Colonialism, Coups, and Commodities: Emerging Risks in the Sahel’s Former French Colonies

The Sahel region has significant energy and critical mineral deposits. While Mali and Burkina Faso possess gold, Niger is one of the world’s foremost suppliers of uranium and Guinea boasts large reserves of bauxite. Other critical minerals in the region include copper, phosphate, manganese, and lithium, with notable deposits of gold and iron ore. Given the demand for these commodities, with rising use of green technology and electric vehicles, the Sahel’s resource wealth should have acted as a catalyst for economic development. However, exploitation and corruption have prevented this from materialising and the region continues to suffer from “political instability, conflict, violence, and food insecurity. The Sahel’s abundance of commodities can thus be seen as a resource curse rather than a blessing.

Even within the context of Africa’s long history of instability, conflict, and violent regime changes, events in the Sahel over recent years stand out. The broader Sahel has seen a steady rise in the influence of violent domestic terrorist organisations – including groups with Al Qaeda, ISIS, and Wagner affiliations. In 2023, approximately 47 percent of all deaths related to terrorist activity globally came from this region, making the Sahel the global epicentre of terrorism.

In a vicious cycle of instability, escalating violence has both triggered and been exacerbated by a string of military takeovers in recent years within an area labelled the “coup belt”, stretching from the Atlantic Ocean to the Red Sea. Of the countries to experience coups, Mali (August 2020 and May 2021), Guinea (September 2021), Burkina Faso (January 2022 and September 2022), Niger (July 2023), and Gabon (August 2023) were all former French colonies. Questions have been raised concerning the legacy of French occupation in the region. While the litany of risks in these countries is exhaustive, ranging from terrorism to humanitarian crises, those related to the shifting control of critical commodities merit greater examination.

The Post-Colonial Period: End of an Era, or More of the Same?

While the applications for Sahelian resources have evolved, the desire to control them has remained consistent. In adherence with colonial-era power dynamics, France’s African policy centred around resource exploitation. Despite decolonisation in the mid-20th century (see image below), France continued to protect its interests by shifting its strategy from direct colonial governance to indirect neocolonial influence. Spearheaded by French President Charles de Gaulle, the strategy was known as La Françafrique, “characterised by decades of political meddling”. The drafting of new military and economic agreements enforced France’s authority by securing bases and guaranteeing access to strategically important resources, including uranium and oil. By influencing and selecting the governments to succeed French rule, Paris secured the approval needed to continue mining and military operations in its former colonies. Strategies were even implemented to expand La Françafrique to nearby countries that were considered strategically useful. For instance, during the 1960s, De Gaulle, who was interested in the Democratic Republic of the Congo’s (DRC) copper, cobalt, and other minerals, supported secessionist forces fighting for their own state in the Katanga Province. Supported by the United States (US), their efforts instigated the downfall of DRC Prime Minister Patrice Lumumba and the installation of Joseph Mobutu, who acted as a proxy for French and US interests.

Map of Former French Colonies in the Sahel Region

Source:Deutsche Welle

Over time, France became increasingly unpopular with Sahelian countries, which strived for genuine independence. Guinea was the first French territory to reject continued subjugation in favour of immediate independence during de Gaulle’s 1958 referendum. Growing anti-French sentiment in the decolonisation period (1940s to the 1960s) created momentum for challenges in the late 20th and early 21st centuries. Notable grievances included military interventions, the persistence of the CFA franc as the local currency, restrictive visa policies, and resource extraction. The exploitation of Sahelian commodities was one of the most contentious and blatant illustrations of French neocolonialism.

The Nail in the Coffin

Despite French President François Hollande announcing the end of Françafrique in October 2012, French influence remained. This was encapsulated by a 2014 parliamentary report that outlined the need for France to “maintain a military apparatus” in the region to “defend its interests”. Three months after Hollande’s proclamation, French troops were deployed to Mali to fight rebel forces as part of Operation Serval. This later expanded into Operation Barkhane, which sought to eradicate jihadism across five Sahelian countries, aligning with the broader US-led War on Terror. This endeavour failed its primary objective of curbing the spread of terrorism, and lent credibility to jihadist allegations of Western imperialism, contributing to political instability. Investigations have also revealed severe war crime accusations against French forces that collaborated with local units, including the slaughtering of civilians from the Peul ethnic group in Mali, Burkina Faso, and Niger.

In light of the country’s waning popularity, France withdrew its troops from Mali, Burkina Faso, and Niger in 2022 after the severing of defence contracts by the military juntas. The trio have also pulled out of the French-backed G5 anti-terrorism Sahel defence pact and expelled Western media entities, including Radio France International and France 24. The Central African Republic (CAR), Chad, Senegal, and the Ivory Coast have each made similar requests for French troops to leave. Demonstrating a broader Western retreat from the region, in April 2024, the US agreed to withdraw 1,000 soldiers from Niger and hand over its last military base in the country following a request from the country’s regime.

Western Grip on Sahelian Critical Commodities Weakens

The West has maintained its interest in the Sahel’s commodities since the colonial period. However, with anti-Western grievances concerning corruption and instability rising, the region’s former colonial rulers are losing their grip. A cogent example is how Western access to uranium and gold has become increasingly threatened in recent years.

Uranium

France has historically relied on Sahelian uranium to support its energy infrastructure. Proportionally, France is the most heavily reliant country in the world on nuclear power, with approximately 70 percent of its electricity produced from this energy source. Although a shift in French energy policy was announced in 2014 to reduce reliance on nuclear power by 2025, in 2022, French President Emmanuel Macron announced plans for six new reactors, underscoring a long-term commitment to the power source. Furthermore, France has sourced a notable portion of their required uranium from Niger. In the last decade, 20 percent of imported uranium was sourced from Niger – making the nation its second largest importer, only behind Kazakhstan.

Although unpopular amongst the Nigerien population, French companies have maintained significant operations in the Nigerien uranium industry following the end of colonial rule. Despite French state company Orano (formerly Areva) mining uranium in Niger for over half a century through its subsidiaries, the country remains one of the poorest in the world, only benefitting from 12 percent of the market value of the uranium produced. In addition to the exploitative nature of the relationship, Orano’s activities have also caused an “ecological and health disaster”, with radioactive pollution and mining waste contaminating local soil and water sources.

In recent years, French influence has come under increasing scrutiny. After overthrowing Niger's President Mohamed Bazoum in 2023, coup leaders demanded France withdraw its remaining troops and expel its ambassador. The junta also seized operational control of Orano’s local mining firm Somaïr. Relations between the Nigerien junta and Orano have been on a downward trend ever since. In June 2024, Orano was stripped of its mining permit for the Imouraren project – one of the largest uranium deposits on earth. Subsequently, in October 2024, Orano announced that it would immediately halt all uranium production in the nation, citing the “highly deteriorated” situation.

Gold

The mining industry in Mali is dominated by gold production, with the commodity being a significant driver for the country’s economy in recent decades. As the nation’s most important export, gold accounted for more than 80 percent of the country’s total exports in 2023. The recent string of coups in Mali has made gold mining operations significantly more difficult for Western entities. For example, although not from a former colonial nation, Canadian firm Barrick Gold – one of the largest gold mining companies in the world – has found itself engaged in an intense legal battle with the Malian junta. Following the implementation of Mali’s new mining code in 2023, the situation escalated to a point in which Mali’s military government seized gold stocks from the Loulo-Gounkoto mine, stopped operations, and detained Barrick employees. In February 2025, Barrick signed a deal to end the multi-year dispute.

With the Barrick legal disaster, Western companies with projects in these nations will likely continue to leave the region as pervasive risks threaten operations and profitability. The Sahelian military governments have continuously tightened restrictions on mining operations for Western companies. In Mali, these restrictions have involved suspending all artisanal mining permits for foreign operators.

Out with the Old, in with the New

With the Sahel shifting away from the West, opportunities have arisen for rival powers to step in. Countries that did not experience a change in leadership, such as the Ivory Coast, Senegal, and Chad, have remained broadly friendly to France. However, states that experienced successful coups, including Mali, Burkina Faso, and Niger, have shifted towards other, non-Western nations. This implies that the greater the level of instability in the country, the higher the likelihood for foreign actors to take advantage.

Russia

As relations between the two deteriorated, Mali’s junta terminated relations with France, turning to Russian private military company Wagner to “shore up its domestic political position”. Exerting control over the mines is a priority for Wagner, which was reconstituted as Russia’s Africa Corps in 2023. While it would be an error to divert responsibility away from France for cultivating an environment that enabled this to occur, Russian propaganda and disinformation campaigns have played a key role in tipping the scale by effectively galvanising anti-Western support.

