Burkina Faso Geopolitical Risk Assessment

Introduction

Burkina Faso (BF) is currently ruled by a military junta under the leadership of Captain Ibrahim Traoré, who came to power through a coup in September 2022. Since the takeover, the junta has adopted an increasingly militaristic and authoritarian approach, while steering BF away from alliances with Western powers, in favour of states such as Russia, who have promised the government heavy military support. Next to strengthening the junta's position, combating powerful non-state armed groups (NSAGs) is the main political driver in BF.

NSAGs mostly include Islamist terror organisations, including home-grown extremist groups and jihadist fighters from neighbouring countries. Many NSAGs operating in the country are linked to larger organisations such as al-Qaeda and the Islamic State (ISIS). Due to their ability to move across BF’s neighbours' porous borders and their desire to attack civilians, NGOs, security forces and infrastructure, they pose a serious domestic as well as regional risk, and are likely to continue to do so over the short to medium term. The lacklustre performance of previous governments and allies in their efforts to improve the security situation in BF has precipitated two coups in as many years, the expulsion of French and other Western forces, the ejection of UN personnel, and an open invitation to the Kremlin.

Executive Summary:

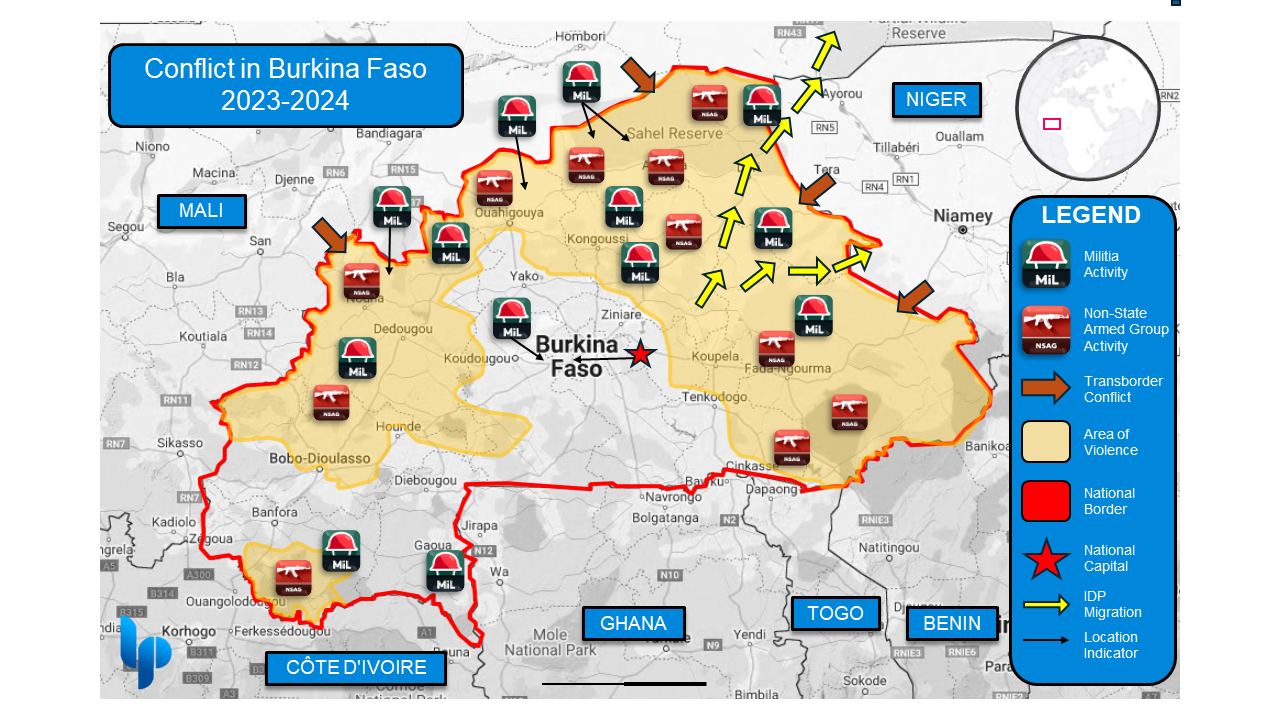

The ongoing conflict between security forces, terror groups, local militias, and external forces will very likely pose a very high risk to civilians and foreigners across the country over at least the next year, apart from central regions in immediate proximity to Ougadougu (as per Figure 1).

Harassment and violence against foreign nationals (particularly French citizens) is likely due to strong anti-Western sentiment fuelled by disinformation campaigns. NGOs and aid workers face significant risks from both NSAGs and government-linked security forces, leading to a challenging operational environment.

We assess with moderate confidence that while GDP growth will remain stable over the next 8-12 months, it will fall short of the previous years' expectations and lag behind regional partners like the Ivory Coast. Political instability, security issues, macro tail risk, and climate factors present significant challenges for individual foreign investors.

Political Risk

The number of Burkinabé civilians and soldiers killed by extremists has risen sharply over the past five years and continues to increase under Traoré’s leadership;

Despite this, public support remains high amid disinformation campaigns which label the French, UN, and ECOWAS, as corrupt entities;

Levels of corruption within government and industry are pervasive;

Russia acts as a key strategic partner to the military junta, rivalled by Turkey; and,

A formalised Confederation of Sahelian States strengthens Traoré’s government, but would very likely impact regional economics and thus global businesses and organisations, through liquidity, trade, security, and movement difficulties.

