches to expansion, privatisation and increased government involvement, seek to foster growth and monetise Vaca Muerta to establish Argentina as a shale powerhouse. As long as the government’s ambitions remain constant and funds don’t falter, a path to growth is possible.

Iran to begin revamp of Venezuela’s largest refinery complex

Iran’s 100-day revamp of Venezuela’s largest refinery complex signals a commitment by Venezuela to end reliance on U.S. refinery technology whilst strengthening ties with Iran. Additionally, it provides Maduro with the opportunity to boost his domestic popularity by bringing the nation out of economic despair.

The €460 million contract will see Petroleos de Venezuela (PDVSA) and the National Iranian Oil Refining and Distribution Company (NIORDIC) working together to revamp the Paraguana refinery complex on the coast of western Venezuela in an effort to restore its crude distillation capacity and boost fuel output. Also included in the revamp is a project aimed at restoring the complex’s power supply. Technicians from the Islamic Republic are considering adding upgraded crude from the Petromangas project, a PDVSA joint venture with Russian state-owned company Roszarubezhneft. NIORDIC will outsource work and hire contractors to repair five of the nine distillation units, which do the primary refining of crude oil. Iran will be procuring the parts, overseeing the installation and handling the inspection before PDVSA oversees the refinery’s operations. In May, a €110 million contract was signed to repair Venezuela’s smallest refinery, El Palito, situated in the centre of the country, a project which is currently underway.

Despite having the largest crude reserves in the world, Venezuela has struggled producing oil products like gasoline due to a lack of investment, refinery outages, and U.S. sanctions. Since 2020, long lines at gasoline stations have been common. The relationship between Iran and Venezuela began under President Chavez when Iran established a plant to produce Iranian bicycles in Venezuela. Iran and Venezuela’s alliance has strengthened in recent years in order to overcome U.S. sanctions. Both nations are seen by the U.S. as sponsors of terrorism and human rights violators. NIORDIC has been sanctioned by the U.S. due to its use of oil to support the Islamic Revolutionary Guard Corps. Prior to the 2017 sanctions, Venezuela’s oil output was 1.9 million bpd before falling to 350,000 bpd in the second half of 2020.

Iran has provided Venezuela with crude and condensate as well as parts and feedstock for its ageing 1.3 million barrel per day (b/d) oil refining network. Additionally, Iran has also sent multiple fuel tankers to Venezuela to help them cope with the lack of gasoline; Maduro has used gold to pay for Tehran’s services. The Islamic Republic has been of fundamental importance in helping Venezuela boost its severely weakened petrochemical industry and wider economy. Relations between the countries extend beyond commodities as there has been an increase in military cooperation over the years. Qassem Soleimani, late commander of the Islamic Revolutionary Guard Corps, visited Caracas in 2019 to help with the establishment of revolutionary militias and the country’s military industrialisation.

The revamp of Venezuela’s largest refinery complex will see the use of Chinese and Iranian parts and equipment in refineries originally built with US technology. Difficulties may arise with the integration of old and new components. The distillation plants must be online for the refinery to work but Venezuela will have to consider the need for chemical products that the plants require, like catalysts and antifoaming agents, which are manufactured in the United States, in order to carry out modifications and replacement of parts in the distillation units. In the last year, technicians from Iran have inspected the refineries several times in preparation for the 400 Iranian workers who are set to work alongside 1,000-1,500 local Venezuelan staff and contractors. PDVSA sent home hundreds of Venezuelan workers to make way for Iranian technicians during the El Palito revamp which triggered protests, indicating that discontent among Venezuelan workers will be a likely source of contention again.

International actors view Iran and Venezuela’s alliance as a hindrance to Western values and many see the Latin American nation as simply a base to develop operations to access international markets due to its privileged geographical location. Maduro wants Venezuela to have a relationship with the United States whilst also becoming a partner of the Russians and Iranians, in the process learning how to avoid U.S. sanctions. This seems unlikely, especially given Western hostility towards Russia amidst the invasion of Ukraine and due to the firm relationship Venezuela has built up with Iran over the years. The most likely scenario is that the U.S. will push back against warmer relations with Venezuela due to its growing relationship with Western adversaries Iran and Russia. Since 2017, Venezuela has faced over 350 sanctions from the U.S. and it is probable that more will follow thanks to growing authoritarianism and a lack of political concessions.