Mali is not an isolated example. By offering military assistance to Sahelian governments interested in strengthening their positions in the face of growing security threats, Moscow has gained a foothold elsewhere and signed contracts for commodities and trade route development. One example was in 2017, when the Kremlin exploited Paris’ decision to withdraw its forces from CAR by sending weapons and deploying military trainers from Wagner. The move paid off with Wagner’s front companies, such as Midas Resources SARLU, Lobaye Invest, and Diamville SAU, being granted permits by the CAR government to mine and export gold and diamonds. These companies have amassed profits over $2 billion, financing Russia’s wider regional efforts as well as the military campaign in Ukraine.

China

As China has continued to expand its Belt and Road Initiative (BRI), the Sahel has fallen into the sights of Beijing, which, much like its Russian ally, has moved to capitalise on declining Western influence. For instance, Chinese company Ganfeng Lithium has invested heavily in Goulamina, a lithium production plant in Mali, while others have begun to exploit gold mines. China has also completed a 2,000km oil pipeline linking Niger to its southwestern neighbour Benin. Although China has involved itself in regional security affairs through arms sales, for Beijing, political and economic dominance trump military and security concerns. However, with a struggling property market, demographic issues, geopolitical confrontations, and a trade war causing an economic slowdown, China’s operations in the Sahel will likely depend upon the country’s ability to manage such issues.

UAE

Since the 2010s, the United Arab Emirates (UAE) has established defence and military relations with Sahelian states. This has included training and arms provision to counter jihadi terrorism in a range of countries. Simultaneously, the UAE is going toe to toe with Chinese investment in Africa. Between 2019 and 2023, the UAE invested approximately $110 billion USD in new projects in Africa across sectors including mining, oil, infrastructure and manufacturing. The UAE’s growing role in the Sahel primarily stems from an interest in “bolstering its influence in areas of competition with its Gulf rivals”. After Chad terminated its defence pact with France in November 2024, the country forged alliances with the UAE and Russia. However, the UAE has demonstrated greater interest in the Horn of Africa and countries along Africa’s eastern coast compared with former French Sahelian countries, which are predominantly located to the West. Abu Dhabi’s strategy of port diplomacy (see image below) provided a clear illustration of this emphasis.

Map of Ports and Logistics Platforms in Africa

Source: Defence 24

What’s Next?

The Sahel’s substantial resource wealth, which could have promoted economic prosperity, has instead been a critical factor in the instability, violence, and corruption that has plagued the region. Western influence in the area is poised to further diminish as the Sahelian juntas continue to push the West out in favour of Russia and China. While these shifts signal steps away from the lingering neocolonial structures that have existed in the post-colonial era, with exploitation set to continue at the hands of different parties, economic and social prosperity are by no means a likely outcome. For as long as authoritarian military regimes remain in power and suppress democracy, the Sahelian people will continue to suffer from an indefinite cycle of instability, corruption and violence.

Semiconductor Showdown: China's Rare Earth Element Export Controls and Geopolitical Tensions

Introduction

The Chinese government is intensifying its efforts to dominate the rare earth element (REE) supply chain. China currently produces 60% of the world's REEs but processes roughly 90%. In addition to developing strong REE production, processing, and recycling capabilities, Beijing is increasingly engaging in supply chain warfare, placing export controls on REE extraction and separation technologies, as well as certain metals. In its most recent and stringent round of trade restrictions, which were announced in early December, China’s Ministry of Commerce banned the sale of antimony, germanium, gallium, and superhard materials to the United States. China also recently announced that it will be acquiring ownership of the last two foreign-owned REE refineries within its borders. Together, these developments reflect a deliberate strategy to solidify China’s dominance in the REE supply chain and reinforce its near-monopoly on these critical materials.

Chinese Rare Earth Global Supply Share

Source: Carbon Credits

The implications of these recent actions – and China’s broader consolidation of REE supply chains – are manifold. Rare earth elements, such as gallium, dysprosium, and germanium, are integral to the production of many advanced technologies, including semiconductors. As such, China’s heightened influence over these critical natural resources could escalate geopolitical tensions between itself and the United States (U.S.), further disrupt and reorient trade of critical minerals, and impact REE prices and the cost of downstream technologies for industry and consumers alike.

REE Uses and Impact on Semiconductor Industry

REEs covered by Chinese restrictions are critical in producing semiconductors for various uses. Antimony is used to make infrared detectors and diode components, as well as batteries and sheathing layers of cables. Gallium is generally combined with other materials to produce wide-bandgap semiconductors, which are smaller, more efficient, and widely used in weapon systems, such as g advanced radar systems for missile defence and target acquisition. Their civilian use is also on the rise, covering cutting-edge developments including 5G signal towers, fast charging stations, and improved solar cells. Germanium is currently utilised for sensors, infrared optics, solar cells, and fibre-optic cables. While its role as the main material of transistors has been replaced by silicon, germanium is making a comeback as researchers investigate the potential of next-generation chips that are solely based on the rare earth element.

Rare Earth Use and Application

Source: China Water Risk

Given their importance, Western users have stockpiled these metals given the impending implementation of the export controls. When similar policies were previously enacted by the Chinese government, prices of gallium and germanium significantly increased. A similar pattern price hike is expected to happen for antimony following the latest announcement on new export controls. The persistent high prices of these metals are poised to push up semiconductor prices, while the limited supply may potentially cause a chip supply crunch.

Reactions by Western Governments

Most commercially viable mines of antimony, gallium, and germanium are located in China, which controlled 48%, 98% and 93.5% of production of these materials worldwide, respectively. In response to this potential bottleneck, Western governments have worked to increase domestic production, raise refining capacity, and develop alternative replacements.

In the United States, the Department of Defense (DoD) is working to increase the production of the country’s only antimony smelting plant, while a private mining firm is expected to obtain government approval by the end of 2024 to open an antimony and gold mine in the state of Idaho. For gallium and germanium, after the initial reaction by the Pentagon to “proactively act to increase domestic mining and processing” of these resources, the U.S. has seemingly adopted a more laissez-faire approach to raising gallium production and refining capacity. Government funding was provided to execute technical studies to develop alternative extraction methods and create new semiconductor chips without gallium. The U.S. DoD has also worked to alleviate a potential germanium glut by awarding contracts to expand the production capacity of germanium substrates, and to develop infrared imaging modules with no germanium use. However, these initiatives are not aimed at addressing immediate needs, such as opening new mines and smelters.

In Europe, primary gallium production facilities existed as late as the 2010s before shuttering due to low-priced Chinese exports that flooded the market. Aware of potential future supply issues, the European Union (EU) has since attempted to resuscitate the production of gallium and germanium. This strategy is exemplified by the EU’s Critical Raw Materials Act, which aims to extract 10%, recycle 25% and process 40% of gallium, antimony, germanium, and other crucial materials within the EU by 2030.

Australia is the biggest producer of bauxite ore. Since gallium is produced during the production of smelting that ore, government agency researchers are now looking into the possibility of also extracting gallium during the production process. The Australian government also added an additional AUD2 billion for critical minerals financing in 2023, which covered the three rare earth elements in question.

Canada promulgated its Critical Minerals Strategy in 2022 and has provided CAD192.1 million and tax credits to support the development of new processing strategies and exploration of new reserves as of September 2024.

Finally, the Minerals Security Partnership (MSP), a multinational collaboration between 14 Western countries, was founded in 2022 to facilitate financial support across the whole value chain for various essential raw critical minerals, including the REEs discussed in this article. The MSP’s activities increased after Beijing raised its export restrictions in 2023, including various conferences and dialogues with Global South countries.

Implications

The Chinese government’s continued efforts to dominate the rare earth element industry mark a significant escalation in tensions between the U.S. and China, with geopolitical considerations shaping public policy in both nations. The White House has warned that China’s actions leave the U.S. and its Western allies “vulnerable to supply chain shocks” and undermine their “economic and national security.” The two countries are locked in a power struggle to gain the competitive edge in advanced technologies, with a focus on semiconductor chips that are key to artificial intelligence and military applications. In 2022, the U.S. imposed export controls to restrict China’s access to U.S. semiconductor technologies in an effort to maintain technological superiority in the sector. In response, China levied export restrictions on two REEs – gallium and germanium – that are critical to the production of advanced semiconductors. The latest measures by China may be considered additional retaliatory maneuvers signaling the country’s continued displeasure with the U.S. Government’s export policies and underscore China’s willingness to weaponize its mineral resources to address its own economic and security priorities.

