Panama Canal drought- effect on commodities

The Panama Canal is a vital artery for global trade, since it connects the Atlantic and Pacific Ocean. The decrease of rainfall in Central America has caused water levels to drop, which may increase the difficulty of large ships to pass through the canal, leading to rising transport costs and potential repercussions for various commodities worldwide. The picture below shows where the Panama Canal is situated, connecting the Caribbean Sea and the Pacific Ocean.

Map 1 - Panama Canal Map. Credit: Port Economics, Management and Policy.

Climate change is primarily responsible for the challenges that encounter the Panama Canal. Rising global temperatures have disrupted traditional weather patterns, leading to prolonged dry spells and reduced rainfall in the region. This drought has the potential to hinder the passage of ships and cause disruptions in global trade flows. The impact of climate change and global warming on the canal highlights the urgent need to address environmental concerns and develop sustainable solutions.

In 2021 the canal transported more than 500 million tonnes of goods, mainly grains and oil. Therefore, the Panama Canal drought is expected to have a substantial impact especially on bulk commodities, since they rely on the efficient and cost effective transport offered by the canal. Crude oil and gasoline may face a cost increase due to the drought in the Panama Canal.

This scenario affects companies in the short and long run. For the immediate effects, shipping company Hapar Lloyd has increased the Panama Canal charge by $500.00 dollars per container on July 1st. Asian shipments arriving in the US East Coast via the canal will be hit hardest by the surcharge. This policy will most likely contribute to higher expenses and squeeze profit margins further.

Companies involved in international trade and reliant on the Panama Canal may face upcoming challenges in the future as the result of the drought. With climate change getting more unstable each year with unpredictable rain scenarios, transport costs are likely to rise due to the canal’s operational limitations impacting profit margins for companies shipping goods through this route. In extreme circumstances, more severe droughts may pose challenges in accommodating larger vessels within the Panama Canal. For now, it is not possible to measure the likelihood of such events taking place in the upcoming years.

Companies specializing in affected commodities such as agricultural exporters and mining firms may experience decreased demand or reduced competitiveness in global markets due to higher prices or delayed shipments. They need to explore alternative transportation routes or consider investing in technologies that minimize reliance on the Panama Canal. One example is Transshipment Hubs, which can provide more flexible options to transfer cargo between larger and smaller vessels that can fit in alternative routes. Infrastructure improvements are also important, since they can directly benefit the canal’s operations. For example, implementing water management techniques and the use of data and artificial intelligence can help optimize vessel traffic and ensure smooth operations despite the drought conditions.

Additionally, companies indirectly connected to the affected sectors, such as transportation and logistics providers, could experience decreased business volume and revenue due to the overall slowdown in canal operations. The main solution announced so far is reducing the load of the transportations on the canal.

It is important to acknowledge that some specialists believe the Panama Canal drought will not have severe consequences since it is not as important as the Suez Canal and that sea-faring world trade hasshown itself resilient in the last years. However, this event sheds a light in climate change risk and how it is already affecting business and commodities. For many years, global warming, droughts, lack of water, and other environmental issues were seen as a problem for the “next generation” that would not impact companies and supply chains. However, as observed, climate change is already affecting commodities and therefore should be treated as a current and not future risk.

Sinking shores and rising concerns: the environmental fallout of sea sand mining

Urbanisation is one of the contemporary era’s defining trends, with urban populations previously comprising 29% of the world’s inhabitants in 1950, as compared to 56% today and a predicted 70% by 2045. The astounding influx of populations into urban areas is accompanied by large-scale construction projects for infrastructure, industrial, commercial, and residential developments, which raises environmental concerns at various levels. One concern pertains to the large amounts of sand needed as a key ingredient of concrete and asphalt. In 2021, the United States, Australia, Malaysia, the Netherlands, and Germany were the largest net exporters of sand, while China, Canada, Japan, Singapore, and Italy were the largest net importers, driven by high rates of urban construction and land reclamation.

The high demand for abundant and easily accessible sand has prompted the need for sea sand mining, which involves the extraction of sand from ocean floors. However, this increasingly prevalent practice brings significant correlated environmental issues and ecological disruption. Extraction activities disturb the delicate balance of marine habitats, destroying coral reefs, seagrass beds, and other essential marine organisms. These ecosystems play a crucial role in maintaining biodiversity, providing food sources, and protecting coastal areas from erosion and storm surges. The destruction of these habitats can lead to the loss of species, damage to coastal areas, and increased vulnerability to natural disasters. Alongside habitat destruction, sea sand mining also contributes to climate change, in that the extraction process releases large amounts of carbon dioxide into the atmosphere, mainly through the use of heavy machinery and transportation. Additionally, the removal of sand from coastal areas can disrupt the natural sediment flow, altering coastal dynamics and increasing the risk of erosion and flooding. These changes have huge implications for the stability of coastal ecosystems, the livelihoods of coastal communities, and the overall resilience of coastal regions in the face of climate change impacts.

Recognising the detrimental effects of sea sand mining, Indonesia banned exports of sea sand in 2003 and consolidated the ban in 2007 with regulations against illegal shipments. Prior to the ban, Indonesia was Singapore’s main supplier of sea sand for land reclamation, shipping more than 53 million tonnes on average per year between 1997 to 2002. Sand mining, coupled with persistently rising sea levels, had caused several islands in the Thousand Islands regency – located north of Jakarta – and the Riau Islands to sink underwater.

However, in late May, Indonesia lifted the ban in desperate hopes of attracting economic benefits to the country. This move comes a few years after Malaysia banned sea sand exports in late 2019, which complicated Singapore’s ambitious land reclamation plans. After Indonesia’s 2003 ban, Singapore turned to Malaysia to import sand, which by 2021 comprised nearly 63% of Singapore’s sand imports. For this reason, Malaysia’s recent ban gave Indonesia a window of opportunity to reattract revenue from sand exports to the region, especially to supplement Singapore’s expansion plans. Mining permit holders are now permitted to collect and export sea sand, provided that domestic demands have been met. Environmentalists, including Indonesia’s former Maritime Affairs and Fisheries Minister, Susi Pudjiastuti, have condemned the reversal of the sea sand mining ban. Greenpeace Southeast Asia labelled the move as ‘greenwashing’, inasmuch as the Indonesian government claims their decision will aid in improved sustainable marine resource management and control sea sedimentation; yet, activists believe the new regulation will only ‘further enrich oligarchs’ and ‘increase state income from the fisheries sector’. This is especially true insofar as the potential for food scarcity, as sea sand mining will erode coastal communities’ primary source of sustenance – the sea – while prioritising commercial exploitation and extraction of marine resources.

Addressing the negative impacts of sea sand mining requires a comprehensive approach to sustainable urbanisation, industrial practices, and environmental management. This includes promoting alternative construction materials, implementing stricter regulations on sand extraction, and investing in research and innovation for sustainable infrastructure development. Additionally, it is crucial to raise awareness among policymakers, industry stakeholders, and the public about the environmental consequences of sea sand mining and the importance of adopting environmentally responsible practices.

Image rights: "Sand Extraction at Cliffe Fort" by Shiro Kazan

The Nuclear Energy Alliance outlines their vision for the EU’s energy transition path forward

Jael Gless

The “Nuclear Energy Alliance” was initiated earlier this year by France, with the mission to bring together the European countries who see nuclear energy as an important part of managing their energy transition. On the 16th of May, during the third meeting of the fourteen member states, which the UK joined as an observer and the European Commissioner for Energy, Kadri Simson, took part, discussed strategies on building an independent European nuclear supply chain, as well as the needs implied by the revival of the European nuclear industry. At the end of the meeting the Members signed a joint statement, which included the assertion that “Nuclear power may provide up to 150 GW of electricity capacity by 2050 to the European Union (vs roughly 100 GW today)” and called for a European action plan around nuclear power. To reach this set goal, up to “30 to 45 new-build large reactors and small modular reactors” would need to be built, which the Members stress would also “ensure that the current share of 25% electricity production be maintained in the EU for nuclear energy." Currently, nuclear energy generates electricity in fourteen European Union (EU) Member States, and provides 50% of the EU’s low carbon electricity.

France

The meeting was organised on the same day as the French National Assembly’s vote on the country’s nuclear energy acceleration bill, which passed – giving the green light for preparatory work to begin at a power plant site in northern France. This development is part of a bigger movement taking place in France, where nuclear energy is seen as crucial in the energy transition, and thus as worthy of investment. France’s takeover of EDF, which is to be finalised later this month, had been struggling with debt and conflicting shareholder demands, in light of their construction of new reactors, is aligned with that same strategy.

