The Future of Infrastructure Investment in Africa

The investment landscape in Africa is undergoing a significant transformation, shaped by a high-interest rate era, evolving geopolitical dynamics, and the continued demand for energy and infrastructure projects. As investors navigate Africa’s financial markets, a rise in public-private partnerships, especially in green energy, will likely be the trend moving into the future. China has played a crucial role in funding energy and infrastructure projects so far, but recent developments suggest that Beijing is altering its approach in response to its own economic woes and the re-election of Donald Trump. With negotiations on peace in Ukraine and Gaza ongoing, the world’s attention could soon be turning to Africa..

A Changing Investment Climate

In Africa, the demand for large scale infrastructure investments remains high, yet capital remains constrained by perceived risks and a lack of well-developed secondary markets for investors. While in traditional investments shareholders can sell off their assets on the stock market (or to other private investors), there are few options for investors wishing to sell their shares of infrastructure developments. Therefore, many early-stage investors in critical infrastructure projects, including renewable energy projects, struggle to find viable exit strategies. Development finance institutions, who usually provide much of the financing for these projects, often find themselves unable to sell off their shares in projects and reallocate their capital.

One solution for this is the UK-backed MOBILIST (Mobilising Institutional Capital Through Listed Product Structures) programme. The programme takes inspiration from REITs (Real Estate Investment Trusts), which are used in the real estate market to pool assets together, making them more accessible to investors. MOBILIST has developed a similar investment vehicle called ‘Yield Cos’, which acquire operational infrastructure and energy projects, lowering the risk for investors while also allowing early-stage investors to reinvest their capital. While the initiative has not totally eased investors fears, it is a step towards Africa bridging its financing gap.

Despite volatility, African stock markets remain attractive for retail and institutional investors, and alternative investments, ranging from private equity to infrastructure funds, are becoming more mainstream. While the re-election of Trump can be seen as a knock to the pro-ESG (environmental, social, and governance) camp, sustainable investments, especially in emerging markets, could provide both safe financial returns and positive social impact.

Cost of Capital

China has been the dominant player in African infrastructure financing for over two decades, providing approximately $182 billion in loans across the continent. Historically, China would use one of its three “policy” banks, Export-Import Bank of China, Agricultural Development Bank of China, or the China Development Bank, to fund infrastructure projects, which would then be built by state-owned enterprises (SOEs). However, this model is no longer sustainable due to a variety of reasons, such as China's economic slowdown and Africa’s increasing debt sustainability issues. The shift was demonstrated during the 2024 Forum on China-Africa Cooperation (FOCAC), where Beijing announced a financing package of $51 billion, including a significant portion dedicated to equity investments. Despite this being a substantial amount, it is lower than previous packages, especially as the financing will be spread over a three year period . With African nations increasingly advocating for equity financing, Chinese firms will now more frequently have to participate in competitive bidding systems rather than rely on closed door negotiations. Furthermore, if they win contracts they will now be stakeholders and not just lenders, meaning they will have more of an interest in the long term maintenance of projects.

The Green Transition

The 2025 China-Africa Cooperation Beijing Action Plan stated that new investments will have a focus on green energy development. This is not entirely new news, as in 2021 Beijing announced it would stop funding new coal power projects as part of the Belt and Road Initiative (BRI), redirecting its focus toward renewable energy. Since then, China has used its domestic expertise to increase financing for solar, wind, hydroelectric, and green hydrogen projects. It has also stated its desire to develop nuclear energy projects across the continent. The Export-Import Bank of China (EXIM) and the China Development Bank (CDB) continue to drive much of this financing, with a new emphasis on smaller, environmentally friendly projects. The recent Chinese pivot toward the “small is beautiful” approach, the phrase used Xi Jinping’s keynote speech at FOCAC, further illustrates Beijing’s new lower appetite for risk. The BRI has been successful for both China and Africa, as China was able to redirect capital and expertise to aid African nations in their modernisation efforts.

Now at the forefront of developments in green energy technology, China is well placed to continue utilising the BRI to build green infrastructure in Africa. Despite increased commitment to renewable energy, challenges remain. African nations still face barriers in raising funding for renewable energy projects, as key stock markets in Nigeria, South Africa, and Kenya have yet to provide low risk investment vehicles to attract capital. While Yield Cos could help alleviate these worries, they are still relatively new investment vehicles and lack the trustworthy profile that is needed to attract large scale institutional investment.

The Role of Private Sector

Due to its economic slowdown, China has pushed for its private sector companies to become more involved in Africa. Between 2015 and 2021, non-policy bank creditors provided approximately $55 billion in financing, making up one-third of China’s total spending in Africa over this period. Where these firms differ from policy banks, is that policy banks aim to implement specific government policies rather than pursuing profit as commercial banks do. Unlike state-backed loans, financing from commercial creditors, such as the Industrial and Commercial Bank of China (ICBC), is faster and less bureaucratic, despite these institutions still being largely owned by the Chinese government. While policy banks can take several years to commit capital after rigorous negotiations, financing from commercial creditors can be obtained within a year. In some cases, these lenders have provided bridge loans to sustain projects while awaiting funding from policy banks.

However, this also highlights one of the main negatives of commercial loans, which is the much shorter time period that creditors want to be involved for. This means that their loans carry higher interest rates and shorter repayment periods, exacerbating short term debt burdens for already struggling African nations. This has been made worse by the recent era of high interest rates and by the fact that the majority of Chinese financing has gone to countries facing debt sustainability issues. Furthermore, they require sovereign guarantees and insurance from China Export and Credit Insurance Corporation (Sinosure), which increases overall borrowing costs. The risk coverage Sinosure provides has also been cut back for countries that have defaulted. With the Chinese financial sector already risk averse due to their exposure to the ongoing domestic real estate crisis, private creditors will be less amenable to debt restructuring than policy banks are. This is because policy banks have to consider China’s geopolitical relationships while private creditors are profit driven. Despite these negatives, China’s willingness to provide equity financing indicates its long-term strategic commitment to close financial ties with Africa.

Western Response

Beijing adapting its strategy to align with both African goals and its own domestic constraints will likely mean that it maintains its dominant position on the continent. While its European counterparts have undertaken projects like MOBILIST and the Sustainable Energy Fund for Africa (contributing states being Denmark, the UK, Spain, and France), Europe’s focus is on rearming in anticipation of standing against Russia without American backing.With Western Europe having to make stricter fiscal decisions in the face of potential economic stagnation, they are unlikely to close the financing gap they have with China in Africa.

Under a second Trump administration, the US is expected to take a more aggressive stance in countering Chinese investments in Africa. USAID has had most of its operations halted and is anticipating a significant shift in its policies once the administration’s 90 day review of USAID is complete. This has and will very likely involve cutting funding to countries that engage with Chinese entities, directly or indirectly, reinforcing Trump’s America First foreign policy. Trump’s emphasis on deal making and the involvement of the US private sector may be to Africa’s benefit, as a transactional approach could allow financing to go ahead with little of the red tape associated with the international NGOs that usually acquire USAID funding to operate in Africa. His nomination of Benjamin Black, whose experience lies in finance rather than foreign policy, to lead the US international Development Finance Corporation (DFC) solidifies this transactional approach, prioritizing economic returns over traditional aid diplomacy. Additionally, US support for fossil fuel rich nations, such as Tanzania and Nigeria, contrasts sharply with the previous administration’s green energy focus, further distinguishing its investment strategy from China’s renewable heavy initiatives. With this in mind, we will likely see African nations reliant on or rich in fossil fuels aligning with the US, while those focusing on green energy will likely become closer to China.