China Dominates Rare Earth Element Supply Chain

Source: Global X

China’s new export restrictions may intensify calls for nearshoring initiatives and alter global trade in rare earth elements. In recent years, the U.S. and its Western allies have reached a general consensus regarding the importance of augmenting domestic REE production and securing alternative supplies from countries with which they have stable and positive relations. Meanwhile, a similar state-directed strategy is being executed by China. The broader decoupling of U.S.-China trade relations and the emergence of parallel supply chain networks for critical minerals could lead to a bifurcated global trading system, with each nation spearheading separate blocs.

However, some Western industry analysts are concerned by this trend, particularly as it relates to resource access and market complexities in REE supply chains. Outside of China, new REE production projects encounter significant challenges including high upfront costs, stringent regulatory requirements, permitting delays, limited technical expertise, environmental concerns, and lengthy project timelines, all of which discourage private investment. As a result, Chinese companies are likely to retain their competitive advantage due to their advanced technology, established infrastructure, and substantial government support.

Amid a lack of plausible alternative REE sources, industry is now sounding the alarm about future shortages. A more restrictive global ecosystem for rare earth minerals is expected to adversely affect key players in the semiconductor industry, such as TSMC and Nvidia. Reduced REE supplies will likely lead to supply chain bottlenecks and drive up resource prices, which exacerbates supply chain volatility and puts upward inflationary pressures on downstream products, including semiconductors. In fact, China’s 2023 export controls on germanium and gallium caused prices of the resources to more than double. Inflated prices may stifle research and development efforts, increase production costs, and cause manufacturing slowdowns, resulting in less innovation and smaller profit margins across the industry.

China's monopolization of rare earth elements has granted it unparalleled control over critical global supply chains, underscoring the global semiconductor industry’s vulnerability to supply disruptions. While Western nations are pursuing alternative supply chains and domestic production, significant barriers hinder rapid progress, allowing China to maintain its dominant position. This escalating resource competition is likely to deepen the fragmentation of global trade networks and increase geopolitical tensions between China and the United States.

Power and Protection - Smart Electricity Grids at the Crossroads of Technology and Geopolitics

In an age of evolving energy demands, climate concerns, and geopolitical tensions, the modernisation of power grids offers transformative potential. This report, authored collaboratively by the Global Commodities Desk and the Emergent Technologies Desk, provides actionable insights into the opportunities and challenges of smart grids, highlighting their pivotal role in building a sustainable, secure, and interconnected energy future. The geopolitical and economic dimensions of energy policy underscore the dual role of electrical and cyber systems, calling for robust protective measures against emerging threats. Discover how cutting-edge technologies and strategic policies are driving the energy revolution—read the full report to learn how smart grids are reshaping power systems and redefining energy security worldwide.

Serbia’s Jadar mine: the energy transition and environmental concerns

Introduction

Following government plans to reboot the Jadar lithium mine proposed by mining giant Rio Tinto, thousands of protesters rallied in Belgrade over the past month. The mine is set to become the largest lithium mine in Europe, significantly boosting Serbia’s economy, and supplying 90% of Europe’s lithium needs. However, the project has also sparked nationwide protests with concerns over the potential impact of the mine on the local environment. With increasing global demand for critical minerals, the Jadar lithium mine highlights broader tensions around resource extraction and the energy transition. This article analyses the implications of the mine and explores the different stakeholder perspectives that pose risks to its commencement.

Background

With the European Union's (EU) increasing demand for lithium, driven by the transition to electric vehicles (EVs) and energy storage, developing a secure lithium supply chain is growing in importance. Portugal is the only EU state that mines and processes lithium, making the region and its green transition heavily dependent on external sources. In response to this vulnerability, the EU has introduced the Critical Raw Materials Act (CRMA), which aims to reduce reliance on imports by promoting domestic production and refining capabilities. The proposed Jadar lithium mine in Serbia, with estimated reserves amounting to 158 million tons, could play a pivotal role in this strategy, with plans to produce 58,000 tons of lithium annually – enough to support 17% of the continent's EV production, approximately 1.1 million cars.

If all goes to plan, mining operations could begin in 2028. According to Serbia’s mining and energy minister, the government “aims to incorporate refining processes and downstream production, such as manufacturing lithium carbonate, cathodes, and lithium-ion batteries, potentially extending to electric vehicle production”. Moreover, in June 2021, amid public opposition in the Loznica region, the government emphasised that the project would involve a full-cycle approach to maximise local economic benefits. In March, Prime Minister Ana Brnabić suggested that the country could restrict or prohibit the export of raw lithium to support domestic value chain development. However, so far the specifics of the refining processes remain unclear.

Stakeholder perspectives

EU view

Since Europe currently has virtually no domestic lithium production, the EU views the Jadar lithium mine as a crucial project to bolster its economic security and support its green energy transition. The mine is expected to produce enough lithium to meet 13% of the continent’s projected demand by 2030, reducing its reliance on imports. Germany has already expressed strong support for the project, with Chancellor Scholz emphasising the mine’s importance for Europe's economic resilience.

Serbian view

The Serbian government views the project as a significant opportunity for the country's economy and its industrial development. Its mining and energy minister has emphasized that the project would comply with EU environmental standards while delivering economic benefits, including the creation of around 20,000 jobs across the entire value chain. Furthermore, Serbia’s finance minister projects that the mine could add between €10 billion and €12 billion to Serbia's annual GDP, which was €64 billion in 2022. To maximize these benefits, Serbia plans to follow the example of countries like Zimbabwe and Namibia by imposing restrictions on lithium exports, aiming to establish a complete domestic value chain for EVs. Additionally, Serbia's bid for EU membership adds a strategic dimension to the project, potentially aligning the country more closely with the bloc's energy and economic goals.

Local population view

Massive protests against the Jadar project have erupted across Serbia since June, following a court decision that cleared the way for the government to approve the mine. Many Serbians are troubled by the lack of transparency that evolved in the granting of mining rights to a foreign company. Moreover, opponents are sceptical of Rio Tinto's involvement, citing the company’s controversial history in developing countries, such as its operations in Papua New Guinea, where environmental damage contributed to a nine-year civil war. In this light, locals fear that the mine could jeopardise vital food and water sources in the Jadar Valley. For example, environmental problems caused by tailings, mine wastewater, noise, air pollution, and light pollution could endanger the lives of numerous communities and harm their agricultural land, livestock, and assets. Concerns have also been heightened by reports that exploratory wells drilled by Rio Tinto brought water to the surface that killed surrounding crops and polluted the river.

Rio Tinto view

Rio Tinto asserts that the Jadar mine is “the most studied lithium project in Europe,” having invested over $600 million in research and development to ensure its safety. As part of its efforts to gain public support, the company has conducted 150 information sessions for the local community, while Serbia's mining ministry has established a call centre to address concerns about the project. To further reassure the public, Rio Tinto has also expressed a willingness to allow independent experts to conduct an environmental review, aiming to alleviate doubts about the mine's potential impact on the ecosystem.

Conclusion

Despite the public opposition, the Jadar lithium mine appears likely to proceed, backed by strong support from the Serbian government and the EU, both eager to meet the onshoring requirements outlined in the CRMA. However, as this article has highlighted, the project faces considerable risks, including environmental challenges and persistent social and political opposition. The recent closure of the Cobre copper mine in Panama, following widespread protests over environmental damage and disputes over a new tax deal, serves as a stark reminder of the potential pitfalls. The Jadar project will need to navigate these complexities carefully to avoid similar outcomes and ensure a balanced approach to economic development and environmental preservation.

Drilling Dreams, Sinking Realities

Introduction

Climate change is increasingly recognised as the most significant long-term downside risk to almost all investment sectors. This urgency is underscored by the approaching 2024 U.S. Presidential election, where energy policy is a key issue, particularly in the context of the Republican Party’s push to revive the fossil fuel industry. With global temperatures in 2023 reaching unprecedented highs and surpassing even the most dire projections, the severity of climate-related disasters has escalated. These developments make it clear that mitigating climate change is not just an environmental imperative but also a critical economic and geopolitical challenge. The outcome of the U.S. election could have profound implications for global energy policies, especially as the Republican nominee, Donald Trump, advocates for an aggressive expansion of fossil fuel production.