It remains to be seen if France and the Nuclear Energy Alliance as a whole can push their interests through the considerable block of EU countries that are against including nuclear energy in the EU's green energy transition strategy. If, however, the ambitions of the Nuclear Energy Alliance is adopted by the EU as policy, the difficult task of building robust supply chains to gain the necessary mineral fuels, whilst navigating difficult geopolitical tensions, will remain.

Supply Chain Risks

Nuclear reactors use uranium for nuclear fuel. The biggest providers of raw uranium are Kazahkstan, Australia and Canada, whilst Russia owns some 40% of total uranium conversion infrastructure in the world, and 46% of the total uranium enrichment capacity. The EU, as of 2021, sources almost 70% of the Uranium needed for their nuclear power plants from Niger, Kazakhstan and Russia, all countries with significant geopolitical risks.

Origins of uranium delivered to EU utilities in 2021 (tU). Source: Euroatom.

As noted in the Nuclear Energy Alliance’s statement, Europe is aiming to continue reducing its dependency on Russian suppliers whilst trying to strengthen cooperation with like minded international partners. As the chart above shows, in terms of sourcing fuel from international partners, currently only Canada and Australia can be described as like minded partners. Therefore, Europe will likely try to increase the share of uranium imported from those two countries, whilst also finding new partners, like the US. The US is an especially attractive supplier for EU countries, due to its similar stance on current geopolitical issues (Russia, China) as well as being the leading supplier for small modular reactors, in which the Nuclear Energy Alliance wants to invest. Increasing uranium supply from these countries does not necessarily mean completely cutting out Russia, as many utility companies purchase enriched uranium from Russian companies. The disentanglement of Russia from the nuclear fuel sector will be an onerous process for the EU. As a recent London Politica report highlights, many European countries have a long history of dependence on the state-owned enterprise Rosatom. France’s EDF, for example, maintains its very close ties with Rosatom, which includes collaboration at “all levels from the production chain, to the exploitation of uranium and treatment of waste, to the construction of power plants and their operation”. Avoiding dependency on Russian supplies also proves difficult for eastern European countries, considering Russia’s state nuclear company being the only supplier option for soviet-designed nuclear plants.

Niger, the EU’s main source-country for uranium, is contending with its own share of political risks. The exploitation of the country's natural resources has led to local protests and pollution. It is also to be seen if Niger is willing to supply the necessary amount of fuel for France's national ambitions. Historically, Niger has been the main country from which France sourced their fuel, but tensions between the two states have been building. The French nuclear energy company Areva, who’s subsidiary Orano owns the operating licence for the large Imouraren mine, negotiated a deal in 2014 that would improve conditions for Niger through operations at the mine. However, with Imouraren being closed since 2014 and Orano not looking to begin operations until 2024, the benefits negotiated for Niger have not yet and will not be felt soon. One French expert speaking to AFP concluded, “there is a future for Uranium in Niger, but not necessarily with France”.

Kazakhstan, another main source-country for the EU, as well as the main provider of Uranium worldwide, is also in a difficult geo-political situation due to its close ties with the EU, Russia and China as well as internal tensions. Moreover, the country is dealing with falling production levels due to “wellfield development, procurement and supply chain issues” caused by the pandemic as well as the war in Ukraine. Nonetheless, the state-owned Kazatomprom took mitigating measures, which indicated a willingness and dedication to serve its western customers, by transporting the goods through the Caspian Sea.

The Kakhovka Dam Destruction: Impact on Local Commodities

By: Frank Stengs, Leopold Maisonny, Ojus Sharma, Carl Allen and Mathilda Minakova

Brief:

Dozens of localities have been flooded downstream up to Kherson resulting in the evacuation of thousands of people along both banks of the Dnipro River.

Russia and Ukraine blame each other for the destruction of the dam. Kyiv has accused Moscow to have sabotaged the dam to hinder a potential upcoming Ukrainian counteroffensive in the Kherson Oblast. For its part, Russia has attributed the attack to Ukrainian strikes.

The destruction poses concerns about the Zaporizhia nuclear power plant whose cooling systems draw from the dam’s reservoir. However, the situation is not yet worrying according to the International Atomic Energy Agency.

The floodings downstream pose a significant threat to agricultural production in the Kherson Oblast. The region is a crucial source of agricultural commodities for the domestic market and constitutes a key global supplier for some commodities.

The destruction of the dam poses great humanitarian risks. The likely rejection of the chemicals and infectious bacteria as a result of the floods may contaminate water supplies.

Who, what, where?

On 6 June, 2.30 local time, the hydraulic structure of the Kakhovka Dam (Каховская ГЭС, Kakhovka Hydro-Electric Station) on the Dnieper delta was detonated, according to Ukrainian officials by Russian troops that control the region around the dam since late February 2022.

The destruction of the dam was first reported on by Operational Command “South”, a military formation of the Ukrainian Ground Forces in the southern part of Ukraine.

Reportedly, only one explosion was heard, according to Ukrainian Defence Intelligence (GUR) and «Ukrhydroenergo» (the main state-owned hydropower administration enterprise along the Dnieper and Dniester) targeting the engine room, which is located near the third gate. Although not the entire structure was destroyed[source - satellite imagery?], the damage to the engine room according to officials makes the dam irreparable. The water reservoir is expected to be activated during the next 4 days.

The water from the dam flooded multiple regions on the right bank, with small settlements in and around the Ukraine-held city of Kherson risking being affected, with announced evacuations from the Ukrainian side in 8 high risk areas. Russian-installed authorities of the Kherson region on the occupied left bank, which has reportedly been most affected due to its low elevation, announced the evacuation of three settlements - the city of Nova Kakhovka, located near the dam, Golo Pristan and Oleshky.

The satellite imagery on the left is from 1/6/2023, while the imagery on the right is from 6/6/2023

Fallout

The Ukrainian Ministry of Internal Affairs published a list of settlement regions, along the right bank of the Dnieper and Kosheva rivers, that are currently being evacuated due to risk of flooding. 8 high risk areas for flooding include the historical centre, northeastern and southwestern neighbourhoods of Kherson area on the bank of the Dnieper and villages and settlements on the bank of Bezmen and Bile Lakes near the Kosheva river. Russian occupation authorities were initially reluctant to declare the need for major evacuations, but have since then declared a state of emergency, claiming that 7 people are missing.

More detailed, the 8 areas signalled as being at high risk of flooding are parts of:

Antonivka (urban settlement; смт) (right bank of Dnieper, northeastern suburb of Kherson)

Dniprovskyi district (neighbourhood in the northeast of Kherson under Antonivka)

Suvorovskiy district (historical centre neighbourhood of Kherson) (not to be confused with the Peresipskiy (until 2023: Suvorovskiy) district near Odessa)

Korabel'nyi district (western part of central Kherson) (not to be confused with southern part of Mykolaiv Oblast/area)

Karantynnyy Ostriv/island (island on Dnieper southwest of Kherson)

Zimivnik village (west of Kherson)

Komyshany (urban settlement; смт) (rear west of Kherson near Bezmen Lake)

Priozernoe village (rear west of Kherson near Bile Lake)

The most affected settlements along the left bank of the Dnieper are encircled by occupied territories and the evacuation status in the region is so far unclear. Russian-installed authorities of the Kherson region on the occupied left bank, which has reportedly been most affected due to its low elevation, announced the evacuation of three settlements - the city of Nova Kakhovka, located near the dam, Golo Pristan and Oleshky . According to Ukrainian evacuation services on the right bank, Russian forces reportedly “blocked communication” between both banks of the river to prevent citizens from the left bank to reach Ukrainian evacuation services on the right bank [?source/specification of block?]. Furthermore, Kherson authorities have accused Russian troops of continuing artillery strikes during the evacuation of flooded areas of the micro-settlement Ostrov (east from the Dam on the bank of the Dnieper Delta), resulting in the injury of two law enforcement officials.

The rise of water in land on the river banks contaminated by explosive ordnance has increased the risk of explosives being displaced through water and detonating. This makes citizens’ attempts to evacuate without the help of authorities highly dangerous. Especially, this concerns left bank settlements, where reportedly Russian-led evacuation efforts are less clear, and which has reportedly sustained more damage due to being located geographically lower. While many people in the most severely affected areas have chosen to follow evacuation measures. There have also been challenges in getting many residents of Kherson to relocate, as many choose to stay until the water recedes.