Domestically, if challenges are mitigated, a successful revamp will yield the results that Venezuela is in dire need of. Following the mid-June restart of the 150,000 b/d crude upgrader operated by PDVSA and Roszarubezhneft which turns extra heavy oil into exportable grades, Venezuelan exports have surpassed 700,000 b/d. Exports have primarily gone to China with Iran receiving 131,000 b/d of crude and fuel oil last month and Cuba receiving 75,000 b/d last month. Consequently, Chevron’s exports fell slightly to 134,000 b/d compared to 150,000 b/d in May. If the Paraguana refinery complex is able to start producing fuels again, this will build upon the success of the Petromangas project. Venezuela will be able to boost its fuel output and export diesel and gasoline at higher levels. Exports will go to the United States as part of a 6-month deal with Chevron, and to allies China, Iran, and Cuba. This will have ramifications for the international market as it will increase the fuel supply, much to the benefit of Western countries that have faced shortages in the fallout of Russia’s invasion of Ukraine. The refinery’s return will bring additional wealth to the Latin American nation, but if lavish spending at the hands of Maduro continues, and minimal efforts are made to alleviate the effects of sanctions, domestic discontent will grow, and the President will see his popularity plunge.

“Protecting America's Strategic Petroleum Reserve from China Act”: Assessing the US Congress’ new idea for depleting Chinese oil markets

On January 12, 2023, the United States House of Representatives passed Bill H.R. 8488, titled the "Protecting America's Strategic Petroleum Reserve from China Act." If enacted, the legislation would prevent the Secretary of Energy from exporting the US strategic petroleum reserve (SPR) “to any entity under the ownership, control, or influence of the Chinese Communist Party”.

The bill received approval with 331 favourable votes and is currently awaiting deliberation by the Senate ever since. The Upper House can either reject or approve the bill and if approved, it would proceed to the President for consideration. This spotlight attempts to clarify the potential impacts on China (if any) in case the Act ever becomes law and restricts its access to imported SPR reserves.

The road ahead on Capitol Hill

The Bill had significant bipartisan support in the Lower House to secure a comfortable majority, with all the 218 present Republicans and about half (113) of present Democrats voting “yes”. Analyst Benjamin Salisbury from Height Capital Markets argues that approval in the Senate might not be so smooth as the Upper House is controlled by Democrats, but it’s still feasible under “tough compromises” - and under greater pressure from voters for a stronger stance against China. The greatest obstacle, however, might arise from the President's Office

President Joe Biden has been depleting the SPRs at an unprecedentedly faster pace to manage oil prices driven up by the war in Ukraine. However, some argue that the move is more about political concerns involved in alleviating inflationary pressures on fuel ahead of an election year. Since the SPRs are only meant to be used in times of great uncertainty and with due restraint - only enough to secure minimal levels of energetic security - critics point out that the President might be compromising the country’s long-term energetic security for short-term political gains. From this point of view, the Executive would hardly sanction a bill that would constrain its influence on oil markets.

But even in a scenario where the Act is approved by both the Legislative and Executive branches, current data suggests that its effects on China’s energy markets are likely to be minimal.

How will China be impacted?

China is the world’s second-largest consumer of crude oil in total volume, and the commodity accounts for roughly 20% of the country’s total energy generation. This figure is roughly comparable to other large emerging economies like India (23%) and Russia (19%). Nevertheless, China represented only one-fifth of the total foreign purchases of SPR released in 2022, while the US itself accounts for only 2% of China’s total crude imports.

Source: S&P Global Commodity Insight

As evident from the chart above, China depends more on oil producers in the Middle East and Eurasia and has concentrated its diplomatic efforts accordingly. It has expanded economic and financial ties with Saudi Arabia, mediated an agreement with Iran, and continues to purchase Russian oil in large quantities. These efforts are likely to provide China with greater resilience against disturbances that may affect energy supplies and limit the US' ability to manipulate oil markets to harm the Chinese economy. Rather than a practical purpose, the act’s eventual approval would likely serve a rhetorical one: Washington is taking a tougher stance against Beijing.

India's Growing Reliance on Russian Oil Imports

Since Russia's full-scale invasion of Ukraine in 2022, India’s reliance on Russian crude oil has increased tenfold. The proportion has risen from as little as 2% of total crude imports in 2021/2022, to 20% in June 2023. Recent estimates suggest that this percentage may reach as high as 30% by the end of the year.

In the wake of the invasion, there has been a largely concerted effort to sanction Russia’s economy and prevent it from further funding their war of aggression. A key component of the sanctions have been directed at Russia’s oil industry, Russia being the world's third largest producer and second largest crude oil exporter.

In December 2022, the EU’s sixth sanctions package came into effect, banning seaborne crude oil and petroleum products from Russia (90% of total oil imports from Russia). This move complimented similar bans enforced in the USA and the UK. Yet an additional component of the combined sanctions effort has been a price cap on Russian crude oil, which set the maximum price at $60 per barrel of crude. Despite the fact that the G7 countries (USA, UK, France, Germany, Italy, Japan, Canada and the EU) have already agreed to ban or phase out Russian crude imports, the cap has given leverage to uninvolved countries, including India, when negotiating prices with Russia.