Conclusion

While Trump could force a clearer alignment of countries currently taking advantage of funding from both the West and China, a significant incentive that China maintains is political stability. The switch from Biden to Trump was tantamount to political whiplash, which countries like South Africa are currently learning the hard way. The US cut $1 billion in loans that were employed to facilitate South Africa’s transition to green energy as part of a growing political spat between the two nations. African countries who could stand to benefit from US investments in its fossil fuels could be deterred by the possibility of a Democratic administration reversing Trump policies. Though China is decreasing the size of its investments, it remains a steady and predictable partner. In addition to this, US warnings of Chinese debt-trap diplomacy will likely fall on deaf ears as there have been no clear-cut cases so far of China leveraging debts to force nations into one-sided agreements. However, the introduction of Chinese private firms more concerned about profit than politics could see this change and may finally give the US the edge it desperately needs in Africa.

The Risks Presented by Poverty, Inequality and Unemployment in South Africa

Executive Summary

London Politica assesses with high confidence that increased poverty, unemployment, and inequality levels will likely continue to drive crime, unrest, and the rise of populist parties in South Africa. This will likely negatively impact the perceived legitimacy and support of the Government of National Unity (GNU) coalition.

To address these challenges effectively and maintain popular support, we assess that the GNU would benefit from investments in infrastructure targeting electricity and water supply, as well as social programs, education and poverty alleviation initiatives at the local level. The implementation of structural macroeconomic reforms to improve living standards and public sector efficiency would also likely continue to improve the country’s business climate and attract foreign investment.

Declining unemployment rates are expected to strengthen demand-driven growth, as evidenced by the 1.3% increase in household consumption following the election. This will likely reinforce business confidence and accelerate the expansion of key national industries, including mining, construction, manufacturing and electricity.

Despite growth in key domestic sectors, economic activity declined across government consumption, imports and exports, contracting GDP by 0.3% in Q3. Persistent trade weakness, driven by declining imports of minerals, precious metals and machinery will likely further constrain trade flows in the near term, limiting the GNU’s external growth prospects.

Introduction

South Africa remains one of Africa’s most advanced and diversified economies offering a relatively stable investment environment. Its appeal to foreign investment lies in its world-class financial services, deep capital markets, transparent legal framework and abundant natural resources. Key sectors attracting foreign direct investment (FDI) include manufacturing, mining and financial services. Despite ample investment opportunities, FDI inflows have consistently declined since 2022, dropping from $1.3 billion in the first quarter of 2024 to $965.87 million in the second quarter.

Throughout 2024, South Africa’s economy faced significant disruptions due to persistent electricity shortages, civil unrest and logistical challenges. These factors - coupled with the outcome of national and provincial elections - substantially impacted business confidence, as the South African Chamber of Commerce’s Business Confidence Index (SACCI) declined by 6.9 points over the two months following the May 2024 general election.

The 2024 general elections marked a historic shift in South Africa’s political landscape, as the African National Congress (ANC) lost its 30-year parliamentary majority, securing a record low of 159 seats. This led to the formation of a coalition government, the Government of National Unity (GNU), composed of 10 parties collectively holding 287 of 400 seats (72%) in the National Assembly. The Democratic Alliance (DA), a pro-business party and the main opposition to the ANC, emerged as a key coalition member, securing 87 seats in the National Assembly.

By prioritizing economic growth and a stable business climate, the GNU has gradually bolstered business confidence through its commitment to implement structural economic reforms and enhance public sector performance. The joint initiative between the presidency and the National Treasury dubbed “Operation Vulindlela” aims to transform electricity, water, transport and digital communication infrastructure to promote economic growth and attract foreign investment.

Within six months of the general election, economic growth and investor confidence are gaining momentum, driven by anticipated structural economic adjustments in energy, logistics and the public sector. The South African Reserve Bank reported the first net inflow of capital since 2022, shifting from an outflow of $1.1 billion in Q2 of 2024 to an inflow of $2.1 billion in Q3. This shift reflects renewed investor confidence in the country’s economic stability, as evidenced by increased inflows of direct investments, portfolio investments and reserve assets.

While the business climate shows signs of improvement, the GNU is likely to face multifaceted risks associated with unemployment, poverty and inequality. South Africa’s high unemployment rates - particularly among young people - create profound negative externalities for the state, as the country’s demographic dividend is disproportionately wasted due to a lack of investment in human capital development. Although 22,000 jobs were created in 2024, 137,000 South Africans entered the workforce the same year. The expanded unemployment rate (including discouraged seekers) was 60.8% amongst 15-24 year olds in Q2 of 2024. As unskilled and unemployed working-age adults are consistently delinked from the labour force, a long-term skill gap is latching itself into the employment market. This risks snowballing into a structural unemployment problem whereby individuals lack the skills necessary to bridge the gap toward average employment requirements.

Unrest

South Africa continues to grapple with worsening civil unrest; data illustrates a visible increase in registered protests and riots since 2021. Civil unrest poses significant risks to both the economic and security environment, leading to financial losses, disruption of business operations, and widespread property damage.

Unrest represents an operational hazard for foreign stakeholders and frequent business disruptions continue to damage the GNU’s legitimacy. These trends are likely to persist unless underlying economic issues are effectively addressed.

The July 2021 riots led to $1.5 billion in economic losses and two million jobs being lost or impacted for both local and foreign companies.

Our analysis of historical trends indicates that politicians' failure to appropriately address long-standing unemployment, inequality, and infrastructure deficits have driven grievances and unrest across the country.

Civil unrest remains a key issue obstructing social and economic development in South Africa. South Africa ranked 127 out of 163 on the Institute for Economics and Peace’s (IEP) Global Peace Index 2024, putting it amongst the fifteen most politically unstable countries in Sub-Saharan Africa. Civil unrest increased significantly last year, with 692 protests and riot incidents registered during the first quarter of 2023 compared to 456 over the same period in 2022.

Historically, analysts have associated civil unrest in South Africa with popular resentment towards high and stagnant levels of unemployment and inequality, which are amongst South Africa’s most critical and longstanding socioeconomic challenges. Unemployment increased from 21.8 percent to 28 percent between 2013 and 2023, with the World Bank describing it as “South Africa’s biggest contemporary challenge” in October 2023.

Moreover, South Africa has some of the highest income and wealth inequality levels globally. The population’s richest decile accounts for about 65 percent of national income while the poorest half accounts for 6 percent. Disillusionment towards politicians has historically grown amongst South Africans as governments fail to confront unemployment and inequality, particularly along racial lines.

In July 2021, former South African president Jacob Zuma was arrested in Estcourt, KwaZulu-Natal, after refusing to appear before a judicial commission investigating corruption during his decade in power. Zuma's incarceration led to the violent 'Free Zuma' protests, which escalated and spread to other areas of the country including major cities such as Johannesburg. The riots constituted the largest period of civil unrest since the end of the Apartheid, with an estimated 354 people losing their lives. In our analysis of related data and interviews conducted by local news sources, we assess these protests were largely driven by background economic grievances.

Although the riots in July 2021 were precipitated by Zuma’s arrest, enquiries conducted in the aftermath illustrate that the causes were more deep-rooted. The South African Human Rights Commission (SAHRC) found that high unemployment rates, inequality and poverty were the bedrock from which unrest permeated. Echoing the findings of the SAHRC’s investigation, South Africa’s Minister of Trade, Industry and Competition Ebrahim Patel stated that “while it was true that there were those with a different agenda who lit the match, that match was thrown on dry tinder in communities where there was severe unemployment and poverty”. Further, protests led by the trade union groups Congress of South African Trade Unions (COSATU) and the South African Federation of Trade Unions (SAFTU) over the cost of living and unemployment rates erupted in Pretoria and Cape Town in August 2022, and Johannesburg in July 2023. In late November 2024, residents clashed with police in Johannesburg over a lack of water supply, demonstrating risks of public dissatisfaction with infrastructure deficits.