Increasing Severity of Climate Disasters

2023 has been a stark reminder of the accelerating impacts of climate change. Record-breaking global temperatures, partly driven by an El Niño intensified by climate change, have led to widespread heatwaves, wildfires, and other extreme weather events. These developments have surpassed the projections of most climate models, highlighting the increasing unpredictability and severity of climate-related disasters, and the real-world implications of inaction on climate policy. The nonlinear trajectory of ecosystem collapse is one that has far-reaching implications, affecting everything from agriculture and infrastructure to public health and economic stability.

Graph 1.0 (Global Temperature Trends)

As the graph above shows, 2023 surpassed every previous temperature record by-far; almost showing an off-the-charts uptick in increasing temperatures. This must be seen in the context of the political economy of the green energy transition, involving stakeholders like big-oil to employ significant effort to subdue, delay, and slow down momentum of green energy through extensive lobbying in an effort to stay relevant in a world where renewable energy has become cheaper than conventional oil and gas as shown in the graph below.

Graph 2.0 (Energy cost by source)

COP and Delayed Multilateral Action

The international community has attempted to make some progress toward addressing climate change, with the United Nations’ Conference of the Parties (COP) serving as a central platform for multilateral action. COP 28 in Dubai marked a significant moment, signalling what many hoped would be the beginning of the end for fossil fuels. However, the subsequent COP 29, hosted in Baku, Azerbaijan—also a petro-state—seems to have reduced the pace and effectiveness of global climate action, and put the world off-track to limit global warming to 1.5C. The influence of fossil fuel interests and lobbying has continued to slow progress, delaying the implementation of much-needed measures to reduce emissions on a global scale, which by the number of lobbyists in COP 26 for instance, outnumbered national delegations to the convention.

Graph 3.0 (number of lobbyists in COP 26)

The 2024 U.S. Presidential Elections

The 2024 U.S. Presidential election represents a pivotal moment for the country’s energy policy, particularly in the context of climate change. Donald Trump’s acceptance speech at the Republican National Convention on July 19th highlighted his intent to revive America’s fossil fuel industry. Declaring, “We will drill, baby, drill!” Trump pledged to ramp up domestic fossil fuel production to unprecedented levels, with the aim of making the United States "energy dominant" on the global stage. His commitment to this vision was evident in his efforts to court oil industry leaders, promising to roll back President Joe Biden’s environmental regulations in exchange for financial support for his re-election campaign.

Trump’s team argues that unleashing vast untapped oil reserves in regions like Alaska and the Gulf of Mexico could significantly boost production if environmental regulations were eased. However, experts contend that such plans might not significantly alter the U.S. energy landscape, whether fossil or renewable. Despite the oil industry’s grievances under Biden, the sector has seen substantial growth, with oil and gas production reaching record levels. Biden’s administration has issued more drilling permits in its first three years than Trump did during his entire term, and the profits of major oil companies have soared due to the 2020s global commodities boom.

Federal Policy and Oil Production

The impact of federal policy on oil production is often tempered by broader market dynamics and investor behaviour. The oil industry, particularly after the financial strains of the shale boom, now prioritises capital discipline, driven more by market conditions and Wall Street’s influence than by the White House’s policies. Even if Trump were to win the presidency, the overall trajectory of oil production is likely to continue being shaped by global supply-demand balances and the strategic decisions of organisations like OPEC.

Interestingly, Trump’s promise to repeal Biden’s Inflation Reduction Act (IRA)—which includes substantial subsidies for green energy—may face significant obstacles. The IRA’s benefits are largely concentrated in Republican districts, and industries traditionally aligned with fossil fuels are beginning to recognise the advantages of low-carbon technologies. For example, companies benefiting from the IRA’s subsidies for hydrogen and carbon capture are prepared to defend these incentives against any potential repeal.

Conclusion

The urgency of addressing climate change is often underestimated due to a common misunderstanding of the non-linear feedback loops involved in ecosystem collapse. Many tend to view emissions as a simple, transactional force with nature, failing to grasp the exponential and potentially catastrophic consequences of inaction. This underestimation leads to a dangerous complacency, undervaluing the need for urgent and robust policy action.

The U.S. holds significant sway over global climate outcomes mainly because of two reasons: (1) It is the second largest emitter; and (2) it is one of the only countries in the world for climate policy to be a partisan issue, making it particularly susceptible to hampering global emissions targets.

With much of the Global South still dependent on coal, oil, and gas, a unilateral decision by the U.S. to aggressively increase fossil fuel consumption could single-handedly push the planet toward an irreversible climate disaster. The stakes are incredibly high, especially as the political economy of the green transition faces opposition from entrenched fossil fuel interests. These forces work to delay and obstruct the shift to renewable energy, despite the clear and present need to accelerate this transition to prevent ecological collapse.

Having already surpassed 1.5C warming; the world is headed towards 4.1-4.8C warming without climate action policies; 2.5-2.9C warming with current policies; and 2.1C warming with current pledges and targets. In this context, if the U.S. were to aggressively change course and begin burning more, instead of less as Trump suggests—it may severely hamper the ability of the global ecosystem to recover and restore, potentially breaching already critical tipping points.

Graph 4.0 (projected warming in different scenarios)

Therefore, it becomes more important than ever for climate-conscious energy policy, to recognise that ecological collapse is a non-linear and irreversible outcome of breaching environmental tipping points, and to underscore the need to prevent misinformation on climate change spreading as a result of forces acting against renewable energy in the political economy of the green transition.

The good news, however, may be that while Republicans may advocate for a new oil boom, the realities of global markets and investor behaviour suggest a different outcome. Wall Street, driven by a cost-benefit analysis that increasingly favours renewable energy, may not align with the interests of a pro-fossil fuel administration. Although the White House can influence energy policy, it is ultimately market forces that will dictate the future of America's energy landscape. This shift towards green energy, driven by economic viability and technological advancements, underscores the need for accelerated action to mitigate climate risks and ensure a sustainable future.

Nickel and Dime: The Philippines' Approach to Attracting Western Capital

Introduction

Aware of the integral role of critical minerals in clean energy systems and other modern technologies, the Philippines has begun courting Western investment to develop its domestic critical mineral industry. The country has vast reserves of untapped natural resources, including nickel, a critical component of electric vehicle (EV) batteries. According to the International Energy Agency, global demand for nickel is expected to increase by approximately 65% by the end of the decade. The Philippines stands to financially benefit from the expected surge of demand for nickel in the coming years, but must first build the requisite infrastructure (e.g., mines, refining plants, processing facilities, transport hubs, etc.) to realise the economic potential of this mineral resource.

To attract increased foreign investment, the Philippines is positioning itself as an alternative to China in the global nickel supply chain. This stance draws from the rationale that the United States (U.S.) and other Western countries will want to diversify their critical mineral supply chains away from China given contemporary security concerns with China and its dominance over nickel supplies and processing capabilities. Such a strategy has both geopolitical and economic implications, especially as it relates to strategic trading and investment blocs that reflect the U.S.-China power competition. By aligning with Western interests, the Philippines aims to bolster its economic growth while contributing to a more balanced global supply chain for critical minerals.

Nickel Industry in the Philippines

The Philippines is currently the world’s second-largest supplier of nickel, accounting for 11% of global production. The country’s nickel exports are expected to increase over the next couple of years to meet growing global demand, particularly in the EV sector. However, this outlook depends on how the country navigates other political and economic factors, including (1) volatility in market prices; (2) trade relations and international partnerships; (3) ability to attract foreign investment; (4) the implementation of government policies that promote industry development; and (5) environmental, social, and governance considerations. The Philippines Government has seemingly decided that, at its current stage, the best way to develop the country’s nickel production capacity is by focusing on boosting foreign investment in the domestic nickel industry.