BF has experienced recurring military coups attempts over the last ten years (2014, 2015, 2022). The present government, under Captain Ibrahim Traoré, came into power in 2022 on an anti-colonial platform, as well as on the premise that the previous governments were incapable of handling the jihadist threat. On foreign policy, Traoré has taken a similar approach to BF's neighbours Mali and Niger; distancing themselves from Western states and institutions such as the UN, as well as severing ties with former colonial power France. The overall region’s influence on anti-France and pro-Russian narratives was apparent in the lead-up to BF’s 2022 coup and has created space that Russia continues to exploit via soft and hard power. In April this year, Burkinabé authorities expelled several French diplomats, after having previously ejected the ambassador and defence attaché. French nationals, businesspeople, and aid workers have also occasionally been detained, in some cases charged with espionage and subsequently deported.

Russia continues to play a strong domestic role; utilising propaganda, deploying fake social media accounts, fake news sites, and state controlled mass-media centres to conduct disinformation campaigns that have led to democratic backsliding. Russia also employs military aid to fill holes left by France and the UN in BF’s fight against jihadism. Indeed, the Kremlin has made itself an indispensable partner of the Traoré government and plays a significant role in the buttressing of broad domestic support for the junta.

Turkey also works to maintain economic, religious, educational, industrial, and military ties with BF, making President Erdoğan a key regional player with significant soft power. The two nations hold several joint commissions and agency corporations, which facilitate the transfer of Turkish development aid, student exchanges, and the sale of significant military equipment – such as the Turkish TB2, a medium altitude, long endurance, ISR and attack drone that has been linked to several human rights violations in BF.

The ‘transitional’ government under Captain Traoré has so far signalled little interest in shifting the country towards democratic rule. In September 2023, the junta cancelled elections scheduled for July 2024, and postponed them indefinitely, labelling them “not a priority”. Governing power remains bundled centrally in the putschist executive, after elected and other transitional bodies were dissolved post-coup.

We assess that public support for Traoré's government remains high, at least in the capital and surrounding regions, with no signs of major unrest/dissidence over the last six months. However, political indicators, such as message control and quickly deployed counter-factual narratives, suggest that the government's popularity can, to a significant extent, be attributed to Russian disinformation campaigns. Traoré’s stability is also maintained through a propagandist civil-political organisation known as the Wayiyans. Acting largely as a watchdog, the organisation is active in a range of activities, from political rallies to vigilante ‘stability’ patrols around the capital. Traoré has effectively dulled any major internal political opposition.

Reporting around a lone gunman attack at the presidential palace in Ouagadougou further demonstrates the depth and sophistication of information-operations within Burkina Faso. The incident in question does not have any obvious political connection, however, local news and social media quickly framed it as a failed coup attempt, spinning a narrative of demonstrated regime strength.

Anti-government demonstrations, which have declined significantly since Traoré’s coup, were frequently centred around anti-French sentiment. Since the recent departure of French troops, they have largely died down. Even though the population appears pro-government, increased reporting around human rights violations perpetrated by local militias, the expulsion of certain news outlets, and a decrease in civil liberties might increasingly fuel disenchantment among the population.

Regional observers have reported on isolated incidents of internal dissent, such as the formation of the political group FDR (The Front for the Defence of the Republic) in early April 2024. The organisation's spokesperson, Inoussa Ouédraogo, called for the “immediate release of all those forcibly conscripted, kidnapped or sequestered by the militias under the orders of Ibrahim Traoré.” However, as of today, the lack of civil unrest and protests suggests that opposition movements have not managed to gain significant momentum. This could change if the junta is not able to produce results against NSAGs over the next 12-24 months, as failure to address the jihadist threat has been a driving factor in past transitions of power.

Since Traoré’s coup, the junta has also been pursuing closer cooperation with the military governments of Niger and Mali. During a recent summit in the beginning of July, the neighbours announced the formalisation of a Confederation of Sahel States (AES). The alliance strengthens the position of Traoré and his colleagues, while further isolating them from the regional Economic Communities of Western African States (ECOWAS) block. The AES’s main goal is increased security cooperation but it also seeks to improve economic ties. For instance, the three leaders have set their sights on a common currency, in an attempt to move away from the French-backed CFA Franc used by many states in West Africa. This development would strongly disrupt trade stability between BF and its key trading partners, such as Cote d'Ivoire.

BF has historically struggled with corruption at the federal and municipal level. Anti-corruption protests are a recurring pattern - the most recent broke out just last year. Local authorities are commonly engaged in bribery, extortion, and rent-seeking. The commodities sector is particularly affected. Mining firms often cooperate with corrupt local authorities to attain commercial licensing or exploitation rights, leading to extensive compliance and reputational risks. Captain Traoré has paid lip-service to an increased fight against corruption with high profile arrests, but the efforts have not been far-reaching and do not reflect tangible changes. While corruption remains common, it has not increased dramatically since 2016.

Pervasive corruption causes various negative externalities for foreign investors and international firms. For instance, involvement of local branches in bribery schemes exposes multinationals to reputational and even legal risks, while refusal to participate may result in additional commercial challenges, such as difficulties in getting permits etc. Overall, corruption is a major obstacle to Foreign Direct Investment (FDI), and stunts domestic economic development.