Previous civil unrest in South Africa has driven security and economic implications that were detrimental enough to shift the risk perceptions of foreign investors and other overseas stakeholders. The ‘Free Zuma’ riots led to $1.5 billion in economic losses and two million jobs being lost or impacted at both local and foreign companies. Unrest primarily disrupts the transportation of goods as major road closures.

Protesters blockaded and damaged key sections of the N2 and N3 highways, significantly disrupting commercial traffic in the KwaZulu-Natal region (KZN) along routes critical to national and regional logistics networks. The closure of these strategic routes constrained commercial cargo traffic and transit freight, disrupting supply chains that link South Africa with landlocked African countries which resulted in significant shortages in food, fuel and medical supplies. In the aftermath, foreign investors cited these riots as a deterrent to new investments and the expansion of existing ones. The economic cost of violence in South Africa as a percentage of GDP amounted to 15.38 percent in 2023.

Assessment:

London Politica assesses that high unemployment and inequality are likely to stagnate or worsen without effective government investments in energy, telecommunication and water supply networks. The absence of effective social investments increases the risk of unrest, particularly in urban areas and neighbourhoods with higher poverty rates. Such unrest is likely to undermine the government’s legitimacy, as constrained economic growth and high unemployment erode support for the GNU’s coalition in favour of populist parties.

The GNU should enact structural reforms to address unemployment, infrastructure deficits, and public sector performance to prevent consequences associated with a declining investment climate. The government’s pledge to address supply-side challenges by boosting investments in electricity infrastructure will likely gradually improve economic productivity and foreign investment in the long term. Although enhanced electricity supply bolstered manufacturing outputs in 2024, persistent social unrest linked to infrastructure deficits remains deeply entrenched and is unlikely to be resolved in the short term.

We assess that disenfranchised South Africans are likely to turn to disruptive demonstrations to voice their grievances against the government’s lack of effective investment. Social unrest will likely continue over the GNU’s term, resulting in occasional infrastructure damage and substantial financial losses to cities and towns across the country.

Crime

South Africa faces high crime rates linked to socio-economic problems which are exacerbated by the ineffective use of resources. Crime and violence divert resources away from development programs, investments in infrastructure and crucial social services as the government focuses instead on immediate security measures.

This misallocation of resources fails to address the root causes of crime and contributes to social inequality. Important sectors like education and economic development are underfunded due to the focus on short-term security.

The problem is cyclical, with short-term security priorities hindering long-term development and prolonging instability.

Crime in South Africa has a very significant impact on foreign investment and capital inflows. Extortion, theft, and violent crime affect the legitimacy of the government and drastically complicate business operations in the country.

South Africa has one of the highest crime rates in the world and continues to see increases in violent crime, including crime that specifically targets businesses. New data put out by the government demonstrates that crime rates have increased since 2021 - coinciding with a decrease in government popularity throughout the same period. Compared to wealthy communities, crime rates in poorer neighbourhoods like Khayelitsha are nearly five times higher, which is indicative of country-wide trends. The significant economic and social issues that residents experience are linked to this disparity. According to research by the Institute for Security Studies, Khayelitsha's high unemployment rate, poor housing conditions, and restricted access to social services all lead to higher crime rates. These circumstances encourage grievances, which can lead people to commit crimes, as illustrated by strong empirical evidence linking economic hardship to higher crime rates in South Africa.

In addition to community-level crime, South Africa is plagued by transnational organised criminal networks that worsen the business environment, slow the economy, and threaten individuals' physical and financial security. According to the Organised Crime Index, South Africa ranks 3rd as the African country most affected by organized crime, based on the prevalence of criminal activity and the ineffectiveness of state responses to counteract it. Transnational organized crime is defined as illegal activities carried out across borders by structured networks such as gangs, drug trafficking syndicates and international criminal networks. The most prevalent criminal markets in South Africa are human trafficking, financial crimes and arms trafficking. Throughout 2024 the South African Police Service dismantled 30 illegal drug laboratories and seized over $18 million worth of illegal drugs.

The prevalence of organised crime is deeply rooted in corruption within government and police forces and is worsened by a lack of cooperation between institutions. Because a large number of politicians and bureaucrats benefit from corrupt relationships with criminal organizations, they hold a vested interest in impeding efforts to combat it. Government officials are frequently compensated to overlook illicit actions once they are uncovered and to provide details on police operations and strategies to combat criminal activities. Despite government strategies implemented to combat organised crime, a lack of institutional cooperation and corruption among government and police forces have hindered their efforts.

There are substantial geopolitical and economic implications of South Africa's internal instability and high crime rate. The country's failure to uphold internal security harms its standing as a regional and international leader, complicating its efforts to project influence and collaborate on international projects through its G20 presidency.

High crime rates - and high rates of extortion specifically - significantly discourage foreign investment; foreign investors have refrained from entering the South African market due to costs associated with crime, including security measures and insurance premiums. Furthermore, a World Bank study from 2023 on South Africa's investment climate notes that a decline in FDI has been observed in industries such as tourism and manufacturing due to safety concerns and high crime rates.

The South African government has attempted to implement several policies to lower crime rates. Crime reduction is a major goal of initiatives such as the National Development Plan (NDP) 2030. Strategies to achieve this goal focus on strengthening law enforcement, improving the justice system, and addressing the socioeconomic drivers of crime. These efforts are complemented by increased funding for the South African Police Service (SAPS) and the adoption of community policing techniques. Unfortunately, corruption, low funding, and the absence of institutional collaboration have frequently impeded these attempts. The overall influence on national crime levels has been minimal, notwithstanding localised successes in certain urban districts. A recent Gallup poll indicated that South Africa ranks among the top three countries in which people feel the least safe walking alone at night. This suggests that more comprehensive strategies are required that address the underlying socio-economic problems that drive crime, in addition to improving law enforcement capabilities.

Assessment:

We assess that insufficient investment in social development, coupled with the failure to address corruption linking the state to transnational criminal networks, is likely to exacerbate existing disparities between communities. This will likely place additional strain on the state’s resources, given the government’s inevitable investment in policing and short-term security expenditures. Rising crime rates driven by unrestrained poverty and inequality will likely fuel growing social unrest and continue to erode public trust in state institutions.

Pessimism concerning South Africa’s investment climate will likely continue to harm the government’s popularity and legitimacy. Limited economic growth worsens already-existing social inequalities, further inhibiting economic progress, and restricting the creation of new jobs. The risk of increasingly frequent and violent civil unrest will likely deter foreign companies from operating in the country, further restricting FDI flows and directly constraining economic growth.

We assess that heightened levels of social unrest are likely to compel the government to divert substantial resources toward security and reconstruction efforts, further constraining funding for investments targeting poverty, inequality, and unemployment. Effective investments targeting structural economic adjustments and socially focused projects will likely benefit the GNU’s expenditures in the long term.

Populism

Right and left-wing populism is on the rise in South Africa. The ANC dropped from a 70% vote share in 2004 to 40.2% in the 2024 general elections. In the same election, populist parties uMkhonto weSizwe (MK) and Economic Freedom Fighters (EFF) respectively gained 14.6% and 9.5% of the vote share.

The rise of populism in South Africa can in part be explained by high voter discontent for the longstanding ruling party, the ANC. Persistent economic challenges that disproportionately impact less educated and economically disadvantaged segments of the population are likely to continue to drive these groups to support populist parties.

Continued failure to address long-standing economic grievances by the government is likely to lead to the further delegitimization of the GNU, threatening its coalition and leading to increased support for populist parties.

Increases in support for populist parties can be particularly observed in rural areas, which have high levels of voter discontent due to regional economic disparities. Rural areas tend to suffer more economically. As of 2017, poverty rates in rural areas (81.3%) were about double those in urban areas (40.7%). Poverty in rural areas has been exacerbated by the effects of the COVID-19 pandemic, the national hunger crisis, as well as continuous load shedding.