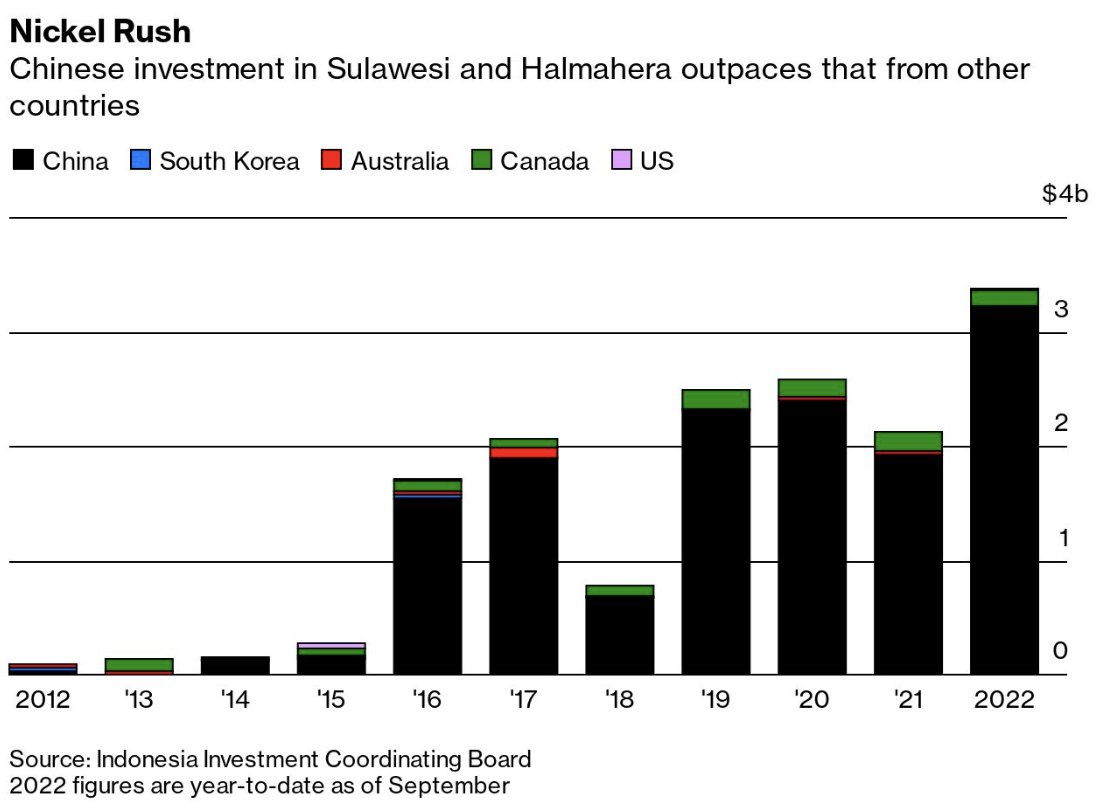

Investment Strategy

Indonesia is the largest global supplier of nickel, producing over 40% of the world’s nickel in 2023. Approximately 90% of Indonesia’s nickel industry is controlled by Chinese companies, giving China a dominant market position over nickel. The market concentration of this critical mineral has caused unease and consternation amongst Western nations that fear China may leverage this control over the global nickel supply chain to their disadvantage. The Philippines, which itself has experienced escalating tensions with China over territorial claims in the South China Sea, has leveraged this fear, attempting to use it to spur greater foreign investment in their own nickel industry. Through this investment, the Philippine government hopes to develop the domestic nickel sector, especially as it relates to downstream processing, where most of the value-added occurs. The investment strategy comes amid a broader effort to augment economic ties and foster greater alignment with the U.S. and its allies, although the country is still open to Chinese investment. Government officials in Manila have shared that the U.S., Australia, Britain, Canada, and European Union have all expressed interest in directing investment to the Philippines’ nickel sector.

To date, there have been a few initiatives to advance the Philippines’ nickel industry. In late 2023, government officials from the Philippines and the U.S. signed a Memorandum of Understanding that provided $5 million to set up a technical assistance programme to develop the Philippines’ critical mineral sector. The leaders of the U.S., Japan, and the Philippines also held an economic security summit in April 2024 that featured discussions on strengthening critical mineral supply chains. Similarly, there have been preliminary talks about a trilateral arrangement in which the Philippines would supply raw nickel, the U.S. would provide financing, and a third country (e.g., Australia) would offer the technology necessary to process and refine the nickel. However, thus far, these discussions have yielded little in the way of concrete financing or investment initiatives that would provide notable benefit to the industry.

Geopolitical and Geoeconomic Implications

While the U.S. and its allies support a diversification of the global nickel supply chain, their ability to shift the paradigm will likely prove to be a difficult undertaking. Strengthening the Philippines’ nickel mining, processing, and refining capacity up to a level in which it will be able to recapture significant market share from Indonesia and China will require a huge amount of economic and political resources. This is something most countries will shy away from incurring in an important election year. For example, the U.S. has communicated its reluctance to sign a critical minerals agreement amidst the 2024 U.S. presidential race. Further, countries will not want to antagonise China and risk retaliation, given that many economies currently rely on China for the production and processing of critical minerals and their downstream technologies.

As a result of major Chinese investment and technological innovation, Indonesia’s production of nickel has notably increased in recent years. This flood of new nickel supplies has put downward pressure on global nickel prices and crowded out competition from entering the market. With slumping prices, it may be a challenge to attract sufficient foreign financing without a policy framework or safeguards that could inspire greater investor confidence. A potential remedy could be regulatory policies and tax incentives that favour non-Chinese companies. Nevertheless, the economic development associated with increased nickel production is integral to the Philippines economy, so the country does not want to alienate Chinese investors if they prove to be the best path forward.

Concluding Remarks

The Philippines’ strategic efforts to develop its nickel industry through Western investment illustrate the dynamics of economic ambition and geopolitical considerations. By positioning itself as a viable alternative to the China-dominated Indonesian nickel industry, the Philippines aims to leverage global security concerns to increase investment in its domestic nickel sector. However, the realisation of this ambition will hinge on overcoming significant political and economic challenges, such as fluctuating prices and dynamic geopolitical tensions. As the country navigates these hurdles, the outcome of its initiatives will significantly impact its role in the global critical minerals supply chain, shaping future economic and strategic alignments.

Small Modular Reactors Nuclear Renaissance?

In the era of climate urgency, increasing energy demands, and geopolitical uncertainties, Small Modular Reactors (SMRs) could redefine the energy landscape and provide viable alternatives to current energy sources. SMRs present a scalable, safer alternative to traditional nuclear power. This report from London Politica explores the potential of SMRs to revolutionise energy production, mitigate climate change, and enhance energy security. With uranium prices soaring and global interest in nuclear energy surging, SMRs are poised to play a critical role in the nuclear renaissance.

Our comprehensive analysis covers key regions, including the US, Europe, and China, examining their nuclear strategies, regulatory landscapes, and market dynamics. We also delve into the controversies surrounding uranium supply chains and the broader political and economic implications of nuclear power. Dive into our in-depth analysis of the future of SMRs and their global impact.

Mexico’s Election Impact on Energy Policy

Background

On 2nd June 2024, Claudia Sheinbaum made history by being elected as Mexico’s first female president. With a strong academic background, Sheinbaum is a physicist holding a doctorate in energy engineering and was part of the Nobel Peace Prize winning UN panel on climate change. Sheinbaum’s economic agenda aims to capitalise on the opportunities presented by American nearshoring efforts, contingent on a stable and expanding energy supply.

Mexico is one of the largest oil suppliers in the world, having produced 1.6 million barrels daily in 2022. The country is also ranked 13th in the global crude oil output. Whilst Sheinbaum has promised to accelerate Mexico’s clean energy transition and aims to generate 50% of its energy from renewables by 2030, most spectators are divided. Some hope her scientific background will lead to a greater emphasis on clean energy, while others fear she might follow the policies of her predecessor, Andrés Manuel López Obrador, who invested heavily in bolstering fossil fuel-reliant state energy companies, PEMEX (Petróleos Mexicanos) and CFE (Comisión Federal de Electricidad).

Regardless of her position on energy transition, Sheinbaum faces the challenge of restoring investor confidence, which was shaken during López Obrador’s administration. Without this achievement, the new leader cannot guarantee Mexico’s energy stability and it could jeopardise the country’s commitment under the US - Mexico - Canada Agreement (USMCA) and the Paris Agreement.

Mexico’s gas supply, traditionally dominated by PEMEX, faced disruptions due to declining production and pipeline congestions. An energy reform in 2013 allowed private firms to enter the gas market to boost market competition and supply reliability. However, under López Obrador, the private sector participation was viewed as a threat, and efforts were allocated to prioritise PEMEX’s production. Currently, the company is the most indebted oil corporation in the world, with its stocks having a -5.74% 3-year return, compared to +11.48% from other companies in the same period and sector.

Considerations for Sheinbaum’s Energy Strategy

Sheinbaum has a decision to make regarding the energy future of Mexico. There is a confluence of energy-related factors that Sheinbaum will need to consider early in her administration, such as increasing domestic energy demands, pressure from environmental groups and international climate regimes, a deepened reliance on energy imports from abroad, and foreign companies’ dissatisfaction with the state’s current control of the energy sector.

Sheinbaum has long supported the state-centric energy policies of the previous administration, including legislative amendments that rolled back the 2013 constitutional reforms that helped liberalise the Mexican energy sector. Nevertheless, while Sheinbaum continues to defend the energy policies of the previous López Obrador administration, she is more pragmatic than her predecessor, which may provide a path for potential policy change to deal with the various energy issues facing her administration.