Assessment:

London Politica assesses the overall political risk level in Burkina Faso as high due to Burkina Faso’s vulnerability to government collapse, or state violence, given the country’s long history of forceful transfers of power. High levels of political risk associated with political instability and regime change pose a significant risk to entities that rely on policy continuity, including foreign companies that hold public contracts with the current government.

We assess as likely that the competition between Russia and Turkey will increase over the next 6-12 months, manifesting in a range of sectors, including industry, security, defence, and information. Global tensions between NATO and Russia may play a larger role in the region as a result. Firms from either block may face additional pressures when geopolitical frictions spill over into the investment sphere. Indeed, actors on both sides seek to use government access to consolidate their economic influence. The same could be true for NGOs, who may be perceived as foreign government entities and therefore are at risk of mistrust and discrimination by local authorities.

Further, we assess that over the next 6-12 months foreign nationals, particularly French citizens, are at a high risk of harassment or violence by local populations or extortion by government representatives. This endangers business continuity in the country and negatively affects the investment outlook for lenders as well as capital allocators, leading to a more complex and challenging commercial environment for foreign actors.

Security Risk

Terrorism is at an all-time high in Burkina Faso, with over 2,000 fatalities and 1,312 civilian casualties in 2023;

Civilian casualties often occur in any area where NSAG (Non-State Actor Groups), government forces, or the Volunteers For the Defence of the Homeland militia (VDP) are operating;

Ongoing information operations have a significant effect on the disposition of government forces, especially the VDP militias who are a poorly trained and unprofessional force;

NGOs and foreign nationals have experienced discrimination and violence by both NSAGs and government security forces.

BF’s security situation has deteriorated since 2023, as security forces, including local militias, are ramping up their presence and operations in NSAG controlled territory. The Figure below provides an overview of the conflict, highlighting areas of reported militia and NSAG activity that has resulted in casualties or collateral damage. London Politica’s research supports an assessment by ECOWAS, which highlights that Burkina Faso’s government controls less than 60% of the country.

NSAGs and Terrorism

BF currently experiences the highest frequency of terror attacks globally. In 2023 alone, around 2,000 people were killed in terror related incidents. In fact, over a quarter of the world’s terror related deaths occurred in the country in that same period. Notable incidents in 2023 included the killing of 71 soldiers in the province of l’Oudalan by an IS Sahel faction and the murder of 61 civilians in Partiaga, a village in the Tapoa province, by Jama’at Nusrat al-Islam wal-Muslimin (JNIM). [see London Politica Sahelian Security Assessment for JNIM profile] JNIM remains the dominant terror organisation in the country. More recent examples include an attack in February 2024, in which terrorists targeted a Catholic church in the north-east, killing 15 worshippers. On the same day, militants massacred several dozen civilians in a mosque in the south-eastern city of Natiaboani. These incidences were reported over X by local journalists.