For instance, the largely rural province of Kwazulu-Natal had the highest share of votes for populist parties of all provinces in the 2024 election. Zuma’s populist party MK received 45.3% of Kwazulu-Natal’s votes. Kwazulu-Natal also has the second-highest number of people living in poverty. In Gauteng - an urban, comparatively wealthy province that makes up roughly 33% of GDP and has the highest provincial GDP per capita - voters largely backed the ANC.

Simultaneously, lower voter turnout rates can be more broadly observed in provinces that have higher GDP per capita, with the exceptions of Gauteng and the Western Cape. Moreover, voter turnout in the 2024 elections reached a historic low of 58.6% (in comparison to 89.3% in 1999). This could be indicative of a wider trend in which voter fatigue has driven lower turnouts in ANC strongholds and stronger turnouts in regions where populist parties have wider support.

Assessment:

We assess populist parties are likely to continue to mobilise poorer segments of the population to cast protest votes against the perceived status quo. Additionally, growing disillusionment with the ANC-led coalition will likely lead to further increases in voter abstention among former ANC supporters, reflecting a deepening erosion of confidence in the government. This trend is underscored by the historically low voter turnout observed in the 2024 elections.

This trend is likely to be exacerbated by the rhetoric of populist parties, which particularly target poorer and predominantly ethnically black communities. In the long term, there is a reasonable possibility that this will result in a significant shift in vote distribution, further weakening the ANC and posing a threat to the GNU.

This trend is likely to persist in both future regional and national elections unless the GNU’s policies effectively address the needs of disenfranchised communities. Such measures must include structural economic reforms and effective investments in education, infrastructure, social programs, and poverty alleviation initiatives at the local level.

The Shift Towards Private Sector-led Growth in Rwanda

Home to some of the fastest economic expansion in the world over the last 20 years, Rwanda has achieved an annual average GDP growth rate of 7% over the last two decades. Paul Kagame, who has served as the country’s president since 2000, is broadly considered by analysts and observers both domestically and internationally as the engineer of Rwanda’s notable economic transformation following the end of the genocide in 1994.

On the demand side, economic growth over the last two decades has been the result of a large public expenditure. Notwithstanding the positive economic transformation this has engendered, it has resulted in several structural challenges for the government. Rwanda’s public-sector-led development model has led to considerable fiscal deficits primarily financed through external borrowing. Debt has risen from 15.6% of GDP in 2012 to 48.9% in 2022. Whilst the national poverty rate declined from 75.2% to 53.5% from 2000 to 2013, this trend has stagnated since, with 56.5% of the population living on less than $1.90 a day.

Capitalising on the opportunities presented by Rwanda’s relatively undeveloped private sector would help to remedy the country’s current economic challenges, and create opportunities for overseas investors and companies.

Advocacy for private sector-led growth from policy makers

Key policy documents published over the past years and months illustrate the importance the Rwandan government attaches to private sector development to create future economic growth. Engaging the private sector and diversifying sources of finances features as one of the four strategic objectives of the country’s ‘National Investment Policy’ (NIP) published in December 2020 by the Ministry of Finance and Economic Planning. The private sector-led economy envisaged by the NIP is one underpinned by increasing mixed funding through mechanisms such as public-private partnerships (PPPs) and joint ventures (JVs), as well as facilitating export-led growth to improve the country’s balance of payments position and increase foreign exchange earnings. The NIP outlines that whilst PPPs have traditionally been a rare form of financing they are “a suitable step to attract further domestic and foreign investors by efficiently sharing inherent project risks and thereby making investing in the provision of public goods and services more attractive for private partners”.

Equally, Kagame’s flagship national development strategy Rwanda Vision 2050, which was launched by Kagame in 2020, highlights the importance of continuing “the journey towards self-reliance through a private sector-led growth”. As is outlined in the Vision 2050 blueprint, leveraging the country’s demographic dividend, increasing the value of human capital by strengthening the country’s education system, and creating “new growth poles” through urbanisation will serve to increase competitiveness and facilitate the operations of private companies. More recently, Rwanda’s proposed budget for the fiscal year 2024-25, serves as an indicator that the government will opt for a state-driven and proactive approach to encouraging foreign investment during Kagame’s fourth term. As outlined in the proposed budget, the government intends to increase public spending by 11.2% during the fiscal year, with RWF 2,037.4 billion (approximately USD 15.5 billion) to be allocated for both foreign and domestically financed projects.

Structural challenges undermining private sector development

Despite increasing awareness amongst policymakers of the importance of driving private sector growth, they face several structural barriers to achieving this goal.

Rwanda is confronted with a deficit of skilled workers upon which the government’s vision of private sector growth spurred by innovation and a prospering services sector is contingent upon. The country’s labour market remains characterised by low-skilled, low wage and informal work, with 85% of workers being informally employed as of 2021. Whilst Rwanda’s agriculture sector only makes up 27% of the country’s GDP, it employs 72.2% of the population, primarily in low-skilled and informal positions. Professions such as accountants, lawyers and engineers, on the other hand, are in particular shortfall. Rwanda’s educational framework is in part accountable for the current state of the workforce, with enrolment in tertiary education at 8% for men and 7% for women in 2023. Without access to higher education and specialised training opportunities, workers will be unable to fill the technical and managerial positions that private investment, especially in areas such as services, is dependent on. Investment into the service sector is of particular importance. As Rwanda lacks the natural resources of some of its neighbours, the tertiary sector will underpin future economic growth.

Access to financing solutions and affordable credit constitutes a further obstacle to private sector development. Lending rates are amongst the highest in the region not dipping below 14.16% in the last two decades and banks primarily offer short-term loans with collateral requirements regularly higher than 100% of the loan value. Viable equity financing solutions remain limited for micro, small and medium-sized enterprises (SMMEs). The Rwanda Stock Exchange remains nascent and only constitutes an equity solution for a handful of large companies. Whilst foreign private investors and companies can overcome these issues by leveraging external sources of financing, domestic companies are not presented with the same options, with local SMMEs often lacking the low-cost financing solutions to unlock growth at the early stages of a company’s development.

Advancing towards a private sector-led economy

There are grounds to believe that Rwanda will be successful in its transition towards a private sector-led economy. Firstly, the transition is already underway. Under Vision 2020, which ran from 2000-2020, a host of reforms were implemented to unlock private investment such as privatisation of state-owned companies and introduction of tax incentives. Between 1996 and 2017, 56 formerly state-owned companies were privatised. Large companies that the Government of Rwanda has sold its stake in through the Rwanda Stock Exchange include: MTN Rwanda - the country’s largest telecommunications company, which was first listed on the RSE in May 2021 - and the Bank of Kigali, which the government sold its 20% stake in through the company’s Initial Public Offering (IPO) in September 2011. Moreover, in February 2021, Rwanda’s Investment Code, which seeks to promote and facilitate investment in Rwanda, was enacted into law. The legislation introduced a wide array of investment incentives, including a preferential corporate tax income rate of 0% offered to any international company that establishes its headquarters and regional offices in Rwanda; invests the equivalent of USD $10 million in the company in tangible and intangible assets; and provides employment and training to Rwandans, amongst other conditions.

Secondly, Rwanda offers foreign and local companies a favourable regulatory environment and a relatively low and declining levels of corruption and crime. In 2020, Rwanda ranked second highest in Africa on the World Bank’s Ease of Doing Business index, jumping 100 places in two decades. The index ranks countries on how conducive their regulatory environments are for establishing and operating a firm in country. Countries are ranked on several topics including starting a business, registering a property and enforcing contracts. Corruption and crime are also in decline in Rwanda, with the country receiving the lowest score in East Africa on Transparency International’s Corruption Perceptions Index in 2023 and being the second safest country on the continent according to the ENACT Organised Crime Index 2023.