Another humanitarian risk is the continued provision of drinking water and power to all affected regions: Dnepropetrovsk, Zaporizhia, Nikolayev and Kherson. Currently, Kryvhii Rih is the most affected by these shortages, with major water shortages reported in the city, shutting down major industries and importing power from other sectors of the grid. Power and water shortages on the East bank of the river are likely to also fluctuate and be quite significant, however there has been limited information divulged by the Russian authorities over the damages inflicted to industry or supply of water and power.

Another major ripple effect is the acute water shortages transporting water to Russian occupied Crimea via the North Crimean canal. Restarting water low to Crimea via the caputre of this canal was a major objective of Russian operations in Ukraine since the closing of the Canal by Ukraine in 2014. So far, the crisis at the Nova Khakovka dam seems to be sabotaging this water flow. As a result, while agriculte in Crimea may face a crisis in the short term, this may not lead to any drastic change in Crimea’s strategic or industrial situation for the time being.

Impact on commodities/ infrastructure

The breach at the Kakhovka Hydroelectric Power Plant and the resulting uncontrolled water flow downstream may pose a threat to agricultural production in the Kherson Oblast region of Ukraine. This region is a source of various agricultural commodities both for the domestic market and as a global supply. The potential effects on the commodities market, particularly for trading agricultural commodities, need to be carefully analysed to assess the risks involved. In this risk analysis, we will evaluate the impact on specific commodities and the potential consequences for the trading of agricultural commodities in Ukraine and globally.

Ukrainian Agricultural Commodities in Kherson: The region of Kherson primarily accounts for 10% of national Millet production, 8% of Soybean production, 6% of national Wheat Production, 6% of national Rapeseed production, 6% of national Barley production, 4% of national Sunflower Seed production, and 1% of national Corn production.

Potential Effects on Commodity Trading: Latest analysis suggests that the river breach and waterflow is limited to the river floodplains, and areas around them. Therefore, the scale of the damage is currently limited to the shores of the river, reducing any risks to storage facilities, or waterlogging, and does not pose any immediate significant threat, or risk to global supplies of the commodities mentioned above.

Map: worst case modeling Nova Kakhovka

Area within the rapid flood zone: between 5% and 10% of Kherson-oblast surface area. This may change with water level rising, and thus depends on the duration of flooding.

Immediate impact if we take the average of region production:

Millet

Ukraine produces 100Mt of Millet

20th largest producer in world, 0,3% of global supply

0,5% of total Ukrainian Millet production in 5% scenario

1% of total Ukrainian Millet production in 10% scenario

Affected supply: Between 0,5Mt and 1Mt

Soybean

Ukraine produces 4,100 Mt of Soybean

9th largest producer in the world, 1,1% of global supply

0,4% of Ukraine Soybean production in 5% scenario

0,8% of Ukraine Soybean production in 10% scenario

Affected supply: Between 16,400Mt and 32,800Mt

Wheat

Ukraine produces 20,900 Mt of Wheat

9th largest producer in the world, 2,6% of global supply

0,3% of Ukraine Wheat production in 5% scenario

0,6% of Ukraine Wheat production in 10% scenario

Affected supply: Between 62,700Mt and 125,400Mt

Rapeseed

Ukraine produces 3,500 Mt of Rapeseed

7th largest producer in the world, 4% of global supply

0,3% of Ukraine Rapeseed production in 5% scenario

0,6% of Ukraine Rapeseed production in 10% scenario

Affected supply: Between 10,500Mt and 21,000Mt

Barley

Ukraine produces 6,180 Mt of Barley

7th largest producer in the world, 4,1% of global supply

0,3% of Ukraine Barley production in 5% scenario

0,6% of Ukraine Barley production in 10% scenario

Affected supply: Between 18,500Mt and 37,100Mt

Sunflower

Ukraine produces 11,200 Mt of Sunflower seed

2nd largest producer in the world, 21,7% of global supply

0,2% of Ukraine Sunflower seed production in 5% scenario

0,4% of Ukraine Sunflower production in 10% scenario

Affected supply: Between 22,400Mt and 44,800Mt

Corn

Ukraine produces 7,200 Mt of Corn

8th largest producer in the world, 2,4% of global supply

0,05% of Ukraine corn production in 5% scenario

0,1% of Ukraine corn production in 10% scenario

Affected supply: Between 3,600Mt and 7,200Mt

Conclusion

It is also important to note that only Sunflower, Barley, Wheat and Rapeseed; represent significant shares of global supply, and therefore the impact on other commodities such as Corn, Soybean and Millets, can be rendered negligible with high confidence. Yet, traders, investors, and market participants must stay informed about the situation, closely monitor market trends, and adapt their strategies to manage the risks associated with the breach's impact on agricultural commodities.

Climate change, El Niño and food security in China

Heavy rainfall in China has caused significant damage to wheat fields, leading to an increase in wheat prices. As the world's top consumer and producer of wheat, China's agricultural sector plays a crucial role in global food security. The impact of the recent extreme weather events on wheat production could be catastrophic for China’s food security, and the Chinese Communist Party (CCP) has announced measures being taken to mitigate the risks.

Henan province, accounting for 25% of China's wheat production, has suffered the worst rainfall near harvest in over a decade. This extreme weather pattern has caused flooding and landslides, resulting in the loss of lives, and further exacerbating concerns about food security. The recent occurrence of record-breaking heatwaves and droughts in China, including Shanghai's hottest May in a century, has raised alarm bells regarding the vulnerability of the country's food supply. Despite the current rain, officials remain worried that the drought may extend to the Yangtze River Basin, which provides China with two-thirds of its rice. Animals have already succumbed to the intense heat, further underscoring the urgency to address the water scarcity issue. El Niño, a natural phenomenon that brings even warmer temperatures originating from the Pacific, is also a cause for concern, as it could exacerbate China's food security challenges.

China's wheat production reached 140 million tonnes in 2022, highlighting its significance as a key crop for the nation and the world. The country is expected to have a bumper crop this year, which is a harvest with an unusually high yield. However, the heavy rains in the last few weeks have resulted in damaged wheat crops, pushing up prices in regions like Henan and causing concerns for both domestic and international markets. Due to the damage to wheat crops, animal feed markets have started to replace corn with cheaper wheat, leading to further price fluctuations. While the rains have temporarily supported prices, the long-term impact remains uncertain, as commodity analysts in Shanghai suggest that clarity will only emerge once the rainfall subsides, which could be as late as August.

Several government agencies agree with the Ministry of Emergency Management also predicting that rain, floods, and hailstorms are likely to persist until August. Northern China faces water-related disasters, the South may experience drought, and the East Coast, a key driver of economic growth, could encounter typhoon storms earlier than usual. Sichuan and Chongqing provinces face a significant risk of reduced rainfall, increasing the threat of drought and adding to the complexity of China's food security situation. Food security has been identified as a top priority by the Chinese government, with President Xi Jinping emphasising its critical importance to national security. Scientists have already warned that climate change will exacerbate global food security challenges in the future, making it crucial for China to address its vulnerabilities and develop resilient agricultural practices.

So far, markets have been focused on the destruction of the Kakhovka Dam in Ukraine. On 6th June, following the sabotage and subsequent flooding of the surrounding area, the price of global wheat spiked 2.4% to US$6.39 per bushel. Corn and oats both rose by 1% and 0.73% respectively. Markets have likely priced in the upcoming possible disruptions in wheat supplies from China, but the extent to which the disasters could damage this year’s yield is yet to be seen, and could surprise analysts. The Kakhovka Dam’s destruction is a reminder to markets of the volatility of wheat supplies, especially to developed countries which are particularly affected by shortages.

Ghanaian electricity: the triumph of competitive politics over good governance

On 26th May, Ghana’s government tried to propose a restructuring of the US$1.58 billion of debt owed to various private power producers. The producers have rejected this proposal and threatened to cut off the power supply, which could cause a third power crisis within the last decade. These power crises are part of a larger consistent failure to provide basic electricity to the citizens of Ghana; It exemplifies the failure of the International Monetary Fund’s (IMF) Structural Adjustment Programmes (SAP) and the Good Governance Agenda of the 1980s. This article will explore how commercialisation can fail in a culture of competitive politics.