One area where Sheinbaum differs from López Obrador is the role of renewable energy sources in Mexico’s energy mix. Sheinbaum has a robust environmental pedigree and has published extensively on the clean energy transition. During her time as mayor of Mexico City, she implemented clean energy infrastructure and electrified transportation modalities. Furthermore, according to her campaign platform, she is committed to progressing Mexico’s clean energy transition and decarbonising the economy. However, climate progress under the Sheinbaum administration is likely to be tempered by fossil fuel supporters. Mexico still strongly depends on the oil and gas industry for its energy needs, accounting for over 80% of its energy mix in 2022. Understanding the necessity of oil and gas for the domestic economy, Sheinbaum has championed domestic oil production and supports the central role of PEMEX in the energy sector.

Source: IEA (2024)

As Mexican energy sovereignty will likely continue to be a focus for Sheinbaum’s administration, issues related to weak foreign direct investment in the Mexican energy industry are likely to persist. Under the current policy framework, private industry does not have an incentive to invest in exploration and production activities in Mexico. Lax private investment coupled with recent financial struggles at PEMEX may result in insufficient investment in Mexico’s energy infrastructure and increased reliance on energy imports. Therefore, to address the increased domestic energy demands, Sheinbaum may alter the government's prevailing energy strategy to ensure sustainable and robust energy supplies by providing private companies more control/access to the energy sector.

There are also broader trade implications regarding Sheinbaum’s potential approach to Mexico’s energy strategy, particularly how it impacts the country’s relationship with the US. The US Trade Representative communicated to its Mexican counterpart that the legislative amendments passed under the López Obrador administration violated investment provisions stipulated by the USMCA, leading the US to open dispute settlement consultations to address the issue. If a negotiated agreement is not reached, the US could invoke trade sanctions targeting Mexico in response. Failure to reaffirm Mexico’s commitment to the trade agreement could also lead to neglect of economic opportunities stemming from American nearshoring efforts.

The outcome of the 2024 U.S. presidential election will undoubtedly further impact Mexico’s energy sector, especially as it relates to trade and investment. Sheinbaum’s industrial policy plans and interest in promoting a green economy align with Biden’s focus on the clean energy transition and nearshoring efforts. Conversely, a Trump White House may provide a more hostile and coercive environment for Sheinbaum to operate within.

Outlook

Given the current instability affecting the early stage of Claudia Sheinbaum’s administration, companies and investors need to adapt their current strategy to seize the right set of circumstances for their business.

Despite the undefined agenda for energy public policies and the ongoing debate between energy transition and oil investment, Sheinbaum will need to prioritise a stable domestic energy supply. Therefore, companies that want to be aligned with the government's agenda should invest in projects focused on new technologies that bolster domestic production or increase resilience.

Foreign companies may have concerns about the continuation of policies aligned with López Obrador’s approach, especially given the limited or even absent participation of private investment in Mexican oil companies in recent years. To mitigate this risk, companies can engage and promote public-private partnerships, which can foster joint ventures. However, joint ventures can present risk in the case of the nationalisation of foreign companies, but this is unlikely to occur under Sheinbaum’s presidency. Investors should focus on sectors that are likely to receive government support, such as technologies that enhance energy independence or generate a constant supply.

It is important to mention that there will be clearer indications if Sheinbaum will prioritise climate commitments or follow the steps of her predecessor in due course. Additionally, the outcome of the US elections is likely to significantly impact the country’s energy policy framework.

Eastern Entente: Houthi Campaign

Following developments in the Houthi campaign, the growing cooperation between China, Russia, and Iran is becoming a major concern for the Red Sea region. This emerging ‘Axis’ increases uncertainty for stakeholders in commodity trade, as the stability of the Suez Canal, Strait of Hormuz, and Gulf of Oman are threatened. Iran’s power projection in the region, characterised by the use of proxy groups in an ‘Axis’ of resistance, has paralysed global trade flows. Although China and Russia's involvement is presented as a means to stabilise the region and foster trade, rising scepticism clouds maritime traffic and worsen future prospects (as quantitatively analysed in a recent article by the Global Commodities Watch). The geopolitical and economic implications are profound and pose risks to all parties involved, raising questions about the motives behind this new ‘Axis’ formation and what it means for the disruptive ‘Axis of Resistance’.

Axis of Resistance - In Retrospect

Since the Iranian Revolution of 1979, the Tehran regime’s foreign policy has been characterised by its desire to propagate its brand of Shi’a Islam across the Middle East. To this end, it has long developed and fostered relationships with sympathetic proxy groups throughout the region. This has allowed it to project power in locations that might otherwise be beyond its reach while exercising some degree of “plausible deniability." In January 2022, this prompted the former Israeli Prime Minister, Naftali Bennett, to brand Iran “an octopus” of terror whose tentacles spread across the Middle East.

The country’s so-called “Axis of Resistance'' has expanded since 1979, its first major franchise being Hezbollah, which was founded in 1982 to counter Israel’s invasion of Lebanon that year. Its most recent recruit has been the Houthis. This group was established in northern Yemen in the 1980s to defend the rights of the country’s Shi’a Zaidi minority. What was initially a politico-religious organisation then evolved into an armed group that fought the government for greater freedoms. It was able to exploit the chaos of the Arab Spring to capture the national capital, Sana’a, in the autumn of 2014, and the group now controls around 80% of Yemen’s population.

Exactly when the Houthis became a part of the “Axis of Resistance” is something of a moot point, but the general consensus among the group’s observers is that it started receiving Iranian military assistance around 2009, with this almost certainly contributing to its capture of the Yemeni capital, Sana’a, in 2014. Since the HAMAS attack against Israel on October 7, 2023, it has rapidly emerged as a key Iranian franchise whose focus has been attacking shipping in the southern Red Sea. At the time of writing, an excess of 40 vessels had been targeted, while repeated US-led strikes against Houthi military infrastructure on the Yemeni coast appeared to have had limited success in degrading the group’s intent or capability.

March 2024 saw a proliferation in the number and efficacy of attacks, with the first three fatalities reported on the sixth of the month as the Barbados-flagged bulk carrier True Confidence was struck near the coast of Yemen. Around three weeks later, on March 26th, four ships were attacked with six drones or missiles in a single 72-hour period. Separately, on March 17th, what is believed to have been a Houthi cruise missile breached southern Israel’s air defences, coming down somewhere north of Eilat, albeit harmlessly.

Since starting their campaign against mainly international commercial shipping in the waters of the Red Sea and Gulf of Aden in November 2023, the Houthis have become one of the mostaggressive Iranian proxy groups in the Middle East. This and their apparently strengthened resolve in the face of US and UK strikes have substantially raised their profile internationally and won them plentifulplauditsfrom their supporters across the region. The perception that they are standing up to the US, Israel, and their Western cohorts has been instrumental in developing their motto“God is great, death to the U.S., death to Israel, curse the Jews, and victory for Islam” into a mission statement.

Map of Houthi Attacks

Source: BBC

Iran-Houthi Mutualism

In terms of regional geopolitics, the mutual benefits to Iran and the Houthis of their cooperation are far-reaching. For their part, the Iranians can use the Houthis to project power west into the Red Sea and Gulf of Aden, pushing back against the influence of Saudi Arabia and other Sunni states. Although not part of the Abrahamic Accords of 2020, Riyadh has been showing signs of a willingness to harmonise diplomatic relations with Israel, even since the events following October 7, 2023. This is a complete anathema to Tehran, for which the Palestinian cause is central to its historic antagonism with Tel Aviv. The fact that Saudi Arabia was instrumental in setting up the coalition of nine countries that intervened against the Houthis in Yemen from 2015 onwards only strengthens Tehran’s desire to confront the country’s influence regionally.

A secondary benefit of the Houthis’ Red Sea campaign is that it helps to maintain Tehran’s maritime supply lines to some of its franchise groups further north in Lebanon, Gaza, and Syria. Their importance to Iran’s proxy operations was illustrated in March 2014 when the Israel Defence Forces (IDF) conducted “Operation Discovery," intercepting a cargo ship bound for Port Sudan on the Red Sea’s western shores carrying a large number of M-302 long-range rockets. Originating in Syria, they were reckoned to have been destined for HAMAS in Gaza following a circuitous route that included Iran and Iraq and which would have culminated in a land journey from Port Sudan north through Egypt to the Levant.