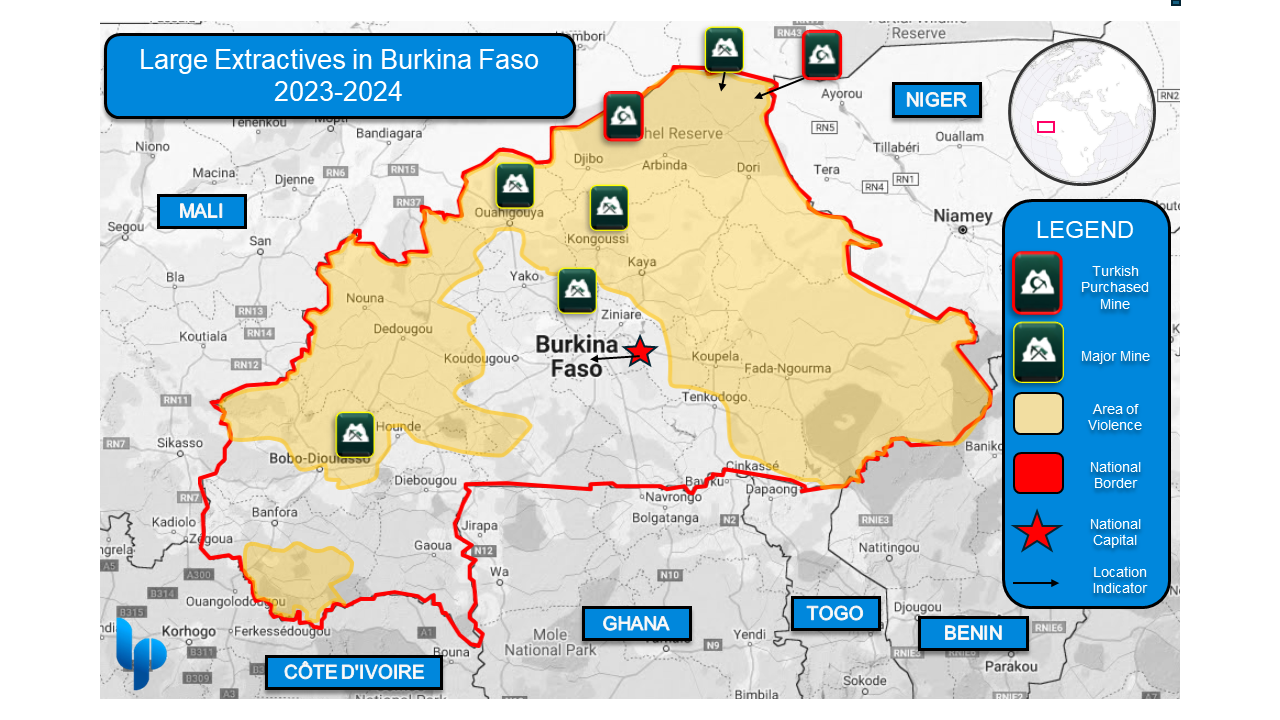

Insurgent guerrilla strategy - including ambushes and hit-and-run tactics - are prevalent in BF. JNIM, for instance, conducts both sophisticated and simple IED attacks to create disruption and tunnel targets into favourable attack positions. Both JNIM and other NSAGs engage in kidnappings to extract ransom payments and organised intimidation tactics to levy taxes on local businesses and NGOs in their territories. Human and arms trafficking is also pervasive in militant controlled regions. NSAGs are also leveraging access to the illegal gold trade and sale of looted government or NGO supplies, to finance their operations. JNIM, for instance, has been aggressively trying to expand their grip on lucrative mining regions, where they mine and smuggle gold, but also provide paid security for locals engaged in artisanal mining.

Terror attacks continue to occur across the country, with a particularly high frequency near the Malian border and the tri-border region between Burkina Faso, Niger and Mali, where militants take advantage of weak border security. The centre of the country, particularly in close proximity to the capital, has been comparatively safe.

Government Security Forces & Vigilante Militias

International observers have also accused government security forces of violence against civilians. Human Rights Watch (HRW) recently published a report accusing the army of killing 223 villagers in February, near the northern border to Mali. HRW has highlighted numerous civilian casualties resulting from TB2 drone strikes, in both 2023 and 2024. Militias have also been accused of atrocities. Reports indicate that the Volunteers for the Defense of the Fatherland (VDP), a national militia created by the Burkinabe government, massacred 156 people in the northern village Karma in April 2024. Their attacks, which have also included forced disappearances and summary executions, often target ethnic Fulanis, who are perceived as extremists by factions of the militia.

The VDP has a strong presence on the front-line against NSAGs, often suffering heavy casualties. The militia relies on quick recruitment and poor training to ensure rapid deployment. While VDP personnel have benefitted from a recent 30% pay rise, the group has also been implicated in criminality, including extortion and kidnappings. As the VDP recruitment numbers have grown, so has NSAG retaliation against communities linked to the militia. IDP camps, perceived as VDP loyal, have suffered reprisal from groups, including from al Qaida-affiliated organisations.

Sporadic social media reporting also suggests a decrease in the recapture of territory, with an increase in permanent army checkpoints on key roads, enacted curfews and declared states of emergency in the most affected northern provinces.

NGO staff, in particular those operating in contested regions, also face increasing harassment and violence from both NSAGs and security forces, including the VDP. Amnesty International reports high-levels of mistrust against NGO members amongst locals and the military alike, who sometimes suspect aid workers of supporting jihadist organisations. These attitudes are boosted by the spread of disinformation. Attacks on NGO staff have ranged from discrimination and wrongful detention to beatings and murder. NSAGs also frequently loot aid convoys. We assess that these risks will not abate over the next 12-months and NGOs operating in conflict zones, particularly around internally displaced persons in the north and northeastern provinces, will have to continuously monitor their security exposure to both government troops and NSAGs.

External Forces

Reporting on the specific activities of the Kremlin-backed Africa Korps remains sparse. The unit, which was established after the disbandment of the Wagner Group, employs mercenaries (including former Wagner members) as well as volunteers, and operates under the umbrella of the Russian defence ministry. While the Russian paramilitaries were originally brought in under the guise of filling the French anti-terror gap, regional sources indicate that their main mandate is to protect the military government, enabling the junta’s political aspirations while carrying out targeted missions and training Burkinabé forces. The organisation continues to recruit heavily across the Russian-speaking world, but has also signalled the desire to expand their ranks locally, in BF. The group has been linked to civilian deaths in neighbouring countries, but continues to enjoy a strong backing by BF’s central government.

Assessement:

London Politica assesses that continued, widespread violence between NSAGs and security forces are highly likely over the next 12 months. It is unlikely that the security situation in the non-capital regions will improve, as government forces have not been able to effectively combat NSAGs in contested regions causing violent spillovers affecting civilians.

We assess that the targeting and harassment of NGOs and foreign nationals by security forces will remain highly likely over the next 12 months. Travellers are advised to avoid known areas of conflict, including the northern border regions of Soum, Oudalan, and Seno. Additionally, travellers should limit travel to main service routes around the capital-south regions around Ganzourgou, Boulgou, Naouri and Bazega. Professionals and aid workers are also advised to hire armed escorts ahead of travel and have emergency backup routes prepared. Staff deployed to conflict regions are exposed to the risk of violent attacks, looting of supplies, and kidnappings by terror organisations. They are also at risk of harassment, detention, torture, and murder from government troops, particularly in regions in which the VDP operates - such as Seno, Kossi, Tapoa, Bam, and Yatenga.

Economic Risk

Burkina Faso's economy is projected to grow by 5.5% in 2024, driven by gold, manganese, cotton, and agricultural production. However, political instability and security issues, particularly attacks on industrial centres, pose significant risks to economic development.