The top-down policy and decision-making structures established by the government have also traditionally shown themselves to facilitate the implementation of economic reforms. International commentators have noted that Western countries provide Rwanda with more aid than other African countries because they deem the country to use it more effectively. These frameworks will likely remain broadly unchanged with Kagame set for at least another five years in office. And we assess that future policies to boost private sector growth will likely be implemented with a similar efficacy. Kagame has committed to improving the economic security of Rwandans and has pledged to transform Rwanda into an upper-middle country before the end of his next term. With 37% of the country’s population under the age 15, Rwanda’s youth will become a powerful voice in the years to come. They represent a valuable driver of growth, however, in the absence of private sector development and integration, they are not likely to be better off than the generations that preceded them.

Despite Rwanda’s traditional reliance on public funds for stimulating economic growth, Kagame has remained persistent in his desire to attract private investment. In recent years, his administration has sought to implement policies, which breaking with the past, are likely to unlock private sector growth. Coupled with high and sustained levels of growth and other progress made under Vision 2020, such as infrastructure developments, a more central role for the private sector within Rwanda’s growth strategy will likely present untapped opportunities for overseas investors and businesses in the years to come, particularly in Rwanda’s fastest growing tertiary sectors such as financial services, IT and hospitality.

Hunger Crisis in the Democratic Republic of the Congo

Overview

The Democratic Republic of the Congo (DRC) is currently experiencing one of the world’s worst hunger crises, with 42.5 million people, of the country’s total population of 105.9 million, experiencing insufficient food consumption. Of these, approximately 23.4 million people are acutely food insecure, including an estimated 4.5 million children who are acutely malnourished. The resurgence of armed conflict in the eastern provinces of Ituri, North Kivu, and South Kivu since 2022 has further exacerbated the situation, with 7.3 million people currently displaced across the country. Women and children are bearing the brunt of the crisis, with access to food and other critical resources severely limited and incidences of sexual harassment, exploitation, and abuse surging in the affected areas.

Drivers and Causes

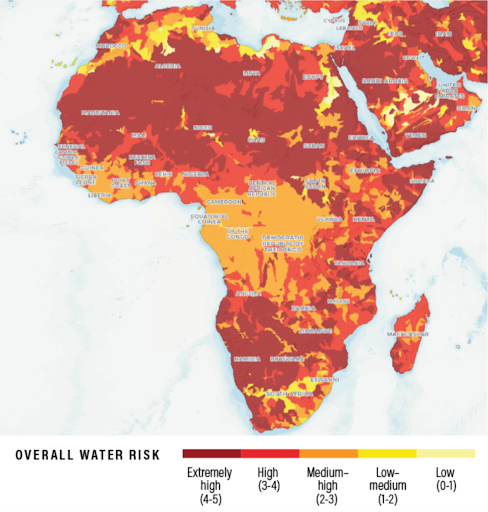

The hunger crisis in the DRC is fuelled by a myriad of factors, including environmental disasters, conflict, economic instability, and poor governance. Although the country possesses significant natural resources such as copper, cobalt, diamonds, and tin, the Congolese population does not benefit from the country’s natural wealth. The DRC is one of the poorest countries in the world, with a score of 0.481 on the 2022 UNDP Human Development Index (HDI), placing it 180th out of 193 countries. Poverty is widespread, with an estimated 74.6 per cent of the population living on less than $2.15 a day in 2023, and much of the population struggles to access basic necessities such as electricity and safe and reliable drinking water.

One of the key factors driving hunger in the DRC is the occurrence of frequent natural disasters such as floods, drought, volcanic activity, and epidemics. In 2021, the eruption of Mount Nyiragongo forced at least 232,000 people to flee their homes in Goma and the surrounding areas as lava flows destroyed more than 3,500 houses and toxic volcanic gases threatened both people’s lives and the environment. Similarly, the flooding of the Congo River in January 2024 affected more than 1,8 million people, destroying thousands of houses, farmland, and critical infrastructure, such as health care, water, and sanitation facilities. While the DRC’s geographical location in the Congo Basin makes it prone to climate hazards, climate change is increasing the frequency and severity of extreme weather events in the country, with floods, droughts, and heat waves all expected to increase over the coming decades.

Alongside disasters, violent conflict is another significant cause of hunger in the DRC. Since gaining independence from Belgium in 1960, the DRC has experienced persistent conflict with political tensions and rivalries over natural resources fuelling violence between different national and ethnic groups. In 1996, Rwandan forces invaded the DRC (then known as Zaire) to root out Hutu rebel groups that had taken cover in the eastern parts of the country, leading to a regional war that pitted Rwanda and its allies along with foreign and domestic rebel groups against the Congolese government of Joseph Mobutu. In 1997, Mobutu was overthrown and replaced by the rebels’ political leader Laurent Kabila. Yet, tensions between Kabila and his allies, Rwanda and Uganda, soon began to mount, resulting in the Second Congo War of 1998. While the war officially ended in 2003, ethnic tensions persisted and continue to be a significant obstacle to long-term peace and development to this day. In 2022, violence escalated between the DRC’s armed forces (FARDC) and the Rwanda-backed M23 Tutsi-led rebels in the eastern DRC, resulting in the killing of several thousand civilians and the forcible displacement of hundreds of thousands more across the region. While exact data on the number of victims is difficult to ascertain, the United Nations estimates that, since 1996, approximately 6 million people have died as a result of war in the eastern DRC, making the conflict the deadliest event since World War II.

Impact

Almost thirty years of conflict, environmental disasters, and poor governance have created a humanitarian crisis of immense proportions in the DRC. The 2024 Global Hunger Index ranks the DRC 123rd out of 127 countries based on indicators of undernutrition, child stunting, child wasting, and child mortality and rates the country’s food security situation as ‘serious’. Hunger is pervasive all across the country and the prevalence of insufficient food consumption is generally high or very high, with 22 of the DRC’s 26 provinces currently experiencing food insecurity levels at or above 30 per cent. This includes the provinces of North Kivu (4,2 million), South Kivu (3,7 million), Ituri (3,2 million), Kasaï-Central (2,9 million), Kinshasa (2,8 million), Kasaï (2,5 million), and Kasaï-Oriental (2,3 million), which together hold more than half of the DRC’s food-insecure population.

While food insecurity affects all segments of Congolese society, women and children have been particularly hard hit by the crisis and face a range of protection issues. In 2023, an estimated 2.8 million children under 5 years old and an estimated 2.2 million pregnant and breastfeeding women were acutely malnourished, with women and children in the conflict-torn provinces of Ituri, North Kivu, and South Kivu the most affected. Malnutrition-related effects include weakened immunity to disease and infections, increased risk of pregnancy and childbirth complications, and stunted growth and developmental delays in children. In the DRC, child stunting is especially common, with 36 per cent of children under five estimated to be affected in 2024. The child wasting rate, while comparatively lower at an estimated 6.6 per cent, is also high, as is the child mortality rate, which at an estimated 7.6 per cent is almost three times the world’s average of 2.6 per cent.

Besides the immediate risk to health and wellbeing, food insecurity makes women and children susceptible to a number of secondary threats, including sexual and gender-based violence, exploitation, and abuse. With food in short supply, many Congolese women and girls are forced to exchange sex for food and water for themselves and their families, while others have to enter forced or arranged marriages to survive. Attacks on water and food-seeking women and girls are also frequent, with those uprooted by violence and conflict the most at risk. In the conflict-affected areas of the eastern DRC, incidences of physical and sexual violence against women and children are particularly high. With no safe shelter available, women and children in the displacement camps in Ituri, North Kivu, and South Kivu are exposed to heightened risks of rape and abduction, while child recruitment by armed groups is also common. Although no exact data on the number of sexual offence and child recruitment victims exists, in 2022 over 80,000 cases of gender-based violence were reported in the DRC while at least 1,545 children were recruited and used by armed groups. The true number of victims, however, is likely to be far higher.