Iran began to increase its military presence in the Red Sea in February 2011 and has since established a near-permanent presence there and in the Gulf of Aden, to the south, with both surface vessels and submarines. However, this footprint is relatively weak compared to that of its presence in the Persian Gulf, to the east, and it would be no match for the Western vessels that have been operating against the Houthis in the Red Sea since late 2023. The latter’s campaign in these waters can, therefore, only reinforce Iran’s presence thereabouts.

A lesser-known reason for Iran’s desire to maintain influence around the Red Sea is a small archipelago of four islands strategically located on the eastern approaches to the Gulf of Aden from the Indian Ocean and Arabian Sea. The largest of the four islands is called Socotra and is considered by some to have been the location of the Garden of Eden. With a surface area of a little over 1,400 square miles, it has, in recent years, found itself more and more embroiled in the struggle for hegemony between Iran and its Sunni opponents in the region. In this sense, it and its neighbours could be seen to have an equivalence to some of the small islands and atolls of the South China Sea that are now finding themselves increasingly on the frontlines of Beijing’s regional expansionism.

While officially Yemeni, Socotra has long enjoyed close ties with the United Arab Emirates (UAE), with approximately 30% of the island’s population residing in the latter. Following a series of very damaging extreme weather events in 2015 and 2018, the UAE strengthened its hold on Socotra by providing much-needed aid, with military units arriving entirely unannounced in April 2018. Vocal opposition from the Saudi-allied Yemeni government led to Riyadh deploying its own forces to the island in the same year, but these were forced to withdraw in 2020 when the UAE-allied Southern Transition Council (STC) took full control of the island. Since then, Socotra has been considered to be a de facto UAE protectorate, extending the latter’s own influence south into the Gulf of Aden.

Shortly after came the signing of the Abrahamic Accords, which normalised relations between Israel and several other regional countries, including the UAE. Enhanced cooperation with the UAE gave Tel Aviv a unique opportunity to expand its own influence in the region through military cooperation with its new ally. In the summer of 2022, it was reported that some inhabitants of the small island of Abd al-Kuri, 130 km west of Socotra, had been forced from their homes to make way for what has been described as a joint UAE-Israeli “spy base." For Iran, this means that Israel now has a presence at a strategic point on the strategically vital approaches to the Red Sea from the Indian Ocean.

Perhaps a greater irritant for both the Houthis and Iran is the presence of UAE forces on the small island of Perim. This sits just 3 km from the Yemeni coast in the eastern portion of the Bab al-Mandab Strait, giving it obvious strategic importance. The UAE took the island from Houthi forces in 2015 and started to construct an airbase there almost immediately. Although there is no known Israeli presence there, Perim is now a major thorn in the side of Iran’s own regional ambitions. In the regional tussle for supremacy, this is yet another very pragmatic reason for the Houthi-Iran relationship.

Perim Airbase

Source: The Guardian

Since February 2022, much has been made of the extent to which Ukraine has become a weapons incubator for both sides in the conflict there, not least with regard to innovative drone and AI technology. Given the range of weaponry now apparently at the disposal of the Houthis in the Red Sea and Gulf of Aden, it may be that that campaign is serving a similar purpose for a Tehran keen to test recent additions to its armoury. Indeed, the Houthis’ use of a range of modern weapons, including drones, Unmanned Underwater Vehicles, and cruise missiles, since November 2023 continues to be reported on a regular basis.

In return for prosecuting its campaign in the Red Sea, the latter received substantial material military support from Tehran, allowing them to raise their standing even more. The aforementioned attack, which killed three seafarers aboard the True Confidence, was the first effective strike against a ship using an Anti-Ship ballistic Missile (ASBM) in the history of naval warfare. First and foremost, this will have been regarded as a major coup for the Iranian military assets mentoring the Houthis in Yemen. Additionally, it has given the latter’s global standing a further boost since an attack of this magnitude would be more normally associated with the much more sophisticated standing military of a larger country.

A simplistic analysis of the Houthi-Iranian relationship could stop at this point. However, recent events in the Middle East and further afield show that it is a relatively small coupling in a much larger, global marriage of convenience. A clue to this appeared in media reporting in late January 2024, when The Voice of America reported that Korean Hangul characters had been found on the remains of at least one missile fired by the Houthis. This led to the conclusion that the Yemeni group has received North Korean equipment via Iran.

North Korean missile supposedly used by the Houthis

Source: VOA

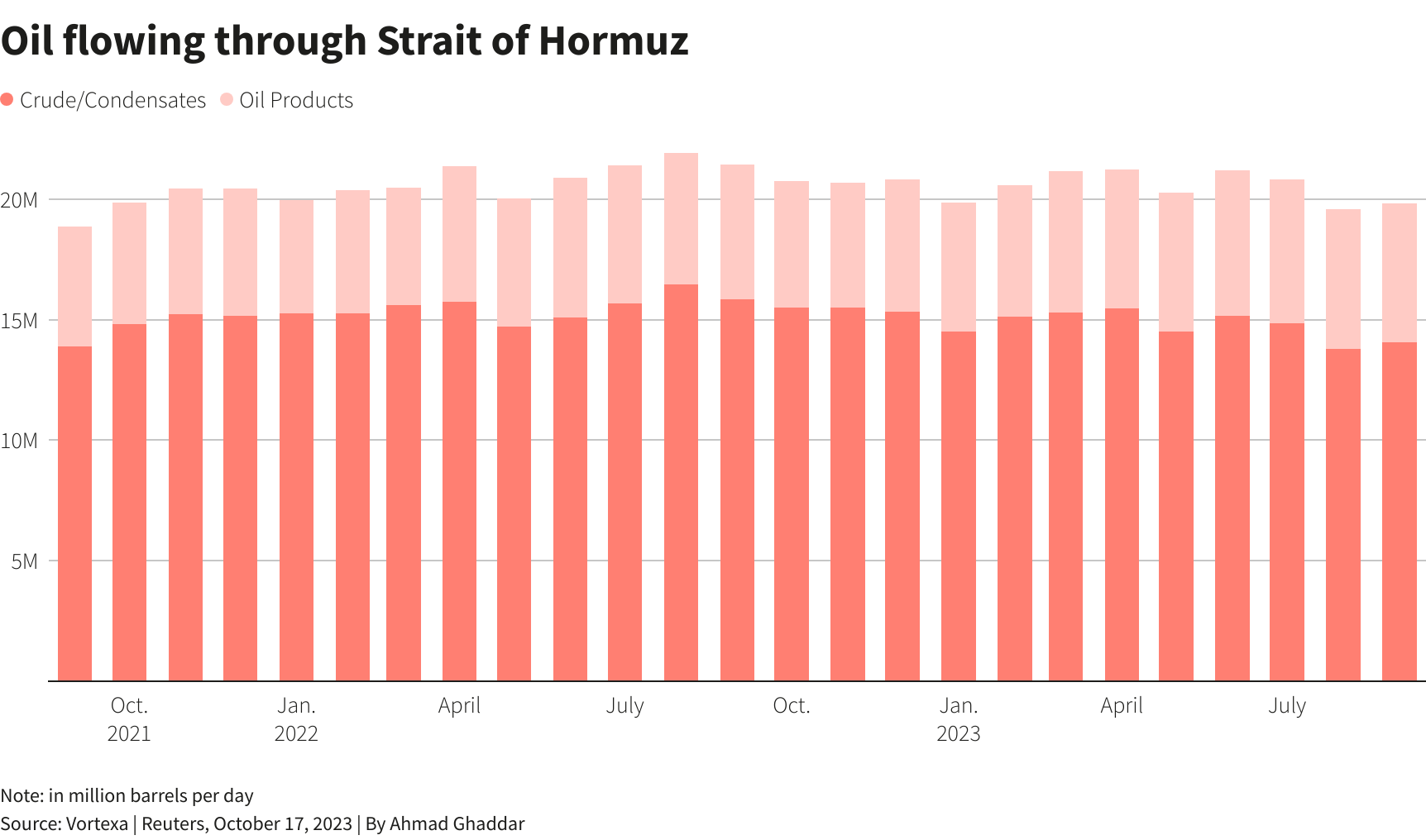

Russian Involvement

In late March 2024, Russia and China signed a historic pact with the Houthi in which the nations obtained assurance of safe passage through the Red Sea and Gulf of Aden in return for ‘political support’ to the Shia militant group. Despite the assurance, safety for Russian and Chinese vessels is not guaranteed. In late January, explosions from missiles were recorded just one nautical mile from a Russian vessel shipping oil, while on the 23rd of April, four missiles were launched in the proximity of the Chinese-owned oil tanker Huang Lu. Evidently, increased regional tensions incur an extra security risk for Russian tankers, regardless of the will of the Houthis to keep said tankers safe.

