The Risks to Indonesia’s Nickel Boom

In January 2020, the Indonesian government banned the export of raw nickel ore in a bid to spur investment in domestic added-value mineral processing. While the protectionist move was met with criticism from the World Trade Organization (WTO), which ruled against the “unfair” policy, Indonesia is experiencing a boom in foreign direct investment focusing on their mining and metal industries.

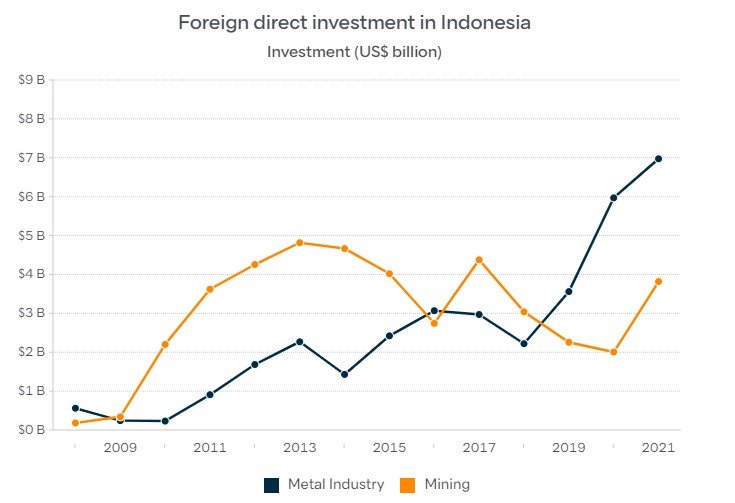

Foreign Direct Investment in Indonesia in selected industries. Image Credit: Lowy Institute

Yet with the growing importance of the nickel industry and Indonesia’s key position by having the largest known nickel reserves, the country is now open to a range of potential risks. From environmental and sustainability concerns to great power politics between the United States and China, there are many challenges ahead.

Explaining nickel supply:

While nickel demand is still dominated by the stainless steel industry, the rapidly expanding battery industry, most importantly for electric vehicles (EV), has become one of the primary drivers of increased interest in Indonesian nickel. Since the beginning of 2020 the price per tonne of nickel has jumped from roughly 14,000 USD to over 23,000 USD today, further indicating the rising demand for the metal.

One exceptional case that must be added is that prior to the war in Ukraine, Russia produced around 20% of global Class 1 battery-grade nickel supply. The onset of the war in early February 2022 led to extreme fluctuation in prices and while this has largely stabilised, between 20,000 and 30,000 USD per tonne, the war will likely continue to apply pressure on nickel supply. While Russian nickel exports have so far avoided sanctions from the US and EU, supply precarity and potential interruption have made finding alternative sources a priority.

There are several key players in nickel production which offer alternatives to Russian sources. The first group, which rely on the more easily processed nickel sulphide ore, are Canada and Australia, with Russia also counting among these. The second category of producers, which rely on nickel laterites, are the Philippines, New Caledonia and most importantly Indonesia.

Indonesian production and its challenges:

Since the ban on ore export in 2020, Indonesia has concluded deals worth more than $15bn for the production of nickel based battery components. These deals include major players in the broader EV market, such as Ford, LG, Hyundai, Foxconn, Zhejiang Huayou Cobalt and others. These deals have also pitted the US and western aligned countries against China in the heated competition over EV supply chains. The rapid development of Indonesia’s nickel mining industry has seen production increase by 13 per cent in 2022 compared to 2021.

The growth of the mining and metal processing industry also has significant environmental and social impacts on Indonesia.

Allegations of workers rights violations in a Chinese facility draws attention to a lag in government oversight. In January 2023 a violent clash, between workers, security guards and protesters, broke out at the Gunbuster Nickel Industry smelter, a facility of the Chinese Jiangsu Delong Nickel Industry, leaving two dead. This is a further indication of the social tensions caused by such quick development and the lack of proper regulation and oversight by the government. In the long term this represents a tangible risk to Chinese interests, and potentially for others, as compromises will need to be made with workers and work stoppages remain a possibility.

At the same time the Indonesia government has been put under considerable scrutiny for the environmental ramifications of rushed and poorly regulated mining operaterations. At mining sites on the Sulawesi and Maluku islands, run-off pollution turned coastal water a “deep red” affecting the local fishing economy as well as raising health concerns in the local communities. Additionally, the problem of deforestation for mining has spurred the Indonesian government to pledge to “reforest” depleted mines, though livelihoods based on forest products, notably clove trees, have already been affected.

The negative impact of the nickel industry has already influenced potential investors. Elon Musk's proposal to build an EV manufacturing “gigafactory” in Indonesia was met by environmental petitions pressuring him not to invest. The environmental risk is high, and comes at a steep price for the Indonesian people. The government will need to weigh the cost of rapid development in the short term with the long term impact of environmental degradation.