Recommendations and Implications

Relief efforts so far have focused on providing emergency food assistance, health care, and livelihood support to vulnerable populations and communities within the DRC and surrounding areas. In 2023, 6.9 million people out of a target of 10 million people were reached, but a lack of funding limits humanitarian actors’ response capacity. In 2023, the humanitarian funding gap for the DRC reached a record $1,311,860, or 58 per cent of the total budget required, with the figure for 2024 currently standing at 55 per cent. Additional help is especially needed in the eastern DRC, where a new clade of mpox is rapidly spreading and threatening the already precarious existence of people living in refugee camps. However, to carry out their work effectively and reach a greater number of people, humanitarian actors require greater financial assistance, both from donor governments and private contributions.

For those operating on the ground, personal safety has become a growing concern in recent years. In 2023, more than 217 security incidents involving humanitarian workers were recorded in the DRC, including almost 30 abductions, around 20 injuries, and at least 3 deaths. Since the beginning of 2024, this number has further increased, with more than 170 attacks on humanitarian workers reported in the first six months of the year alone. Most attacks are taking place in the eastern provinces of Ituri, North Kivu, and South Kivu, where fighting between government and armed opposition forces continues to rage despite the conclusion of a ceasefire agreement on July 30, 2024.

In North Kivu, the security situation is particularly challenging. Since the beginning of the year, M23 forces have significantly expanded the territory under their control, most recently, in early August 2024, capturing the towns of Ishasha, Katwiguru, Kisharo, Nyamilima, and Nyakakoma and taking control of the southern and eastern shores of Lake Edouard and areas along the Ugandan border. Fighting between the M23, FARDC, and pro-government Wazalendo militias has also been reported in the Lubero and Rutshuru territories in recent weeks, killing at least 16 people. In Ituri, armed groups including the Islamic State-affiliated Allied Democratic Forces (ADF) and the Cooperative for the Development of Congo (CODECO) remain active, launching recurrent attacks against civilians in the territories of Djugo, Irumu, and Mambasa. In South Kivu, the withdrawal of the United Nations Organisation Stabilisation Mission (MONUSCO) in June 2024 has raised concerns about a potential security vacuum, especially given the M23’s recent advance into the region. In light of the rapidly changing security landscape, it is therefore vital that humanitarian organisations liaise with local stakeholders and secure timely insights on armed group activities and movements. If your organisation is interested in tailored, PRO BONO insights from London Politica’s Africa Desk, please contact us at externalrelations@londonpolitica.com.

Intelligence Brief: South African Elections

Tomorrow, 29 May 2024, At 0700 SAST (0500 GMT) South Africans go to the polls. South Africa will engage its proportional voting system to fill 400 parliamentary seats in the National Assembly. The governing African National Congress (ANC) will look to retain a majority, albeit likely a declining one. Below the forecast are factors likely to influence the vote.

Short Term Situational Forecasting

London Political assesses with high confidence that the ANC will lose its majority due to perceived governance failures; the ANC will likely retain at least 44% of seats in the legislature, which will likely enable them to enter into a coalition with smaller parties, and without the EFF.

This would represent a continuation of the status quo as it relates to operational, security, and reputationl risks.

Due to political instability caused by a reduced ANC position, it is likely that we will see unrest, and possibly clashes between party supporters during the elections. Previous clashes involving MK supporters suggest this may result in violent altercations, protests, and destruction of property.

We assess this risk for Pietermaritzburg as high, with Johannesburg and Cape Town assessed as moderate risk locations. We are also likely to see severe congestion and petty crime in Pietermaritzburg.

Although political unrest is possible in Johannesburg and Cape Town, large-scale rioting and looting are unlikely.

Hate crimes spurred on by xenophobia are likely in all three cities; foreign nationals - particularly those from other African countries - should prepare contingency plans that take into account possible unrest and heavy congestion in cities.

Immediate Election-Associated Risks

· In the event of unrest, we are likely to see damage to property, arson, barricading of roads, looting, hijacking of trucks, and political violence;

· Campaigning around illegal immigration and foreign investment in relation to unemployment can act as a trigger for episodes of targeted violence, and human right organisations have reported a heightened watch for xenophobic activity;

· Increased foot traffic, and possible unrest and vehicle protests may lead to movement difficulties in urban centres surrounding the elections; and,

· Large crowds, particularly in Cape town and Johannesburg, may act as easy concealment for petty theft and gang activity.

Turnout

Turnout is expected to rise compared to recent years, according to the Chief Electoral Officer Sy Mambolo, with an increase of 1.2 million registered voters, which would be a rebound from record low voter turnouts of just below 66% in 2019. While this could be the result of important issues acutely affecting voters, or electoral inclusion campaigns, the South African median age of 27.6 is the highest it has been in the last decade, which highlights that aging young voters may simply be more likely to vote than when they were younger.

While inequality is a major issue, especially as it relates to the youth vote, other capstone issues such as the ongoing energy crisis, ageing physical infrastructure, and a volatile dependence on foreign capital have become key issues in recent years. The invigoration of young voters, and an increased age of voter-mobilisation, will likely play a large role in how key issues are assessed at the polls; South Africans appear generally more likely to prioritise social issues over economic ones.

The Economy

South Africa’s economy is in a joblessness crisis, both leading to and being caused by sluggish growth. With unemployment reaching 32.4% in 2023, young people account for just over 40% that number. According to Reuters, falling tax revenue has been detrimental to government debt, causing debt-servicing to consume a greater share of the national budget than social spending. Further, a reliance on volatile foreign capital has reduced trust in public spending, leading to sentiments of abandonment in some regional electorates.

Infrastructure

Healthcare and Energy are at the forefront of this election. The nation’s state-owned utility company, Eskom, has resorted to major load shedding, causing crippling blackouts in recent years due to structural faults in power stations and inequity across delivery infrastructure. Much of this is the result of endemic corruption, and is perceived as a major failure of the ANC.

Healthcare inequality has sharply risen, with the rise of drug prices and poverty. While the ANC has already tabled the National Health Insurance plan, the largest opposition party, the Democratic Alliance (DA), criticises its lack of foundation for funding, registration & administration, or hospital buy-in. As a result, the bill has sat for some time and all parties are looking to propose better solutions.

Key Players:

African National Congress

The African National Congress (ANC) is the country’s political powerhouse, with incumbent President Cyril Ramaphosa looking to secure his second and final term. Often cited as ‘Mandela’s Party’, the ANC enters the race with a 57.5% (230/400) seat majority from 2019.

Reporting from eNCA indicates that despite its status, the ANC is sitting at about 40% in the opinion polls, with major news outlets such as the BBC and Al Jazeera predicting a slim loss of the party’s majority. A perceived lack of success in stopping rolling power outages, curbing corruption, and improving both provincial and national infrastructure has been seen as a major party failure by the population and is reflected in opinion polls.

We assess that it is likely that the ANC acquires 44% - 50% of the vote, forcing it to seek alliances with several smaller parties in an effort to keep its legislative power. If the ANC gets less than 45% of the vote, it is likely that the EFF (Economic Freedom Fighters) and ANC form a coalition. The Democratic Alliance (DA) has already entered an alliance agreement isolating the EFF.

Any event in which the ANC maintains a majority, either through an outright win or coalition, sustains risks to businesses around corruption and crime, particularly if the party joins into a coalition with the EFF. Businesses would be very likely to face continued and increasing levels of financial and reputational risks around corruption, operational risks associated with degrading infrastructure, as well as physical risks associated with crime.

An EFF/ANC coalition could have damaging effects for the ANC’s reputation and South Africa as a whole, as the EFF is economically radical and aggressively nationalist. Markets would likely react negatively to such a coalition due to concerns around populist policies, asset nationalisation, corruption, and institutional overreach.

