Central and Eastern European countries are well-prepared for the next 2023/2024 heating season, but risks still loom large

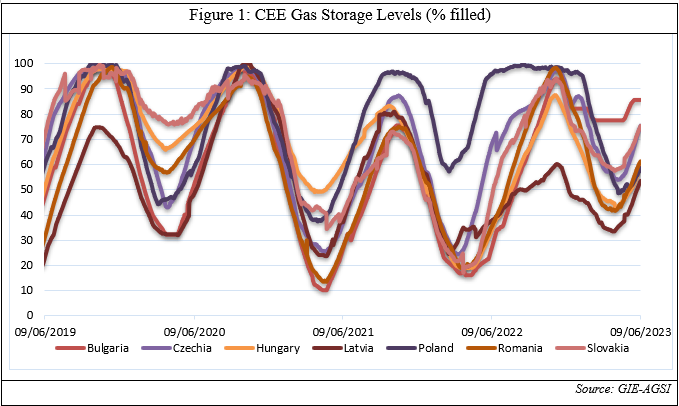

Central and Eastern European (CEE) countries are well-prepared for the next 2023/2024 heating season, despite the presence of moderate risks. This is due to two factors. Their strategies to diversify from Russian gas have been overall successful, and current gas storage levels are high. As of June 2023, they are considerably higher than in the same period last year. While at the beginning of June 2023 they amounted to an average of 49%, nowadays storage facilities are filled between 53.5% (Latvia) and 85.6% (Bulgaria). What emerges is a positive situation with regard to the CEE’s energy security in winter 2023/2024. Indeed, according to the EU Gas Storage Regulation (EU/2022/1032), to ensure reasonable gas prices in the next heating season, EU countries have to reach a storage level of 90% before October 2023. Considering that all CEE states have achieved the intermediate targets for May set out in the regulation and that they still have the entire summer to build up their gas storage facilities, they will likely reach the EU-mandated level of 90% before next winter.

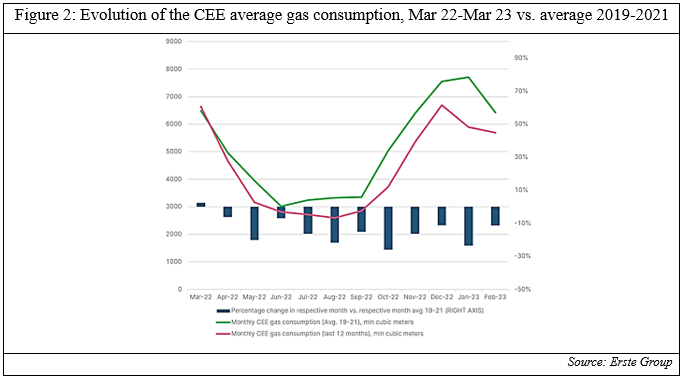

Moreover, the CEE states have also reduced their vulnerability to Russian gas by reducing their total demand for natural gas and diversifying their suppliers. When looking at the gas consumption in the region over the last 12 months as opposed to the average between 2019 and 2021, it can be noted that it decreased by 14% -more than the Eu average reduction of 11%- with a more visible decline taking place since mid-2022 [Figure below]. At the same time, they also diversified the remaining gas imports away from Russia, importing natural gas from Scandinavian countries (especially Norway) and LNG from overseas, including the US. In this regard, CEE countries were supported by the construction, ahead of the 2022/2023 heating season of several gas interconnectors, i.e., physical infrastructure systems that enabled natural gas transportation from other European countries. All these factors allowed the CEE to reduce its dependence on Russia.

In 2022, the IMF estimated that a potential Russian gas supply shut-off would have led to a GDP output loss of an average of 2.8%, compared to an EU average of 2.3%. In the short term, Hungary, the Slovak Republic and Czechia -which were the most vulnerable CEE countries- were expected to experience gas consumption shortages of up to 40% and a potential GDP decline of up to 6%. However, even if later in 2022 Russia did halt its gas supplies to the CEE, the expected gas shortages did not materialise. And while the CEE annual growth rate will slow down to an average of +0.6% in 2023 according to the European Commission, this is still double the expected EU average 2023 growth, and the output losses were considerably less than what was projected a year earlier by the IMF. In other words, countries in the region have so far proved to be economically resilient.

Nevertheless, the CEE still faces challenges regarding its energy security. Mainly, this relates to the steep surge in energy prices in the region following Russia’s weaponisation of gas supplies to the EU. After Gazprom unilaterally changed the terms of its gas supply contracts demanding payments in rubles, it halted all supplies to Poland and Bulgaria, which refused to pay according to the new rules. Even if Slovakia, Czechia and Hungary agreed to pay in rubles, Russian gas flows were anyway gradually stopped. First, Russian supplies through the Yamal pipeline ceased in May 2022, then, gas in transit through Ukraine also significantly decreased. Lastly, in August 2022 Moscow completely stopped the Nord Stream 1 pipeline. To date, the main way Russian gas flows to Europe is via the TurkStream route (which however supplies only Hungary and Serbia). The other is the Ukraine route, but this is likely to reduce in the coming months. As a result, energy prices in the region rose substantially, affecting especially energy-intensive industries. In 2022, producer energy prices increased by 93%. Coupled with the increase in inflation and the decision by CEE central banks to raise their policy interest rates, the increase in energy prices led to a surge in the production costs of CEE industries. As the CEO of Volkswagen Thomas Schafer claimed “Europe is not cost-competitive in many areas, in particular, when it comes to the costs of electricity and gas”. As a result, CEE energy-intensive manufacturing firms cut energy consumption and jobs, while substituting their own production with cheaper energy-intensive imports. Even if currently energy prices have decreased, there is the possibility that they will rise again next winter, when energy demand will rise again.

The overall situation of the CEE with regard to its energy security is positive, since storage facilities in the region have reached an adequate level, and the CEE has reduced its dependence on Russia. However, CEE countries have to ensure energy price stability for their industrial sector. This is especially important in view of the upcoming winter, when energy demand will rise again. In order to avoid such a scenario, CEE countries have to increase their diversification efforts to expand the number of reliable gas suppliers. This will not be an easy task, especially for landlocked states in the region such as Hungary and Slovakia.