Electricity has been a front-running issue in Ghanaian politics since its founding President Kwame Nkrumah’s belief that building the Akosombo Dam, the third biggest dam in the world in terms of water capacity, would bring developmental leaps. The succeeding presidents including President Jerry Rawlings, the first democratically elected President, used the extension of the electric grid to draw votes, making electricity a critical measure of political success and developing a norm that electricity provision is a core responsibility of the government. This has led leaders to intervene frequently in the privatised energy sector to increase electric grid sizes (making it one of the biggest in West Africa). The political structure also allows the president to have a say in the decisions of the supposedly ‘independent’ Public Utilities Regulatory Commission (PURC) since he has the power to appoint board members. Ghana adopted the IMF’s SAP in 1995 when its inflation rates were over 100%. Under the Standard Reform Model, Ghana allowed private management of their electrical facilities.

Fast forward to August 2012, the anchor of a pirate ship ruptured on the West African Pipeline, inflicting a GDP loss of US$320-924 million. This external element is only the tip of the iceberg. The underlying issue for such a large GDP loss (an estimated 4%) was that the remaining power generation capacity required crude oil, which was more expensive than pipeline gas. This led to high debts within the producing companies; the Volta River Authority (VRA) and the Electricity Company of Ghana (ECG). Furthermore, Government subsidies and financial support were insufficient for these companies to continue ordering fuel, despite multiple requests. For example, The VRA requested amelioration for six cargoes of light crude but was only provided with finance for three. As such, the government played a significant role in the elongation of the crisis. A central problem can be traced back to the inefficiency of Ghana’s large electricity grid. Incumbents often expanded the grid in hopes of demonstrating their continued dedication to providing electricity, but large parts of these grids are unmonitored and suffer from severe reliability issues. This can be traced back to show how competitive politics has compounded the severity of the crisis.. With the 2012 General Elections scheduled for December of the same year,, there was a further electorally motivated intervention to prevent tariff rises, increasing profit and allowing the companies to order more fuel. This resulted in the inability of the VRA to pay the fuel suppliers, thus further elongating the crisis.

Without sufficient investigation into the underlying issues of the price of fuel and the lack of capital to invest in them, the government signed 43 new contracts for primarily thermal power plants taking the total electricity capacity (assuming sufficient fuel is provided) from 1GW to 5GW.. The then President John Mahama did little due diligence and circumvented officials in the Energy Commission who had predicted energy demand of 3,000 to 4,000MW by 2020. The simplest way to mitigate this oversupply would be for Ghana to become an electricity exporter in the region; however, this did not materialise due to high tariffs, poor infrastructure, and neighbouring countries wanting to be self-reliant after previous experiences of shortage. This overabundance has driven government debt to US$1.4 billion, which is approximately 4% of GDP. Furthermore, these contracts were used to create thermal power plants instead of implementing the planned hydropower plants including Micro-Hydro Western Rivers Scheme and the Juale Dam. Focusing on increasing electricity capacity instead of the fundamental cash flow and reliability issues can be best explained as an electorally driven solution which demonstrates the incumbent’s continued dedication to providing electricity by investing in tangible infrastructure instead of actually solving the electricity crisis in the long run.

These two crises show the failure of the Standard Reform Model in a highly competitive political situation. The market mechanism, commercialisation and separation had no effect in a country where governments continue to intervene to meet short-term political objectives. Since tariff increases meant a loss of power, it was impossible for leaders to divert resources to achieve long-term stability and instead focus on unsustainable practices like low tariffs.

Today, Ghana is set to default on loans by the IMF and has been in talks with the G20 to restructure its external debts. While the IMF is imposing more stringent conditions on loans, its leaders have also been cosying up to the Chinese to help solve their debt crisis, leading to increasing tensions with the United States. If this gridlock continues, the Ghanaian people would either be buried in further debt or have to face another electricity shortage crisis.

Cover image: “Ghana Akosombo Dam” by Mark Morgan Trinidad A

Central and Eastern European countries are well-prepared for the next 2023/2024 heating season, but risks still loom large

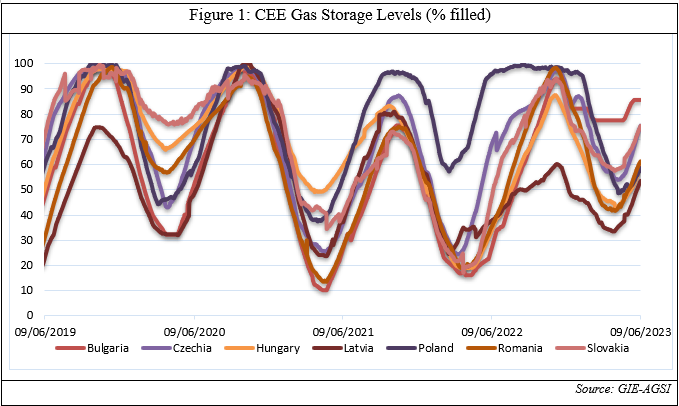

Central and Eastern European (CEE) countries are well-prepared for the next 2023/2024 heating season, despite the presence of moderate risks. This is due to two factors. Their strategies to diversify from Russian gas have been overall successful, and current gas storage levels are high. As of June 2023, they are considerably higher than in the same period last year. While at the beginning of June 2023 they amounted to an average of 49%, nowadays storage facilities are filled between 53.5% (Latvia) and 85.6% (Bulgaria). What emerges is a positive situation with regard to the CEE’s energy security in winter 2023/2024. Indeed, according to the EU Gas Storage Regulation (EU/2022/1032), to ensure reasonable gas prices in the next heating season, EU countries have to reach a storage level of 90% before October 2023. Considering that all CEE states have achieved the intermediate targets for May set out in the regulation and that they still have the entire summer to build up their gas storage facilities, they will likely reach the EU-mandated level of 90% before next winter.

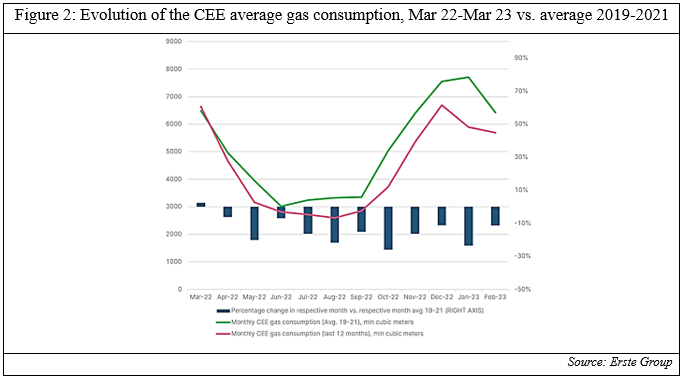

Moreover, the CEE states have also reduced their vulnerability to Russian gas by reducing their total demand for natural gas and diversifying their suppliers. When looking at the gas consumption in the region over the last 12 months as opposed to the average between 2019 and 2021, it can be noted that it decreased by 14% -more than the Eu average reduction of 11%- with a more visible decline taking place since mid-2022 [Figure below]. At the same time, they also diversified the remaining gas imports away from Russia, importing natural gas from Scandinavian countries (especially Norway) and LNG from overseas, including the US. In this regard, CEE countries were supported by the construction, ahead of the 2022/2023 heating season of several gas interconnectors, i.e., physical infrastructure systems that enabled natural gas transportation from other European countries. All these factors allowed the CEE to reduce its dependence on Russia.

In 2022, the IMF estimated that a potential Russian gas supply shut-off would have led to a GDP output loss of an average of 2.8%, compared to an EU average of 2.3%. In the short term, Hungary, the Slovak Republic and Czechia -which were the most vulnerable CEE countries- were expected to experience gas consumption shortages of up to 40% and a potential GDP decline of up to 6%. However, even if later in 2022 Russia did halt its gas supplies to the CEE, the expected gas shortages did not materialise. And while the CEE annual growth rate will slow down to an average of +0.6% in 2023 according to the European Commission, this is still double the expected EU average 2023 growth, and the output losses were considerably less than what was projected a year earlier by the IMF. In other words, countries in the region have so far proved to be economically resilient.