Democratic Alliance

The Democratic Alliance (DA) is currently the largest opposition party, seeking to grow their representation in legislature from 20.77% to at least 25%, an increase of at least 19-20 seats. Led by John Steenhuisen, a career politician, the DA has capitalised on regional wins over the ANC since 2019, and has based its platform around enabling more regional governance, and curbing crime, corruption, and healthcare inequity.

The DA is much smaller than the ANC, both in historical clout and assembly power, polling at just 18.6%., However, successful regional election wins in the Western Cape have provided a significant party stronghold.

The DA has also struck a pre-election coalition deal with the IFP, FF Plus, ASA, and ACDP, to form the Multi-Party Charter for South Africa (MPCSA). A coalition that currently maintains 112 seats and is expected to grow exponentially.

With the DA and IFP both being substantial players, it is likely that the MPCSA will grow to at least 140 seats; enough to force the ANC into a coalition of its own, but not enough to achieve a majority.

uMkhonto weSizwe Party

The uMkhonto weSizwe (MK) party is the wildcard in the race. Formed in December 2023 by Jacob Zuma, a former South African president who left the ANC amid several legal controversies and convictions. Despite being barred from standing in parliament due to his previous convictions related to charges on corruption, racketeering, money laundering and fraud, the former president is splitting votes, achieving up to 14% in opinion polls.

Hailed as an “anti-apartheid veteran and Zulu traditionalist”, MK’s targeting of the ANC plays a significant role in our assessment that the ANC is likely to lose its majority. MK may win up to 8% of the vote (32-33 seats) based on Ipsos polls. It is very likely that the majority of these seats would come from the ANC.

Economic Freedom Fighters

The EFF, led by Julius Malema, is currently polling at around 11-12%, and was founded after Malema was expelled from the ANC in 2013 for sowing divisive radical-leftist views. Known for public stunts and inflammatory remarks against minorities, the EFF is trying to capture the youth vote with promises of free WiFi and electricity – amongst other things.

The EFF’s platform proposes land to be stripped from the wealthy and nationalised, assets to be pulled from mining companies to be redistributed towards education, and the establishment of accessible 24-hour medical clinics. While these are not the typical eye-catching pillars for moderate South African Voters, the EFF seems to be resonating with the growing lower class, promoting their manifesto at a time when the ANC is accused of failing to look after the poor and black majority. A coalition involving the EFF would likely cause capital flight, although nationalist economic policy would likely be dampened by the ANC’s overwhelming majority within the coalition.

It is likely that the EFF will see marginal gains in 2024. With polling at 11.5%, an increase from 2019’s 10.8%. Having been left out of the MPCSA, it is likely that they will be open to coalition deals.

Implications for Political Risk

While no party is currently bringing forward a plan that will directly impact foreign investment or South Africa’s economy, international onlookers should watch for signals from the ANC tomorrow that they will prioritise continued economic stability, as well as its possible plans to join in a coalition with the EFF. During the election there is an increased risk of violence, looting, and civil unrest that may incidentally affect businesses.

The sturdiness of South African politics also has larger regional implications, as the country acts as a stabilising regional entity that wields a significant amount of soft and hard power. Less stable states within the African Union (AU) continuously rely on South Africa's steady hand to promote regional development and integration. The AU and UN also rely on their conflict resolution prowess to address conflicts in states such as the DRC or Burundi. Thus, internal unrest and/or power grappling may affect the government’s peacekeeping efforts on the continent, possibly impacting international organisations and NGOs.

Recent reports highlight ongoing disinformation around voter fraud, gerrymandering, and deceptive tactics at polling stations. The exact nature of these issues—whether they are electoral suppression or information operations—remains unclear. Unconfirmed breaches of ballot storage sites have been reported in KwaZulu-Natal, Mpumalanga, and the Western Cape. The Electoral Commission of South Africa (IEC) is investigating these claims, emphasising that they currently lack substantiation.

Despite IEC warnings against electoral disruptions, there are heightened concerns around violence and unrest following the election. This unrest would likely be largely fueled by former President Zuma’s inability to stand for office and a growing sense of disenfranchisement among impoverished populations, exacerbated by the EFF and MK. These tensions echo the 2021 riots in KwaZulu-Natal after Zuma’s imprisonment, which caused over R50 billion in economic damage.

Post-election, South Africa faces several significant risks, including heightened unrest, crime, and continued high-level corruption. The increased security measures by the National Joint Operational and Intelligence Structure (NATJOINTS) suggest that physical risks around unrest and crime are being taken seriously. Additionally, the previously suspended trucking protests from early May could resurface, gaining traction during the election period on highways that already report heavy amounts of crime.

Nigeria’s Transforming Oil Industry

The Exit of Foreign Oil Companies

Despite having oil reserves of over 37 trillion barrels, Nigeria has undergone $21.12 billion of divestment since 2006, with over $1.1 billion of divestment occurring in 2020 alone. Since 2023, foreign companies have dramatically accelerated divestment from Nigeria’s oil industry, citing widespread theft and vandalism. The resulting takeovers of foreign subsidiaries by local companies has strong potential to worsen the Niger Delta’s already dire environmental situation due to the inability or unwillingness of local companies to follow sustainability practices. While other multinational companies such as Unilever, GSK, and P&G have also left the country, the oil industry is a particularly extreme example, one which is also likely to have significant environmental impacts.

Equinor ASA, a Norwegian company with a three decade long presence in Nigeria, recently resold its local entity Equinor Nigeria Energy Company to an obscure local corporation, Chappal Energy. During Equinor’s time in Nigeria, it pumped over 1 billion barrels of oil from Agbami field, where it maintained a 20.21% stake. The Agbami field, which holds an estimated 900 million barrels of recoverable oil, is operated by Chevron, which holds a 67.3% interest, and was the largest oil discovery in the world at the time of its opening in 1998. In 2022 Addax, a division of the Chinese oil company Sinopec, sold four oil mining blocs to Nigeria’s state oil company National Nigeria Petroleum Corporation (NNPC). Likewise, Eni, an Italian oil company, announced it would sell its local subsidiary to Oando PLC, a Nigerian company, although Oando’s acquisition has been challenged by the NNPC for failure to obtain prior authorization.

ExxonMobil plans to sell four onshore oil fields for $1.3 billion to Seplat, a company dual-listed in Lagos and London. Seplat is now mostly controlled by UK investors, following prolonged boardroom disputes. ExxonMobil also plans to sell Seplat its equity interest in Mobil Producing Nigeria Unlimited, which held over 90 shallow water and onshore platforms and 300 producing oil wells. The deal was initially approved by then President Muhammadu Buhari, who had appointed himself as the country’s oil minister. However, Buhari reversed course days later, and the deal has yet to be approved. NNPC has also objected to the sale, leading to criticism from ExxonMobil, which states that this is creating uncertainty among contractors and communities dependent on the oil industry. Despite major onshore divestments, ExxonMobil will continue its offshore presence in Nigeria through Esso Exploration and Production Nigeria (Deepwater) Limited and Esso Exploration and Production Nigeria Limited, which include the Bonga, Usan, and Erha developments.

Shell also hopes to divest from its onshore oil fields, potentially resulting in sales of up to $3 billion, but its plan has been delayed by a series of court cases. Shell’s divestment from Nigeria stretches back to at least 2010. Between 2010 and 2014, the company sold off eight oil mining leases, and in its 2022 report it revealed that it had sold over half its Nigerian assets. Currently, Shell is offering to sell its onshore assets to Renaissance, a consortium of local companies, for $2.4 billion, ending its 88 year long presence in Nigeria’s onshore oil fields. Renaissance, which includes the Nigerian companies ND Western, Aradel Energy, First E&P and Waltersmith as well as the Swiss based Petrolin, will purchase Shell’s local subsidiary Shell Petroleum Development Corporation of Nigeria (SPDC). SPDC operates the NNPC/SPDC/NAOC joint venture, consisting of the NNPC Limited (55% holding), SPDC (30%), Total Energies (10%), and Nigerian Agip Oil Company Limited (5%). However, the sale is being resisted by the Petroleum and Natural Gas Senior Staff Association of Nigeria, which has complained of maltreatment of workers by one of the companies involved.