The Kremlin is trying to walk a thin line between provoking and destabilising the West while simultaneously trying to avoid, literally and figuratively, capsizing regional Russian maritime activity. Its seemingly contradictory two-pronged approach aims to secure vital shipping routes while fostering an anti-Western bond with regional actors. Russia is seen upholding its anti-West rhetoric, which serves as a cornerstone for bonding with regional actors and pushing forth Russian economic interests, while silently attempting to facilitate regional de-escalation led by Washington. Despite being a heavy user of their veto power in the UNSC, Russia abstained from voting on Resolution 2722, which demands the Houthis immediately stop attacks on merchant and commercial vessels in the Red Sea.

On January 11th, Washington put forth UN Resolution 2722 to the UNSC, which sought to justify attacks on Houthi infrastructure as a push-back for the group’s recent activities in the Red Sea. During the voting procedure of the resolution, Russia chose to abstain, even though Moscow often frequents vetoes as a tactic to show support for Kremlin-friendly states in Africa and the Middle East. The resolution subsequently passed, and the US and UK commenced their first strikes on Yemen the following day. These reveal Russia’s interests in securing enough stability to continue shipping its estimated 3 million barrels of oil a day to India, while aligning with overarching geopolitical alignments.

Russia’s interest in stabilising regional conflicts may lie in the threats to its weapon supply chains. As the war in Ukraine drags on, Tehran’s importance as a weapon supplier increases the Kremlin’s collaboration efforts. Putin continues to foster and protect regional connections by actively protesting Western regional presence, attempting to balance the current crisis with crucial ties to middle-eastern nations.

Trade Route Diversion

Since the onset of the crisis in the strait, Russia has utilised the opportunity to bolster anti-Western and pro-Russian sentiments. For one, Russia has flagged various Russian transport initiatives. On January 29th, Russia’s Deputy Prime Minister, Alexey Overchuk, noted that Russia’s “main focus is on the development of the North-South international transportation corridor," which is a 7200-km multi-modal transport network offering an alternative and shorter trade route between Northern Europe and South Asia.

International North-South Trade Corridor

A key part of the trade route involves an imagined rail network spanning from Russia to Iran. Though positioned as a universally beneficial transport option for both Europe and Asia, it seems Moscow and Tehran would benefit the most. The two highly sanctioned states, whose connection has recently deepened due to their shared economic isolation from the global economy, could position themselves as lynchpins of an effective transport network.

Unlike Tehran, which still has control over the vital Strait of Hormuz choke point, Russia’s political might in terms of energy transport networks is quickly dwindling after the Baltic states’ complete exit from the BRELL energy system and the West’s resolve to decrease energy dependence. The North-South corridor thereby holds value as a catalyst of global energy transport and trade.

However, this vision is thwarted by financial crises, with workon the railroad from Rasht to Astara in Iran suffering setbacks. Iran does not have the means to pour into the project and has already obtained a 500 million euro loan (about half of the total cost of construction) from Azerbaijan in FDI. In May 2023, it became known that the Kremlin would fund the project themselves by issuing a 1.3 billion euro loan to Tehran, despite Iran’s ballooning debt to Russia. The same month, Marat Khusnullin, Deputy Prime Minister, announced that Russia is expecting to invest approximately $3.5 billion in the North-South corridor by 2030. This is likely a major underestimation of the costs needed to complete the project.

With Iran’s growing debt and Russia’s war-born financial strain, further trade route developments are sure to be delayed. Seeing as the railroad project between Russia, Azerbaijan, and Iran has been in existence since 2005 with no concrete end in sight, the North-South Corridor, despite Russia’s active marketing campaign in light of the troubles in the Red Sea, is unlikely to become a viable transport option in the near future.

The Northern Sea Route (NSR), which Putin has similarly promoted since the start of the Houthi attacks, is likely to suffer a similar fate. The NSR’s realisation as a major global route is hindered by the fact that the Arctic Circle’s harsh climate causes the route to be icebound for about half of the year. Furthermore, in light of the recent war in Ukraine, the NSR is off-limits to even being considered a viable transportation route for large swaths of the West due to sanctions against Putin’s regime.

Russia: Long-Term Strategy

With Russia’s closest regional naval presence being Tartus in Syria, Russia is also interested in establishing naval bases closer to the Red Sea. Russia’s primary interest is to establish a port in Sudan. High-level bilateral negotiations have been actively taking place between Khartoum and Moscow, with an official deal being announced in late 2020. The construction of a naval base would increase Russia’s influence over Africa, facilitating power projection in the Indian Ocean. Nonetheless, the ongoing Sudanese civil war seems to have stalled negotiations.

The region is of such strategic interest to Russia that Moscow has recently pushed forth another alternative for bolstering its presence in the Red Sea: a naval base in Eritrea. During a state visit to Eritrea in 2023, Russian Foreign Minister Sergey Lavrov underscored the potential that the Massawa port holds. The same year, a Memorandum of Understanding was signed between the city of Massawa and the Russian Black Sea naval base Sevastopol, in which the two countries pledged to foster closer ties in the future.

A New Axis

China and Russia have recently struck a deal with the Houthis to ensure ship safety, as reported by a Bloomberg article. Under the agreement, ships from China and Russia are permitted to sail through the Red Sea and the Suez Canal without fear of attack. In return, both countries have agreed to offer some form of “political support” to the Houthis. Although the exact nature of this support remains unclear, one potential manifestation could involve backing the Yemeni militant group in international institutions such as the United Nations Security Council. In January 2024, a resolution condemning attacks carried out by the Houthi rebels off the coast of Yemen was passed, with China and Russia among the four countries that abstained.

Despite instances of misfiring by Chinese ships after the deal, the alignment between these countries has been viewed as the emergence of an “axis of evil 2.0." Coined by former U.S. President George W. Bush at the start of the war on terror in 2002, the term “axis of evil” originally referred to Iran, Iraq, and North Korea, which were accused of sponsoring terrorism by U.S. politicians. Indeed, China and Iran have maintained a robust economic and diplomatic relationship. China is a significant buyer of Iranian oil, purchasing around 90 percent of Iran’s oil output, totalling 1.2 million barrels a day since the beginning of 2023, as the U.S. continues to enforce Iranian oil sanctions.

Chinese Dominance of Iranian Crude Oil Exports

Source: Seeking Alpha

However, it may be far-fetched to consider China, Russia, Iran, and North Korea as a united force akin to the Communist bloc against the West during the Cold War. After all, there are significant tensions within these relationships. For example, Beijing has not fully aligned with Moscow regarding the invasion of Ukraine. Additionally, there are power imbalances within these relationships, as Iran relies on China far more than China relies on Iran.

Despite the thinness of this idea of an "axis," it remains concerning that these powerful countries (three of which are nuclear-armed) are aligning against the democratic world. Considering the volume of trade passing through the Suez Canal and the impossibility for the U.S. and company’s Operation Prosperity Guardian to protect every ship in the region, the deal struck between China, Russia, and Iran may be a significant factor that could shift the current global economic balance towards the side of the "Eastern Axis.”

Similarly, China’s recent activities against the Philippines in the South China Sea could be viewed as an attempt to undermine the Philippines’ economy, which heavily relies on its seaports. This could force the Philippines to capitulate or incur significant costs for the U.S. should it decide to provide more assistance to further enhance the Philippines’ defence capabilities.

China: Long-Term Strategy

In recent years, China has increased its ties with countries outside the ‘Western sphere’. Apart from being present in the Gulf of Oman and destining a myriad of vessels to secure the region, it has made strides in developing long-term partnerships with Russia and Iran. Chinese collaboration with Russia is advertised as having “no limits,”, and its 25-Year Comprehensive Cooperation Agreement with Iran further cements its political and economic involvement with both nations.

The security and economic aspects of China’s long-term plans are the most relevant to commodity trade, as violent conflicts and geopolitical tensions are the prime hindrances to trade flows through the region. Nonetheless, the cooperation of these nations does not bode well with the West and could negatively impact trade regardless of improved security.

China’s circumvention of the financial sanctions placed on Iran mocks the international community’s concerted effort to dissuade Tehran’s human rights violations, nuclear activities, and involvement in the Russia-Ukraine war. Its “teapot” strategy, which allowed China to purchase90% of total Iranian oil exports, relies on the use of dark fleet tankers and small refineries to avoid detection and evade the financial sanctions placed on Iranian exports.