Nevertheless, the CEE still faces challenges regarding its energy security. Mainly, this relates to the steep surge in energy prices in the region following Russia’s weaponisation of gas supplies to the EU. After Gazprom unilaterally changed the terms of its gas supply contracts demanding payments in rubles, it halted all supplies to Poland and Bulgaria, which refused to pay according to the new rules. Even if Slovakia, Czechia and Hungary agreed to pay in rubles, Russian gas flows were anyway gradually stopped. First, Russian supplies through the Yamal pipeline ceased in May 2022, then, gas in transit through Ukraine also significantly decreased. Lastly, in August 2022 Moscow completely stopped the Nord Stream 1 pipeline. To date, the main way Russian gas flows to Europe is via the TurkStream route (which however supplies only Hungary and Serbia). The other is the Ukraine route, but this is likely to reduce in the coming months. As a result, energy prices in the region rose substantially, affecting especially energy-intensive industries. In 2022, producer energy prices increased by 93%. Coupled with the increase in inflation and the decision by CEE central banks to raise their policy interest rates, the increase in energy prices led to a surge in the production costs of CEE industries. As the CEO of Volkswagen Thomas Schafer claimed “Europe is not cost-competitive in many areas, in particular, when it comes to the costs of electricity and gas”. As a result, CEE energy-intensive manufacturing firms cut energy consumption and jobs, while substituting their own production with cheaper energy-intensive imports. Even if currently energy prices have decreased, there is the possibility that they will rise again next winter, when energy demand will rise again.

The overall situation of the CEE with regard to its energy security is positive, since storage facilities in the region have reached an adequate level, and the CEE has reduced its dependence on Russia. However, CEE countries have to ensure energy price stability for their industrial sector. This is especially important in view of the upcoming winter, when energy demand will rise again. In order to avoid such a scenario, CEE countries have to increase their diversification efforts to expand the number of reliable gas suppliers. This will not be an easy task, especially for landlocked states in the region such as Hungary and Slovakia.

Export Bans – A Means to Shore-up Ghana in the Bauxite and Iron Ore Industry

Aluminium and Steel remain some of the most widely used materials across industry. Produced from bauxite and iron ore respectively, their demand has led the Ghanian government to establish laws to prohibit the export of bauxite and iron ore in their raw form. The ban is expected to take effect soon and aims to legislate the exploitation, utilisation and management of these resources.

Defending its decision, the government claims that the legislation is “to safeguard the country's limited natural resources and learn from the past mistake of gold exportation”. The origin of the government’s export ban can be traced back to the creation of two statutory corporations, namely:

1. Ghana Integrated Aluminium Development Corporation (GIADEC):

2. Ghana Integrated Iron and Steel Development Corporation (GIISDEC):

A reading of section 28 from GIADEC Act, 2018 and section 30 from GIISDEC Act, 2019 confirms the state’s actions in following procedures for an export ban of bauxite and iron ore respectively. Interestingly, section 4 from both the laws talks about the need to adhere to local content requirements and measures aimed at boosting the country’s upstream and downstream operations. As a result, the Minerals and Mining Local Content and Local Participation Regulations were passed in December 2020 to promote job creation, use of local goods and services, and to improve the attractiveness of domestic businesses in Ghana’s mining sector. These regulations apply to:

holders of mineral rights (holders of reconnaissance and prospecting licences and mining leases);

holders of licences to export or deal in minerals; and

registered mine support service providers

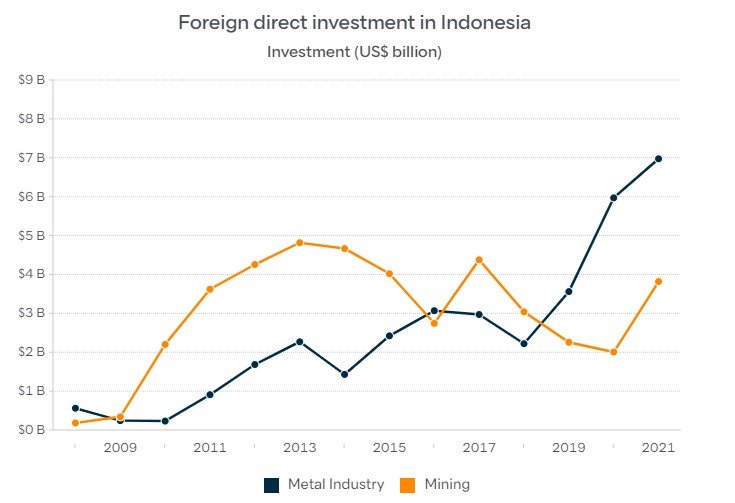

Ghana’s iron ore reserves are estimated at about six billion tonnes and there is potential to start mining operations by 2025. On the other hand, Ghana, the eleventh-largest global producer of bauxite, is also estimated to produce 10 to 20 million tons of bauxite a year from its 900 million tonne reserves. Between 2016 to 2021, production from Ghana decreased by a CAGR of 13.18%. The Ghana Export Promotion Council attributes the decline in production to underutilisation of its reserves and poor infrastructure. Given the absence of bauxite refineries in the country, the mineral is exported to Canada and Scotland for refining and imported from USA and Jamaica to obtain alumina (refined bauxite). It is then processed by the only local smelter in the country, the Volta Aluminium Company Limited (VALCO). Aluworks Ghana, one of VALCO’s major customers further leads the process in aluminium continuous casting and cold rolling mill to produce the raw materials that are used in products ranging from household appliances to aircrafts. As a result, the government has been attempting to fill the vacuum by shoring up VALCO’s production capacity alongside GIADEC’s projects that aim at expanding the country’s exploration and refining capacities. The $1.2 billion deal (2021) to build a bauxite mine and refinery between GIADEC and the Ghanaian-owned Rocksure International showcases the government’s zeal in producing local aluminium products to substitute its annual imports of up to 45,000 tonnes. In addition, Ghana has partnered with China for obtaining the requisite infrastructure and funding to create value-addition to its existing supply chain despite the plausible environmental concerns.

Ghana’s push to limit market access in the bauxite and iron ore industry is similar to Indonesia’s ban on the export of nickel ore for which it is currently facing legal action at the WTO. The rise in such trade restrictive measures also potentially exposes the weaknesses in upholding WTO’s trading principles. Consequently, by promising more jobs, the Ghanaian government must also be wary of the impact of layoffs that such trade-restrictive measures can have on the existing labour engaged in the mining industry. Here, the case study of PT Freeport Indonesia can act as a definite reminder about the ill effects of hasty mining regulations. As far as Ghana’s mining industry is concerned, the export of gold brings maximum revenue to the country. Hence, when introducing new laws to legislate and build its bauxite industry, which amounts to just 0.29% of the global bauxite production, the country’s competitiveness remains to be seen especially when compared to top bauxite producers such as Australia, China or India.

Solidarity Lanes and Import Bans: The Dichotomy of Ukrainian Agricultural Exports in Eastern Europe

In mid April, five eastern EU nations – Poland, Hungary, Slovakia, Romania and Bulgaria – threatened or implemented unilateral import bans on Ukrainian grain and other food products to protect their agricultural sectors. After two weeks at the bargaining table, these European Union (EU) nations struck a deal with the European Commission (EC). In return for dropping their unilateral bans, the EC adopted exceptional and temporary preventative measures on certain Ukrainian imports under the Autonomous Trade Measures Regulation. Under these import restrictions, four agricultural products – staple grains like wheat and maize, as well as rapeseed and sunflower seed – originating from Ukraine can only enter the aforementioned European nations if they are in transit to other countries. In addition to these restrictions, which are in effect from 2 May 2023 to 5 June 2023, the EC is providing €9.77 million to Bulgaria, €15.93 million to Hungary, €39.33 million to Poland, €29.73 million to Romania and €5.24 million to Slovakia to alleviate the downward price pressures proliferating within their agriculture industries.

In response to Russia’s invasion of Ukraine and the Black Sea Blockade, the EC established EU-Ukraine Solidarity Lanes, which are alternate transport routes within the EU facilitating the export of Ukrainian agricultural products. The United Nations-brokered Black Sea Grain Initiative – which lifted this blockade and was recently extended for two months on May 17 – has been unstable and unreliable. Consequently, these solidarity lanes have faced an increasing influx of Ukrainian agricultural products. While these trade routes represent a lifeline for war-stricken Ukraine, they exerted immense pressure on eastern European agricultural markets. Rather than simply transiting through these five ‘frontline’ nations, Ukrainian grain flooded their markets, creating a supply glut that jeopardised their domestic farmers' livelihoods (See Figure 1). Prices plummeted while supply skyrocketed. With the summer harvest ahead, the situation reached a tipping point, hence the threats and enactments of unilateral bans.