Inflation has slowed due to stable commodity prices and monetary policy, but the macro environment remains volatile.

Turkey's FDI ambitions faced setbacks with revoked mining licences, while disputes among foreign investors highlight the challenging business environment.

Burkina Faso’s economy is driven by the production of gold, manganese, cotton and agricultural goods. The IMF has projected that the country’s economy will grow by 5.5%, slightly lower than the average of 6% from 2017-2019. The lagging economic performance is largely attributed to the precarious security situation and political instability.

Inflation, previously a grave concern to policy makers, has slowed down, mainly due to stabilising commodity prices and a monetary tightening of the Central Bank of West African States. The macro environment remains challenging, however, and resurging inflationary headwinds cannot be discounted over the next 12-months.

Overall, the country’s economic outlook hinges largely on the political and security situation. Indeed, many of the major industrial centres are located within contested regions and are prone to attacks by NSAGs. Extractives businesses are at particularly high risk. Additional headwinds will likely include climate events, such as reduced rainfall or drought, damaging agricultural yields. Presently, growth appears largely stable, positioning BF’s economy on solid footing, compared to regional standards.

A notable development in terms of FDI is the increasing influence of Turkey. Besides the sale of military equipment, Turkish firms are expanding into other business areas. The mining venture Afro Türk, for instance, purchased licences for the Tambao manganese mine and the Inata gold mine for $50 million in April 2023. However, in late March 2024 the operating licences were revoked again, due to failure to deliver full payment. The licences have since been handed over to new undisclosed investors. This set-back was a blow to Turkey’s ambitions and their relationship with the government. The now-defunct contract between the junta and the Turkish miner contained a noteworthy clause, which required the company to build security infrastructure for military forces fighting the NSAG threat in the vicinity of the mines, which is demonstrative of the pervasive threat these groups pose in the north of the country. This is also an indication of a broader, unspoken, trend; investors need to demonstrate alignment with the central government in order to win business, at least in major state-backed industries. Hence, this adds to the considerations of foreign business ventures, who might be wary of cozying up to an authoritarian government.

A recent dispute between Lilium Mining, the largest gold-producer in West Africa, and Endeavour Mining, a Canadian conglomerate, further demonstrates the challenging business environment in BF’s conflict zones. During the summer of 2023, Endeavour finalised a deal to sell their Boungou and Wahgnion mines to Lilium, due to the constant threat of attacks by terror organisations. The $300 million deal has since turned sour, as Endeavour brought forth a lawsuit, accusing its counterparty of failing to pay the agreed sum in full. Lilium in turn has launched legal proceedings against Endeavour, claiming they were misled regarding the operational capacities of the mines. Hence, the precarious security landscape poses serious challenges for foreign investors, especially regarding business continuity, but also when it comes to appraising investment opportunities, including the pricing of counterparty-risk.

Assessment:

BF’s economic landscape presents a high-risk environment for foreign firms considering launching or expanding business operations. The interplay of political instability, the presence of armed groups, geopolitical tensions, and other macro drivers creates significant challenges for investors. A high risk appetite is required.

We assess that the country’s economy is heavily reliant on commodity prices (cotton, gold). This dependency makes the macroeconomic environment highly volatile. Foreign firms must be prepared (hedges etc.) for significant fluctuations in revenue linked to global commodity markets.

It is highly likely that climate change exacerbates the frequency and severity of adverse weather events, presenting ongoing risks to economic stability and individual business operations. While extreme tail risk events such as the insect infestations that decimated cotton production in 2022 are unlikely, they remain a present risk that can have significant localised and macroeconomic impacts.

Political instability remains highly likely over the next year and a change in sentiment or government may bring about nationalisation of foreign-owned assets. International firms must navigate the political landscape cautiously, nurture good relationships with local and federal government, and develop contingency plans to mitigate the risk of abrupt policy changes.

The country hosts a high number of IDPs, resulting in a weakened workforce, leading to difficulties for foreign businesses seeking reliable labour. Companies must consider strategies to address potential labour shortages and invest in workforce development.

Infrastructure Risk

Infrastructure remains unreliable both due to underdevelopment and damage as a result of ongoing conflict;

Access to water and medical supplies are limited outside the capital, and competition over basic resources may lead to conflict

NGOs and commercial enterprises are likely to face difficulties traversing outside of the national capital region as a result of poor telecommunications and road infrastructure.

The conflict has heavily damaged infrastructure across BF. Attacks on water points are common, and according to UNICEF, results in increased water scarcity, with some regions losing regular water access for up to 223,000 persons.

With BF’s paved and maintained road systems reaching just over 1,000 km in 2021, transportation can be a challenge, particularly in the hinterlands. Road systems’ traversability is likely to be worsening in the north to north-west regions as a result of intense heat and ongoing conflict. Major bridging and paved roads have also become targets for IED attacks and convoy ambushes, in systematic attempts to limit vehicle movement and the flow of supplies to besieged areas.

Access to medical supplies and treatment has also been heavily affected by the ongoing conflict. In embattled regions medical facilities are frequently forced to cease operations, due to a lack of resources and looting by NSAGs. Indeed, in provinces such as Soum, as much as 65% of health infrastructure is non-functional. NGOs seeking to deliver medical care will be particularly challenged by the lack of pre-existing facilities and the threat of looting. In affected areas, NGOs would be well advised to hire a security detail to protect their staff and property.