Shell has denied speculation that it will leave Nigeria entirely, and despite divestment from oil it remains highly involved in the natural gas industry. Shell Nigeria Gas currently distributes 60-70 million scuffs (standard cubic feet) of gas daily, and is diversifying into offshore activities. Active in Otta, Aba and Port Harcourt, it also has an increasing presence in Bayelsa state and its currently collaborating with the state government of Oyo.

It is likely that this divestment will severely increase environmental degradation, particularly in the Niger Delta. NGOs focusing on the environment and sustainability should closely watch ongoing developments in the Delta region.

Factors Driving the Exit

Theft and vandalism are the immediate cause of flight by IOCs (international oil companies), with environmental concerns playing a more long term role. Theft and vandalism have significantly increased in the oil rich Niger Delta over the last 5 years. Two years ago, the Nigerian economist Tony Elumelu ignited a firestorm on social media by claiming that oil companies were losing up to 95% of their profits to thieves. While the claim was exaggerated, it illustrates a very real and pervasive problem. Between March 2022 and March 2023, IOCs lost the opportunity to produce and sell approximately 65.7 million barrels of oil due to vandalism and theft. From January to September 2013, 189 crude theft points - holes drilled in pipelines to syphon off oil - were repaired by Shell. In December 2023, NNPC recorded 112 instances of theft within a single week, and has appealed to Nigeria’s Economic and Financial Crimes Commission for assistance in stemming theft. NNPC Chief Executive Mele Kiyari has stated that 6,409 illegal refineries have been deactivated in the Niger Delta, and 4,846 illegal pipelines have been disconnected out of a total of 5,543 illegal connection points. Oil theft became a major issue in the 2023 presidential election, with then candidate (now president) Bola Tinubu promising to utilise technology to reduce thefts, though this promise has largely been unfulfilled.

Foreign businesses and NGOs are advised to pay close attention to rates of oil theft, regional trends around theft, as well as to any potential efforts by the Nigerian government to seriously reduce theft and vandalism.

The Nigerian Government’s Response

While many investors were initially hopeful that President Tinubu would speed up approval for the sale of foreign oil subsidiaries, this has proved not to be the case. Eni, Equinor, and ExxonMobil are all still waiting for their divestment plans to be approved. Many deals are currently held up in court cases surrounding oil spills, and even unexecuted court judgments. While this may cause short term delays, such punitive measures are unlikely to slow the exodus of foreign investors in the long term.

The current exodus of oil companies is ironic in light of Nigeria’s 2021 Petroleum Industry Act, which allowed for greater foreign investment in oil. More recently, Nigeria has tried a number of measures to boost its onshore and shallow water oil and gas industries. In March 2024, President Tinubu signed measures streamlining contracts and providing tax credits to companies in this area. These include a 25% gas utilisation investment allowance in new and current projects in the midstream sector, as well as a measure to increase investment in deepwater. The approval threshold for joint ventures and production sharing will be raised to $10 million. Such measures aim to improve on the 2021 Petroleum law. However, given Nigeria’s failure to improve the security situation in the Nile Delta, it seems likely that these actions will stem the flow of foreign companies overseas.

The Environmental Implications of Foreign Oil Divestment

It is highly likely that the exit of foreign oil companies will significantly worsen the environmental situation of the Niger Delta, already one of the world’s most polluted areas and the site of almost daily oil spills. Approximately 40 million liters of oil are spilled in the Delta each year. While environmental groups state that over $100 billion will be required to clean up the Delta, less than $1 billion has been committed by Nigeria’s government for a clean energy program which began eight years ago (and has since stalled). Environmental damage has had a severe effect on residents' quality of life in the Niger Delta. A study conducted at the University of St Gallen shows that infants are twice as likely to die in the first month of their life if their mothers live near an oil spill, and the region suffers around 11,000 premature deaths per year. Additionally, there is vast damage to local farmlands.

Local companies taking over former foreign subsidiaries often have less willingness or capacity to commit to sustainability. For example, in Bayelsa State’s Nembe Region, a region covered in dense mangrove swamps, severe oil leakage continued for over a month before it was stopped. As a result, local fishermen only catch a small percentage of their previous hauls. These issues have continued since Shell’s local licence was sold to the Aiteo Group, a Nigerian company, in 2015. Aiteo and Nigerian regulators blame the spillage on sabotage, but environmental groups and locals have blamed faulty infrastructure. Moreover, Nigerian companies are responsible for 35% more oil spills than international companies, raising concerns about their takeover of oil fields in the Niger Delta from IOCs.

Gas flaring is a particularly severe example of this concern. Gas flaring is caused by surplus natural gas combusting during production, leading to greenhouse gas emissions. Since the recent acquisition of foreign assets by Nigerian oil companies, gas flaring has significantly increased according to reports by Stakeholder Democracy Network and the Environmental Defense Fund. A Stakeholder Democracy Network report indicates that domestic Nigerian companies flare 10 times more gas per barrel of oil produced than IOCs. Heirs Holdings, a Nigerian company which purchased a licence from Shell, increased its flaring by eight times following the purchase. If the two companies with the highest level of flares are excluded, local companies still flare 5 times more.

Decommissioning infrastructure left behind by departing IOCs presents another challenge. There is no fund to pay for decommissioning the infrastructure left behind by Shell and other companies, and no law required oil companies to maintain a fund of this nature until the Petroleum Industry Act of 2021. Since Shell’s divestments do not fall under this law, new companies will have to pay for decommissioning the infrastructure, but they lack the money to do so.

Local civic organisations have agreed on a series of principles for divestment known as the “National Principles for Responsible Petroleum Industry Divestment”, which were put forth in Port Harcourt on December 6, 2023. The document, which calls for strong government intervention to prevent IOCs from leaving local communities with the decommissioning bill, was put forth together with a report by petroleum industry expert Professor Richard Steiner, based on a fact finding trip involving input with government agencies, local communities, and experts on the industry.

The Role of International NGOs

Environmental and humanitarian NGOs operating in Nigeria are advised to pay greater attention to the Niger Delta in the wake of the IOCs’ exit. Organisations focused on public health should pay particular attention to families facing food insecurity as a result of damage to crops, and related issues such as child malnutrition and infant mortality. NGOs focused on environmental issues should work with local communities to promote the Port Harcourt Principles to Nigeria’s government, while also seeking to partner with local oil companies to implement sustainability measures.

U.S. Economic Engagement in Africa

The AGOA

Since 2000, the African Growth and Opportunity Act (AGOA) has formed the foundations of US-African economic relations. The act provides duty-free access for African-made goods to enter the United States to advance Africa’s development.

Since its inception, the US has imported over half a trillion dollars worth of goods from eligible states. Initiatives from the US public and private sectors have a far-reaching impact on various industries, spanning energy, information technology, and manufacturing. Among these sectors, FDI input into African renewable energy dominates other industries as global demand increases. The United States allocates funding for projects in collaboration with its international partners, extending beyond the AGOA and other US-sponsored initiatives. This underscores Washington’s dedication to fostering a shift towards a renewable energy-oriented African continent. The Green Hydrogen Portfolio project, overseen by Niger, Egypt, Mauritania, Morocco, Namibia, and South Africa, is sponsored by the United Kingdom, France, Italy, and the United States, enabling the production of green hydrogen. International project partnerships aim to incentivise African nations to join US-led initiatives, such as the AGOA, by aligning with US policies, as participants are also more likely to receive further FDI support from US partners.