Figure 1. Imports of Cereals into Frontline Member States. Graph and data produced by the EC’s Directorate-General Taxation and Customs Union’s Surveillance System.

While protectionist sentiment sprouted from within the EU, it rapidly spread; calls to unilaterally ban Ukrainian grain imports emerged and gained traction within Moldova, Ukraine’s south-western neighbour. Specifically, the Moldovan Agriculture Minister proposed a plan to apply the EC’s measures while the farmers union released a statement calling for an import ban, citing a shortage in storage capacity for its summer grain harvest set to arrive in roughly one month. Alexander Slusari, the head of the Farmers’ Power Association, stated the following: “If Moldova does not restrict grain imports from Ukraine with its stocks of 10 million tonnes, it will be deposited in Moldovan silos and we will face a problem when we do not have storage for the new harvest.”

While this initial knee-jerk reaction within Moldova has dissipated largely due to retaliatory threats from Ukraine, the Moldovan affair and the ‘frontline fives’ import bans affirm the growing sentiment and empowerment within eastern Europe to abandon Kyiv when it is most in need. As Ukrainian Deputy Minister Olga Stefanishyna has stated, the “flow of Ukrainian agro-export is a matter of survival for the Ukrainian economy” amidst the full-scale Russian war of aggression. Due to the fragility of the Black Sea deal and the preventive measures’ looming June 5 expiry date, the EC should consider further financial or legislative measures to appease these agitated EU nations and ensure the flow of Ukrainian grain goes unchecked.

Emilia-Romagna Floods: Impact on Local Agribusiness

Since the start of May, the Northern Italian region of Emilia-Romagna has endured heavy rainfall culminating in flash flooding across the region. At time of writing, the region’s weather alert agency classified the provinces of Modena and Bologna at a moderate risk of flooding and gave high-risk flood warnings to the provinces of Ferrara, Ravenna, Forlì-Cesena, and Rimini. Bologna remains at high risk of landslides, although in neighbouring provinces there is only a moderate risk. Satellite imagery published by NASA’s Earth Observatory illustrates the severity of the flooding in farmland near the town of Lugo, in the Province of Ravenna.

Map 1 - Emilia-Romagna Provincial Map. Available here.

Emilia-Romagna is Italy’s fourth region in terms of GDP output behind Lombardy, Latium, and Veneto. The region’s diverse economy is made up of agriculture, manufacturing, and textiles sectors. In the first half of 2022, agricultural output was valued at €575 million ($621 million), just under two per-cent of all regional output. Although agricultural output in the primary sector does not amount to much of the region’s economic output, the processing of agricultural products in the secondary sector represents almost a fifth of Italy’s total agricultural value chain and agri-food exports represent over ten per-cent of the region’s exports, according to information published by the regional government of Emilia-Romagna.

The collateral damage faced by Emilian farmers is not just economic. The region’s farmers produce 44 geographically-protected agricultural products such as Parmigiano Reggiano, Parma ham, balsamic vinegar, and Lambrusco wine. In addition to this, the region’s farmers and their respective research partners are field-leading innovators of food safety farming practices. This has led Confagricoltura – an Italian farming association – to describe the situation as having the potential to trigger a significant socio-economic gulf within the region, due to the costs of rebuilding. Currently, Confagicoltura estimates a cost of approximately €40,000-50,000/hectare for fruit farmland ($43,250-$54,060/hectare) and €6,000/hectare for grain and cereal farmers ($6,490/hectare), not to mention the years it will take for affected farms to return to capacity-level production. Notwithstanding, the large part of the region’s spring harvests are pretty much written off as fruit trees suffer from root rot and 400,000 tonnes of wheat have been lost.

The figures reported above only represent the immediate cost for the 5,000 farms impacted by the floods, and do not consider the longer-term social and economic costs associated with the loss of assets and labour of Emilian farmers – not to mention the increase in costs of secondary food products which are the heart of gastrotourism in the region. For the Italian government, there is the question of financing reparations and rebuilding. At the moment, some €100 million ($108 million) have been approved by the central government for relief spending in Emilia-Romagna, as head of government Giorgia Meloni explores the use of the European Union’s Solidarity Fund.

Cover Image Credits: International News - The Chronicles of Life. Available here.

The Piano Mattei lands in Brazzaville: A Look at Italy's Latest Quest for Energy Security.

On 25 April 2022, Italy moved one step further in consolidating its energy diplomacy across Africa. After securing gas deals in Libya, Morocco and Algeria, the state-owned energy group Ente Nazionale Idrocarburi (Eni) signed a US$ 5 billion deal gas liquefaction project with the Republic of Congo, from whom it had previously acquired the Tango FLNG liquefaction station in early August of 2022. Together, the facilities make up the Marine XII joint venture project along with 31 drilling wells, 10 platforms and 1 gas pre-treatment plant logistically integrated off the shores of Pointe-Noire.

Eni has been the flagship of Rome’s new foreign policy towards Africa dubbed as the Piano Mattei, initiated by Prime Minister Giorgia Meloni as a strategy to reduce dependency on Russian gas imports by projecting its influence just below the Mediterranean Sea. Since the Piano could be pivotal for the EU to fulfil its energetic security objectives (as we previously discussed in this must-read Spotlight!), this article identifies key drivers of risk and success emerging from Eni’s new undertaking in the Republic of Congo and what is its contribution to Italy’s greater energetic security planning.

How Eni did it: Managing Political Risk in Congo

After almost 60 years in Congo, one could expect that Eni would have nurtured an engagement with the country’s most influential stakeholders in order to create an identity of interest that would later pay off as the company’s most competitive aspect to secure the resilience of its business. Interestingly, Congolese law largely centralizes the administration of oil and gas exploration projects - including the issuance of permits, renewal of contracts, and local content requirements - under the Minister of Hydrocarbons’ authority and discretion. Minister Bruno Jean-Richard Itoua, the current incumbent, not only oversaw the signing of the new LNG project but actively supports it as a potential driver of Congolese economic growth and energy self-sufficiency. Such good deeds bode well for the project's stability and are likely to work as a preemptive measure against any major regulatory disruption for the foreseeable future.

The Republic of Congo’s stable relations with Italy, the European Union and major continental powers such as France are also likely to play a stabilizing and supportive role in the operation as they currently show little signs of major degradation, even if thorny issues such as corruption, autocratic practices, and environmental degradation should be kept on a close watch for precaution’s sake.

On the other hand, the majority of installations comprising the Marine XII project - including the ones designed to export liquefied gas - are located on the Gulf of Guinea where piracy activities targeting cargo ships happen, thus remaining a relevant risk to be observed along with the possibility of criminal violence against foreigners in Pointe-Noire. Whether Eni's previous incidents in Nigeria will foster greater investment in maritime security against piracy remains something to be seen.

Was it really all for nothing?

Despite positive outlooks, Eni’s new undertaking in Congo is likely to do little for Italy’s energy security. Congo’s LNG production is expected to reach a peak of 4.5 billion cubic meters per year by 2025, which would only correspond to roughly 6.5 per cent of Italy’s total LNG imports in 2022. More broadly, the experience is telling of Piano Mattei’s fundamental weakness of over-pulverizing supply among possibly more reliable sources while still relying on other major individual actors.

Figure 1: Share of Italy’s Natural Gas Imports by Country (2010-2021). Based on data compiled by the Ministry of Environment and Energy Security (2021),

For example, in 2020, it would take the combined gas supply of 4 countries (Netherlands, Libya, Netherlands and Qatar) to match Algeria’s participation totalling 24 per-cent in that year. While it should be recognized that Russia’s participation suffered sharp drops in 2022 and that logistical impediments could certainly hinder alternative solutions, data seems to indicate that Piano Mattei's current supply diversification strategy currently seems more like a substitution: by trading Moscow for Algiers, Rome’s new diplomatic undertaking might still be falling short of its ambitions. Nevertheless, the pursuit of risk hedges could be recognized.

Since Meloni has veiledly thrown her support behind Algeria on the Western Sahara conflict before, further signs of support in this and other issues could indicate an appeasement with Algeria for the short term. Likewise, the share of renewable energy consumption consistently grew from 2018 to 2021 as well as their participation in Italy’s total energy consumption, despite still accounting for the smaller share. Thus, in the long term, the return of investment flows to renewables production capacity could become pivotal for Italy to achieve its desired - and fiercely pursued - energetic security.