The country’s telecom sector has made significant inroads over the past four years, reaching a fibre-capable backbone that links over 145 central communities and implementing terrestrial cables to neighbouring countries. Despite this, much of the country's cellular capabilities remain largely underdeveloped, as much of the country still relies on regional 3G.

In their late 2023 Burkina Faso country brief, Janes reported that while attacks on critical infrastructure are recorded and common, the largest threat to infrastructure remains weather-linked risks, such as heavy rainfall and floods. The World Bank has additionally highlighted that drought-like conditions are another major risk variable regarding food and water insecurity.

Assessment:

We assess that major infrastructure and industrial sites within the; Boucle du Mouhoun, Nord, Centre-Nord, and Sahel regions are under moderate short-term risk - due to historic assaults by NSAGs who have demonstrated a willingness and capability to carry out targeted attacks. These circumstances are highly unlikely to change in the next 12-24 months, as the threat to infrastructure is particularly high in conflict zones, towards the northern borders with Mali and Niger due to an increase in NSAG blacktracked trafficking and smuggling routes which have proven effective against Government Forces. As a result, NGOs and businesses operating in these regions must be prepared for delays in supplies delivery - due to ambushes and IED attacks - and should therefore keep a well-secured inventory of basic items and materials needed for operational continuity. Travelling across the Nord to Sahel regions should also be limited to self-established safe-routes, alternating in frequency and changing routes frequently.

The junta has increasingly focused on protecting infrastructure. The adoption of technology solutions, such as drone surveillance, as well as the presence of the Africa Corps has reduced the number of attacks over the last 12 months. The reduction in violent incidents, however, is not a perfect indicator of the government’s success against terror groups, as defending fixed infrastructure is easier than uprooting highly mobile terror groups.

Individuals and organisations should also prepare for civilian telecommunications coverage dead zones and blackouts, as well as bring health and water supplies. Doing so will ensure preparedness for lack of availability, but it is better to do so moderately as to not draw unwanted attention.

Societal and Legal Risks

Inter-community violence in Burkina Faso has increased, especially against the Fulani minority and the country hosts around two million IDPs and 40,000 refugees.

Russian disinformation campaigns influence public sentiment, and the government restricts media freedom, suspending various international news outlets and digital platforms.

Homosexuality is illegal in Burkina Faso as of 10 July 2024 and discrimination is pervasive.

BF is a multi-ethnic state, in which the Mossi people make up the majority of the population (54%). Reports of inter-community violence have intensified over the last five years, with claims ranging from harassment to skirmishes between ethnic militias. Due to their perceived ties to terror organisations, the Fulani group (7%) has been among the most persecuted minorities in BF. They face regular abuse and violence from factions of the Burkinabé security forces. The Collective Against Impunity and Stigmatization of Communities, a local civil society organisation, has reported 250 extrajudicial killings of Fulani community members in the last three months of 2023 alone. We assess, however, that despite these incidents, ethnic violence will not significantly impact levels of political stability.

BF is also home to approximately two million IDPs and hosts refugees from war-torn neighbours such as Mali. The number of refugees remains comparatively small (approx. 40,000) and their arrival has not led to observable patterns of (ethnic/community/economic) violence or unrest in affected border regions.

Homosexuality is now criminalised in BF, as of 10 July 2024. Even prior to that development, there had been no explicit protections against discrimination based on sexual orientation. Social surveys show that only 8% of the population is tolerant of same-sex relations, well below regional standards. Foreigners that are perceived as members of the LGBTQ+ community may be subject to raids, screenings, harassment, and even violence.

International observers and think tanks have continually reported on the presence of Russian disinformation campaigns within Burkina Faso. Further, evidence of groups both internal and external to the Burkinabe Government are believed to be operating pro-junta and anti-French information campaigns; with up to 11 simultaneous campaign streams sighted in just 2024. Reports have also linked the public’s positive perception of Africa Korps mercenaries to Russian misinformation campaigns. Specifically, fake social media accounts and news sites spreading anti-democracy and pro-Kremlin propaganda across channels such as YouTube. Journalists and bloggers have also been accused of being on Russia’s payroll to push authoritarian objectives.

According to Freedom House, BF has demonstrated the largest decrease in civil and political freedoms of any country in the region over the last 8 years, down 26 points since 2022. In the regional ranking, BF is etching closer to the bottom of the list. The country currently occupies the second to last spot, ahead of its neighbour Mali.

While media freedom is technically a constitutional right in BF, the junta government has frequently ordered the suspension of broadcasting and access to media outlets promoting dissent. In 2023, Burkinabé authorities suspended French news outlets LCI and France24, while removing publication and access rights to Radio France Internationale and the magazine Jeune Afrique. In April 2024, in the wake of reported human right violations and the massacre of 223 civilians by the VDP, the Burkinabé government announced the suspension of BBC broadcasting rights, and Voice of America (VOA) radio networks from broadcasting for two weeks. Websites and digital platforms including Facebook are also routinely cut off without notice.