The rapid increase in Indian imports from Russia suggests that India has been able to harness Russia’s weakened bargaining position. At the same time this new arrangement has put downward pressure on the oil prices charged India’s former suppliers in OPEC, primarily, Iraq and Saudi Arabia

Source: Reuters

The price differential between Russian and OPEC sourced crude, provides a clear basis in explaining India’s shift. Taking the April 2023 price as a point of comparison, India was able to pay as little as $68 per barrel for Russian imported oil, while oil from Iraq (traditionally India’s largest supplier) was priced at $77 per barrel and oil from Saudi Arabia cost as much as $86 per barrel. During the month of April, the overall OPEC basket price ranged from $79 to $86 per barrel. The price gap between OPEC suppliers and Russia makes a clear case for India’s growing imports from Russia, while the significantly lower price of Russian crude demonstrates the impact of the $60 price cap.

Source: Euronews

The challenges posed by India’s growing taste for Russian oil are twofold. In the first instance, while the price of Russian oil is considerably lower than OPEC in this case, the $68 per barrel price tag is still well over the imposed price cap, revealing the limitations of the price cap regime. In the second instance, India has become a rapidly growing market for Russian oil and as such a prop for the Russian war economy. While EU oil imports declined, figure 2 shows the relative increase of Indian oil imports, partially offsetting the impact of oil sanctions. India’s growing reliance on imported Russian oil has already become a point of contention with Western leaders. With the forecasted increase of India’s Russian oil imports, it is likely to remain so.

Image credit: President of Russia via Wikimedia Commons

North African Energy Market Analysis: Algeria

This report serves as an overview of the risks – mainly political, economic, social – in the Algerian energy market. It will look at natural gas, as well as crude oil and green energy. The report is also part of a broader series of analyses on North African energy markets.

The Dangote Refinery and its Effect on Commodities

The Dangote Refinery is a massive oil refinery project owned by Nigerian billionaire Aliko Dangote that was inaugurated on the 22nd of May 2023 in Lekki, Nigeria. It is expected to be Africa’s biggest oil refinery and the world’s biggest single-train facility, with a capacity to process up to 650,000 barrels per day of crude oil. The investment is over 19 billion US dollars.

The refinery is expected to have a significant effect on the commodities market, both internationally and in Nigeria. Possible impacts include:

Reduced oil import dependence

The refinery will help Nigeria meet 100% of its refined petroleum product needs (gasoline, 72 million litres per day; diesel, 34 million litres per day; kerosene, 10 million litres per day and jet fuel, 2 million litres per day), with surplus products for the export market. This will reduce Nigeria's reliance on petroleum product imports, which cost the country $23.3 billion in 2022. Nigeria currently imports more than 80% of its refined petroleum products.

Lower fuel prices

The refinery will likely lower the domestic prices of fuel products, as it will eliminate the costs of transportation, demurrage and other charges associated with imports. This will benefit consumers and businesses in Nigeria, as well as reduce the burden of fuel subsidies on the government budget.

Economic growth and diversification

The refinery will stimulate economic growth and diversification in Nigeria, as it will create thousands of direct and indirect jobs, enhance value addition and generate tax revenue for the government. The refinery will also spur the development of other industries that depend on petroleum products, such as petrochemicals, fertilisers, plastics and power generation.

The refinery also faces some challenges that could affect its performance and impact. Here are some of the possible challenges:

Crude supply issues

The refinery needs a constant supply of crude oil to operate at full capacity, but Nigeria's oil production has been declining due to oil theft, vandalism of pipelines and underinvestment. In April 2023, production fell under 1 million bpd, below Angola's output. Lower production could affect the state-owned oil company NNPC Ltd's ability to fulfil an agreement to supply Dangote refinery with 300,000 bpd of crude. According to economist Kelvin Emmanuel, who authored a report on oil theft last year: “The challenge is that if you don't have enough crude production then you can't supply Dangote Refinery with enough crude. And if you don't have enough crude then you can't produce enough refined products for domestic consumption or export.”

Commissioning delays

The refinery has faced several delays and cost overruns since it started in 2013. It was initially planned to be completed in 2016, but was pushed back to late 2018, then late 2019 and then early 2020. However, due to the COVID-19 pandemic and other factors, the refinery was not mechanically complete until May 2023. According to Reuters, citing sources familiar with the project, construction was likely to take at least twice as long as Dangote publicly stated, with partial refining capability not likely to be achieved until late 2023 or early 2024. Oil and gas expert Henry Adigun told the BBC that Monday's launch was “more political than technical” and that “there are still a lot of technical issues that need to be resolved before the refinery can start producing at full capacity”.

Market competition