The Russian Oil Maskirovka: Why Aramco is Cutting Oil Prices

Oil markets have had an interesting year following the Russian invasion of Ukraine, to say the least . While firms have benefitted from this, with many announcing record profits, Saudi Aramco announced that it would be lowering oil prices in its main market Asia. This is off the back of weak manufacturing data from China that triggered a fall in Brent and WTI futures which track global oil prices. Although prices were raised in Asia, they remain unchanged in the United States but increased for European consumers. Aramco cut prices to $2.55 above the regional benchmark while Brent Crude futures jumped up to $87 per barrel before stabilising at $73 per barrel. Markets now look to the OPEC meeting in June, with some analysts believing that the group may decide to cut production again in a bid to keep high prices inflated.

On the one hand, it is not that surprising that Saudi Aramco’s profits dropped 19 per-cent considering their record profit of $161 billion off the back of an abnormal year for markets, but this is not just because of the oil market correcting itself. Saudi Arabia is competing with cheap Russian oil in key markets, like China and India, and, with 60 per-cent of its crude oil going to Asian markets - this is beginning to hurt the Kingdom’s economy. The IMF has halved its prediction on Saudi GDP growth from 8.7 per-cent to 3.1 per-cent, after cheap Russian oil undercut OPEC and priced Saudi Arabia out of key markets. However, this will only last until the Ukraine crisis is resolved and Russian oil can freely flow in global markets again. By convincing Saudi Arabia and OPEC to help sustain high prices, Russia has been able to sell its own oil at a discount to make up for the damage Western sanctions have caused on its economy. Unsurprisingly, this has ruffled feathers in the United States.

While Saudi Arabia is considered an ally of the United States, the relationship between the two nations has been less than cordial in recent years. The Kingdom has found itself becoming a rival oil exporter to the United States, and so has shown less interest in cooperation. President Biden refused to communicate with Crown Prince Mohammed Bin Salman, due to his involvement in the assassination of Jamal Khashoggi, and the relationship was further strained in March 2020, when Saudi Arabia dumped 40 million barrels of oil onto the market while in the midst of an oil price war with Russia. The resulting price decrease to -$37.63 per barrel was unprecedented and pushed American fracking companies out of business, thereby benefitting Saudi Arabia by decreasing global production and increasing prices.

Since then, Russia and Saudi Arabia have led their respective group of oil producers, together called OPEC+, to sustain high oil prices which had been placing inflationary pressures even before the Ukraine crisis began. In March of last year, they decided to increase production by 400,000 barrels a day each month, signalling that they had no interest in providing a safety net for Western Europe which has faced a decrease in Russian oil imports. This was following a call between Biden and King Salman in February, in which the former asked for more Saudi oil to relieve American allies, but nothing came of this. This coupled with Saudi Aramco making a $3.6 billion investment in Chinese Petrochemical firm Rongsheng and Xi Jinping calling for oil trade in Yuan, has caused security concerns in Washington. Biden might be facing more personal political problems due to oil markets though. Since WW1, sitting presidents won re-election only one out of seven times the economy has been in recession 2 years before they were up for re-election. With the OPEC meeting in June being held when the US is expected to breach its debt ceiling, if Biden does not receive favourable outcomes from both these issues, he can all but wave re-election in 2024 goodbye.

In the same way that neither Russia nor Saudi Arabia officially admitted to being in a price war in 2020, neither side has acknowledged the deception Russia orchestrated in convincing Saudi Arabia to sustain high oil prices. While the war in Ukraine has helped to keep these prices high, this has backfired in allowing Russia to snap up key markets in Asia. Whether this will remain the case going into the future is dubious. Looking at China, Russia was only able to unseat Saudi Arabia for 2 months of this year as the main supplier of oil, so if peace talks progress this year Saudi Arabia is likely to retake their lost market share. Moving forward we can expect oil prices to spike again if OPEC decides to cut production in June, but these prices are also dependent on the US debt ceiling. Although a default has never occurred before, OPEC are still looking at developments in the United States warily and it is evident that bad news coming from Capitol Hill will overshadow whatever decisions OPEC makes.

Photo Credits: mining.com

Powering the future: Cobalt in the EV battery value chain

Powering the future: Cobalt in the EV battery value chain

This research paper sheds light on the key risks associated with the supply of cobalt, a critical mineral for the production of electric vehicle (EV) batteries. With demand for EVs projected to grow steadily in the coming decade, it is crucial that companies mitigate these risks. The concentration of finite cobalt reserves in the Democratic Republic of the Congo (DRC) and the concentration of refining capacities in China create a delicate balance of supply that is highly risk prone.

Petrobras: Balancing Risk and Opportunity in Brazil's Oil Industry

Petróleo Brasileiro S/A - or simply called Petrobras - is the leading player in oil and gas production in Brazil. The majority-state-owned company has a net revenue of R$ 452 billion (approx. USD$90bn), outputs approximately 2.77 million barrels of oil equivalent per day, and is a publicly-listed company traded on the New York Stock Exchange (NYSE:PBR), Nasdaq (NASDAQ:PBR), and the London Stock Exchange (LSE:0KHP), and several others. Despite its relevance to the global energy markets and its considerable growth potential, investors’ sentiment towards Petrobras usually contains extra grains of salt. The company is often embroiled in domestic wrangles and power struggles that shed uncertainty about its corporate governance and was at the centre of a major corruption scandal involving high-rank Brazilian policymakers in 2015.

After the election of Lula da Silva as president, markets again reacted badly due to a perceived high potential for undesired political influence over the appointment of Petrobras’ Board of Directors, for changes in its dividend distribution, and a revision of the company’s pricing policy (which currently follows a parity with international import prices). One year later, a scanning of those three issues and of the newly appointed Board might still prove revealing of Petrobras' future and better prepare investors to hedge against associated risks.

Currently, the State-owned Companies Act (2016) prohibits figures with a potential conflict of interest due to previous positions inside public administration from being appointed to the Board for a period of 3 years after leaving the previous function, which is also endorsed in Petrobras’ statute. A Bill reducing the “quarantine” period to 1 month is stalled in the Upper House of Congress since 2022, prompting many to wonder if the Bill’s approval could be pushed to ensure greater coalition support in times of political turbulence. Despite being a possible strategy, it is far from being the likely one. A Supreme Court decision has already suspended the proposed 3-year quarantine period of the Bill, and 3 of the government’s 6 appointees were confirmed on the Board despite alleged concerns about their ties with partisan politics. However, other bills and reforms are among Lula's top priorities with Congress, making it unlikely that he would create an unnecessary conflict with the Upper House over Petrobras, especially when opposition forces are strengthened.

Acting as Petrobras's CEO is Jean-Paul Prates, who has vaguely commented on the possibility of changing the dividend distribution policy, but both Lula’s and Bolsonaro’s defence for greater taxing in dividend yield distributions likely does little to appease markets. Still, a recent judicial attempt of halting Petrobras’s dividend distribution shed even more uncertainty about how alternative ways of interference - ones that do not even involve the Board’s discretion - can be overreaching, indicating a high likelihood of taxation in the future.

The potential for a change in the company’s policy of maintaining parity with international oil prices also cannot be discarded, as key figures inside the Board have signalled they desire its revision. Nevertheless, in a continued scenario of high oil prices due to external shocks, the Board is likely to be interested in retaining a part of Petrobras’ profitability by not announcing major changes in the parity policy for the near future.

While the prospects for stable dividend yield distributions and insulation from rent-seeking dynamics appear less optimistic, posing increasing risks for investors, Brazil's potential to become a major player in clean energy production presents an opportunity. Petrobras is actively exploring cutting-edge technologies in renewable energy markets, such as wind-powered energy and green hydrogen production, which could enhance its long-term profitability. While the company’s issues span across multiple incumbencies and require careful assessment of long-term tolerance for loss, the most risk-appetite investors can still find creative ways to offset the balance and - with some stroke of luck - profit from the undertaking.

Photo credit: Global Business Outlook

Conflict in Sudan- impact on critical oil and gold flows

Conflict in Sudan started on April 15 between the country’s army and a paramilitary group called the Rapid Support Forces (RSF). With its strategic location, gold reserves, and access to crude oil, Sudan’s resources have long been desired by its neighbours, Gulf countries, Russia, and Western powers. A previous London Politica article has examined how the conflict can expand and escalate to a civil war or even become the site for international confrontation. There is another side of this conflict that needs to be explored- how the conflict is impacting the commodities Sudan is so reliant upon.