Assessment:

London Politica assesses that the situation around civil liberties is is likely to continue to worsen over the short to medium term. As Traoré’s junta moves past the cancelled July 2024 election period, and seeks extended power, we are highly confident that the state will further utilise the means at its disposal to control the dissemination of information. Moves to retain order through the control of information may lead to information blackouts and possible targeting of region specific 4/5G L-band communication networks to halt communications all together.

Specifically in the wake of failed military operations and increased violence, a worsening of the information environment would pose a severe risk to any commercial or civil operations on the ground, severely limiting both freedom of movement and critically disrupting any operations that require telecommunication based coordination. Further, disinformation poses a direct threat to any operations which rely on local-civil cooperation due to the volatility in narrative flow. Companies and NGOs with static locations are advised to invest in telecommunications equipment not-dependent on local infrastructure or geo-regional web data.

Intelligence Brief: South African Elections

Tomorrow, 29 May 2024, At 0700 SAST (0500 GMT) South Africans go to the polls. South Africa will engage its proportional voting system to fill 400 parliamentary seats in the National Assembly. The governing African National Congress (ANC) will look to retain a majority, albeit likely a declining one. Below the forecast are factors likely to influence the vote.

Short Term Situational Forecasting

London Political assesses with high confidence that the ANC will lose its majority due to perceived governance failures; the ANC will likely retain at least 44% of seats in the legislature, which will likely enable them to enter into a coalition with smaller parties, and without the EFF.

This would represent a continuation of the status quo as it relates to operational, security, and reputationl risks.

Due to political instability caused by a reduced ANC position, it is likely that we will see unrest, and possibly clashes between party supporters during the elections. Previous clashes involving MK supporters suggest this may result in violent altercations, protests, and destruction of property.

We assess this risk for Pietermaritzburg as high, with Johannesburg and Cape Town assessed as moderate risk locations. We are also likely to see severe congestion and petty crime in Pietermaritzburg.

Although political unrest is possible in Johannesburg and Cape Town, large-scale rioting and looting are unlikely.

Hate crimes spurred on by xenophobia are likely in all three cities; foreign nationals - particularly those from other African countries - should prepare contingency plans that take into account possible unrest and heavy congestion in cities.

Immediate Election-Associated Risks

· In the event of unrest, we are likely to see damage to property, arson, barricading of roads, looting, hijacking of trucks, and political violence;

· Campaigning around illegal immigration and foreign investment in relation to unemployment can act as a trigger for episodes of targeted violence, and human right organisations have reported a heightened watch for xenophobic activity;

· Increased foot traffic, and possible unrest and vehicle protests may lead to movement difficulties in urban centres surrounding the elections; and,

· Large crowds, particularly in Cape town and Johannesburg, may act as easy concealment for petty theft and gang activity.

Turnout

Turnout is expected to rise compared to recent years, according to the Chief Electoral Officer Sy Mambolo, with an increase of 1.2 million registered voters, which would be a rebound from record low voter turnouts of just below 66% in 2019. While this could be the result of important issues acutely affecting voters, or electoral inclusion campaigns, the South African median age of 27.6 is the highest it has been in the last decade, which highlights that aging young voters may simply be more likely to vote than when they were younger.

While inequality is a major issue, especially as it relates to the youth vote, other capstone issues such as the ongoing energy crisis, ageing physical infrastructure, and a volatile dependence on foreign capital have become key issues in recent years. The invigoration of young voters, and an increased age of voter-mobilisation, will likely play a large role in how key issues are assessed at the polls; South Africans appear generally more likely to prioritise social issues over economic ones.

The Economy

South Africa’s economy is in a joblessness crisis, both leading to and being caused by sluggish growth. With unemployment reaching 32.4% in 2023, young people account for just over 40% that number. According to Reuters, falling tax revenue has been detrimental to government debt, causing debt-servicing to consume a greater share of the national budget than social spending. Further, a reliance on volatile foreign capital has reduced trust in public spending, leading to sentiments of abandonment in some regional electorates.

Infrastructure

Healthcare and Energy are at the forefront of this election. The nation’s state-owned utility company, Eskom, has resorted to major load shedding, causing crippling blackouts in recent years due to structural faults in power stations and inequity across delivery infrastructure. Much of this is the result of endemic corruption, and is perceived as a major failure of the ANC.

Healthcare inequality has sharply risen, with the rise of drug prices and poverty. While the ANC has already tabled the National Health Insurance plan, the largest opposition party, the Democratic Alliance (DA), criticises its lack of foundation for funding, registration & administration, or hospital buy-in. As a result, the bill has sat for some time and all parties are looking to propose better solutions.

Key Players:

African National Congress

The African National Congress (ANC) is the country’s political powerhouse, with incumbent President Cyril Ramaphosa looking to secure his second and final term. Often cited as ‘Mandela’s Party’, the ANC enters the race with a 57.5% (230/400) seat majority from 2019.

Reporting from eNCA indicates that despite its status, the ANC is sitting at about 40% in the opinion polls, with major news outlets such as the BBC and Al Jazeera predicting a slim loss of the party’s majority. A perceived lack of success in stopping rolling power outages, curbing corruption, and improving both provincial and national infrastructure has been seen as a major party failure by the population and is reflected in opinion polls.

We assess that it is likely that the ANC acquires 44% - 50% of the vote, forcing it to seek alliances with several smaller parties in an effort to keep its legislative power. If the ANC gets less than 45% of the vote, it is likely that the EFF (Economic Freedom Fighters) and ANC form a coalition. The Democratic Alliance (DA) has already entered an alliance agreement isolating the EFF.

Any event in which the ANC maintains a majority, either through an outright win or coalition, sustains risks to businesses around corruption and crime, particularly if the party joins into a coalition with the EFF. Businesses would be very likely to face continued and increasing levels of financial and reputational risks around corruption, operational risks associated with degrading infrastructure, as well as physical risks associated with crime.

An EFF/ANC coalition could have damaging effects for the ANC’s reputation and South Africa as a whole, as the EFF is economically radical and aggressively nationalist. Markets would likely react negatively to such a coalition due to concerns around populist policies, asset nationalisation, corruption, and institutional overreach.

Democratic Alliance

The Democratic Alliance (DA) is currently the largest opposition party, seeking to grow their representation in legislature from 20.77% to at least 25%, an increase of at least 19-20 seats. Led by John Steenhuisen, a career politician, the DA has capitalised on regional wins over the ANC since 2019, and has based its platform around enabling more regional governance, and curbing crime, corruption, and healthcare inequity.

The DA is much smaller than the ANC, both in historical clout and assembly power, polling at just 18.6%., However, successful regional election wins in the Western Cape have provided a significant party stronghold.

The DA has also struck a pre-election coalition deal with the IFP, FF Plus, ASA, and ACDP, to form the Multi-Party Charter for South Africa (MPCSA). A coalition that currently maintains 112 seats and is expected to grow exponentially.

With the DA and IFP both being substantial players, it is likely that the MPCSA will grow to at least 140 seats; enough to force the ANC into a coalition of its own, but not enough to achieve a majority.

uMkhonto weSizwe Party

The uMkhonto weSizwe (MK) party is the wildcard in the race. Formed in December 2023 by Jacob Zuma, a former South African president who left the ANC amid several legal controversies and convictions. Despite being barred from standing in parliament due to his previous convictions related to charges on corruption, racketeering, money laundering and fraud, the former president is splitting votes, achieving up to 14% in opinion polls.

Hailed as an “anti-apartheid veteran and Zulu traditionalist”, MK’s targeting of the ANC plays a significant role in our assessment that the ANC is likely to lose its majority. MK may win up to 8% of the vote (32-33 seats) based on Ipsos polls. It is very likely that the majority of these seats would come from the ANC.

Economic Freedom Fighters

The EFF, led by Julius Malema, is currently polling at around 11-12%, and was founded after Malema was expelled from the ANC in 2013 for sowing divisive radical-leftist views. Known for public stunts and inflammatory remarks against minorities, the EFF is trying to capture the youth vote with promises of free WiFi and electricity – amongst other things.

The EFF’s platform proposes land to be stripped from the wealthy and nationalised, assets to be pulled from mining companies to be redistributed towards education, and the establishment of accessible 24-hour medical clinics. While these are not the typical eye-catching pillars for moderate South African Voters, the EFF seems to be resonating with the growing lower class, promoting their manifesto at a time when the ANC is accused of failing to look after the poor and black majority. A coalition involving the EFF would likely cause capital flight, although nationalist economic policy would likely be dampened by the ANC’s overwhelming majority within the coalition.

It is likely that the EFF will see marginal gains in 2024. With polling at 11.5%, an increase from 2019’s 10.8%. Having been left out of the MPCSA, it is likely that they will be open to coalition deals.

Implications for Political Risk

While no party is currently bringing forward a plan that will directly impact foreign investment or South Africa’s economy, international onlookers should watch for signals from the ANC tomorrow that they will prioritise continued economic stability, as well as its possible plans to join in a coalition with the EFF. During the election there is an increased risk of violence, looting, and civil unrest that may incidentally affect businesses.

The sturdiness of South African politics also has larger regional implications, as the country acts as a stabilising regional entity that wields a significant amount of soft and hard power. Less stable states within the African Union (AU) continuously rely on South Africa's steady hand to promote regional development and integration. The AU and UN also rely on their conflict resolution prowess to address conflicts in states such as the DRC or Burundi. Thus, internal unrest and/or power grappling may affect the government’s peacekeeping efforts on the continent, possibly impacting international organisations and NGOs.

Recent reports highlight ongoing disinformation around voter fraud, gerrymandering, and deceptive tactics at polling stations. The exact nature of these issues—whether they are electoral suppression or information operations—remains unclear. Unconfirmed breaches of ballot storage sites have been reported in KwaZulu-Natal, Mpumalanga, and the Western Cape. The Electoral Commission of South Africa (IEC) is investigating these claims, emphasising that they currently lack substantiation.

Despite IEC warnings against electoral disruptions, there are heightened concerns around violence and unrest following the election. This unrest would likely be largely fueled by former President Zuma’s inability to stand for office and a growing sense of disenfranchisement among impoverished populations, exacerbated by the EFF and MK. These tensions echo the 2021 riots in KwaZulu-Natal after Zuma’s imprisonment, which caused over R50 billion in economic damage.

Post-election, South Africa faces several significant risks, including heightened unrest, crime, and continued high-level corruption. The increased security measures by the National Joint Operational and Intelligence Structure (NATJOINTS) suggest that physical risks around unrest and crime are being taken seriously. Additionally, the previously suspended trucking protests from early May could resurface, gaining traction during the election period on highways that already report heavy amounts of crime.