According to The Observatory of Economic Complexity, gold is the most exported product in Sudan, accounting for $2.85B and 52.3% of total traded value. Crude oil is the 4th in the category of exports, with a total value of $395M in 2021.

The RSF claims to have seized a major oil refinery, which supplies around 70 per cent of the country’s fuel. In the official twitter account of the RSF, the paramilitary group posted a video of men standing close to a billboard of “Garri Refinery”. As for now, the crude exports from Port Sudan, which also account for South Sudan’s exports, of around 100,000 b/d have not been impacted. The country’s army has stated the RSF is trying to create a fuel crisis to promote an even more unstable situation on the ground. Imports of oil products have stopped since the conflict started, maybe due to the necessity of using the country’s infrastructure for evacuations.

Historical context

In August 1999 Sudan first started exporting crude oil and the country emerged to be one of Africa’s most important oil producers. Nine years later, in 2008, the country was pumping 500,000 barrels every day. Before the most recent conflict this number dwindled to only 70,000 b/d, an 86 percent fall in 14 years due to war over South Sudan and its consequent secession.

During the 1990s, in the middle of civil war, the present incumbent, Omar Al-Bashir announced that energy would help the country grow its new economy. In order to achieve this goal, the military regime ethnically cleansed the areas where oil would be extracted and partnerships were established with Chinese, Indian, and Malaysian national oil companies. Growing demand in Asia for these crude oil exports saw petrodollars flow into the country, increasing economic growth between 1989 and 2019.

Export Crisis

The conflict in Sudan is making other countries concerned, among other issues, about oil pipelines. South Sudan, for example, exports around 170,000 b/d via a pipeline that crosses the unstable area. Although there is no clear interest of either RSF or the country’s army in stopping oil flows, South Sudan claimed that this week's conflict had already obstructed logistics between the oilfields and Port Sudan. Pout Kang Chol, South Sudan’s oil minister, said that current fighting in Sudan may affect oil production. The Minister also stated that oilfield facilities such as pipelines, pump stations, field processing facilities, and export marine rerminal are safe from any damage at the moment and that logistics and transportation of equipment that pass via Port Sudan are slightly affected.

Despite the fact that, for now, Sudan’s oil operations have not been affected, the takeover of the refinery in Khartoum could lead to fuel shortages.

Imports of oil products are also obstructed. According to Vortexa, at least five vessels carrying around 130,000t of gasoil and 80,000t of gasoline are found in the Red Sea around Sudan. With Port Sudan being their destination, the containers arrived in Sudanese waters over two weeks ago and have not yet been discharged. This may also happen since the port is being used to evacuate foreign nationals from Sudan after operations at Khartoum International Airport were disrupted.

According to the U.S. Energy Information Administration, the main oil companies operating in Sudan are Greater Nile Petroleum Operating Company (GNPOC), Petro Energy E&P (PEOC), Petrodar Operating Company and Petrolines for Crude Oil Ltd. (PETCO). The main countries of origin of these companies are China, Malaysia, India, Sudan and Egypt.

DPOC, GPOC and SPOC have set up an Emergency Response Team that “will structure a contingency plan to mitigate the impact crisis by en-routing all the logistics and transportation of critical materials, Chemicals, and Equipment through other safer routes”.

Oil is not the only commodity being affected by the emerging conflict. Gold, the country's most important commodity export, also has political risks attached to it. The Russian paramilitary group, Wagner, operates a gold processing plant in Khartoum and has been accused of being involved in Sudan's conflict. This gold has helped Russia evade sanctions imposed by Western countries after the Ukraine invasion by using Sudan’s gold to fund war costs.

Therefore, among the humanitarian, economic, political and social issues related to any kind of war, it is important to keep an eye on the commodities sector, and how the conflict can impact already unstable oil exports and prices around the globe.

Brazil-China: Trade Relations and their Impact on Commodities

Brazilian President Lula's recent trip to China has stoked tensions between Brazil and the West. From both a geopolitical and financial point of view, Lula’s actions surrounding the trip represent a marked change from his predecessor Bolsonaro. Where Bolsonaro had backed ally President Trump’s aggressive rhetoric on foreign policy, Lula is not only trying to reestablish Brazil’s role in global diplomacy, but is also toeing a more neutral line in the developing cold war between China and the US. Lula seems to be aligning himself with the other BRICS (Brazil, Russia, India, China, and South Africa) nations, but due to rivalries between the member nations, it is the bilateral economic deals that will have a more visible effect on the world, rather than empty foreign policy promises.

Alongside 240 Brazilian business leaders, Lula headed to China for the inauguration of former Brazilian President Dilma Roussef as head of the New Development Bank, a multilateral development bank established by the BRICS to help fund infrastructure projects in developing countries. This set the financial tone for the rest of his visit, in which 15 deals worth about $10 billion were signed between Brazil and China. China has long been Brazil’s largest export market and Lula wants to leverage this relationship to help with the reindustrialization of Brazil. With US companies leaving Brazil, the symbolism of Ford seeking to sell its plant to BYD cannot be understated. This coupled with talks between BRICS to dethrone the dollar as the currency for international trade will come as a blow to Biden, though it is unlikely that China will want the Yuan to become an international currency. Lula’s comments surrounding the Russo-Ukrainian war sparked more controversy in the West after he offered to join China in mediating peace talks while also placing partial blame for the conflict on the US.

Overall, Lula’s visit is most surprising as it marks a shift in Brazilian foreign policy, though this is only surprising when looking at the policies of his predecessor. Indeed, Lula is known to be a staunch leftist and had started cultivating a relationship with China in his previous presidency, so we can assume that this relationship will only be strengthened under his administration. President Xi has made it clear that Brazil is a key part of his plans of challenging US global hegemony, and this is shown by bilateral trade increasing by 10.1% from 2021 to 2022. A key commodity being sold by Brazil is beef, as China has a huge demand for it with 55% of their imports coming from Brazil and 10% of Brazil’s sales being to China. However, Brazil is also a key part of the iron, soybean, and crude petroleum markets. In addition to this, Brazil was the single largest recipient of Chinese FDI in 2021. This is part of Xi’s plan of integrating Brazil into the Belt and Road initiative, to increase China’s influence in Latin America, so we can expect trade to grow in coming years.

The markets for each of Brazil’s main commodities, beef, soybeans, and crude petroleum could change drastically by the end of the year. Both beef and soybean sales are interconnected. Soybeans are instrumental for feeding beef cattle with cattle feed making up 18% of soybean sales in the US and 52% of the oil gathered from soybeans are used in the food industry. With growing demand for beef from China opening up, we can expect beef sales to increase through restaurants reaching pre-pandemic levels of demand and pushing soybean prices up as restaurants need more oil for frying food, while farmers will need more soybeans to feed growing cattle numbers. While some feared stricter controls on cattle rearing in the Amazon with the election of a left leaning President, Lula has been unwilling to change his predecessor's profitable policies. While Lula has talked about placing people and nature in front of profits, this philosophy has not yet reached the agricultural sector, but this does not necessarily mean it will enjoy projection for the rest of his term. For now the only thing which has stopped the flow of Brazilian beef has been cases of mad cow disease, but suspensions were normally lifted within a few months of being placed.

Iron ore makes up the largest portion of Brazil’s exports and its price shifts are harder to predict. In the short term, prices will increase as China opens back up. As it eases its coronavirus policy and its real estate sector gradually recovers, it is likely that demand for iron will increase from Brazil’s main trading partner. However, as the markets recover their supplies from India and Brazil, it is likely by the end of the year that prices could decrease. There is even the chance that Russian and Ukrainian supplies flood back into the market, which could drastically change the price of iron ore but it is unclear if a peace settlement can be reached anytime soon.

Uncertainty behind the Black Sea Grain Initiative

Russia’s invasion of Ukraine in late February 2022 fuelled high inflation rates and a consequent global cost of living crisis. Prices of major commodities, such as oil and gas, aluminium, nickel, copper, and wheat drastically increased following the invasion. This was due to a combination of EU, UK, and US-led economic sanctions against Russia and a Russian blockade of Ukraine’s Black Sea ports.